Equity Group is planning to venture into the insurance industry fully after a decade of treading careful steps as a bancassurance agent.

The company’s board met on Thursday to discuss the plan to set up a conglomerate that will oversee all insurance business for Equity Group Holdings.

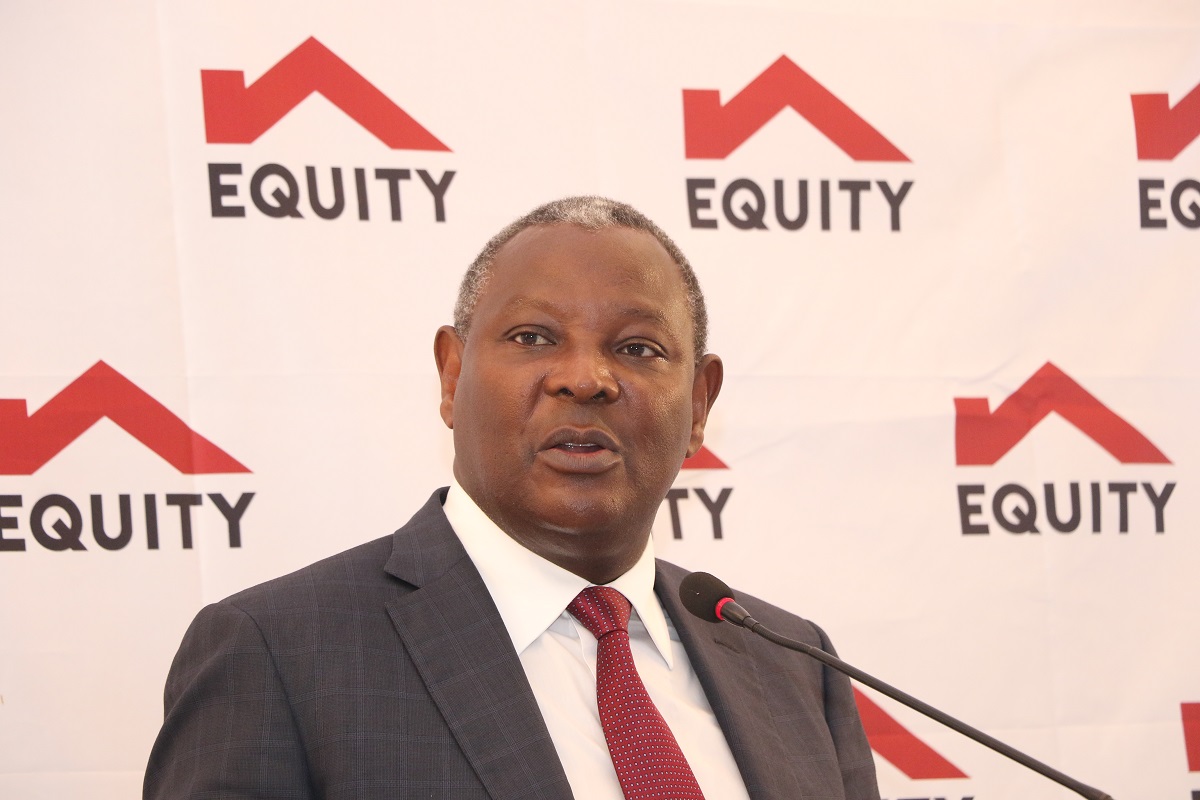

According to the Group’s Managing Director James Mwangi, the board of directors gave the nod to set up a non-operating holding company to hold the company’s insurance business. The insurance company will also act as a subsidiary in Kenya to conduct and undertake long-term insurance business in the country.

The insurance might be going commercial in the near future but has been licensed by the Insurance Regulatory Authority (IRA). The Equity Insurance Agency Limited, the Group’s fully-fledged subsidiary, was licensed on May 2001 by IRA to offer life and non-life insurance.

Equity now wants to make it a fully-fledged business with separate structures and commercial arrangements that will manage insurance-related products for the group.

Recently, the insurance watchdog issued regulations for setting up insurance conglomerates to ensure that each entity in the group has a distinct operational framework, including premises. The Equity Insurance Agency is an example of such a conglomerate and will have to be operated separately from the group’s other subsidiaries.

IRA wants to police capital adequacy and interparty transactions done by regulated and unregulated businesses operating under one group banner.

See Also; Bus Travel Up 40 Percent Over Coronavirus Pandemic

Banking Sector Mergers

Currently, the banking sector in Kenya has witnessed the expansion of banks constrained by a maturing market. However, a number of banks have been able to buy out smaller banks and basically expand their businesses.

A number of banks have turned to mergers and acquisitions, with Commercial Bank of Africa marrying National Industrial Credit to form NCBA, KCB taking over National Bank and purchasing Imperial Bank assets, and Co-operative Bank seeking to buy Jamii Bora Bank.

Smaller tier 3 banks have had a difficult time trying to keep up with the rate at which the market has been maturing with little success. Tier 1 banks are taking these opportunities to widen their scope and get more customers by buying out the struggling tier 3 banks.

Equity bank, however, has not revealed any plan to merge with another bank or acquire another bank. The group’s expansion plan is commercialising an insurance subsidiary to get into the insurance industry as well.

Equity Group’s venture into insurance is in line with its bet on setting up a financial service firm with digital subsidiary Finserve that hosts Equitel, investments and consulting.

Insurance offers a great opportunity for growth given that Kenya’s cover industry has had low penetration and now stands at 2.43 per cent of the country’s gross domestic product, a 15-year low.

The industry is skewed towards general insurance business underwriting, which contributes 57.3 per cent of the industry, of which most is motor insurance, with huge claims settlements that may have informed Equity’s strategy to target long-term products.

![Equity Group CEO Dr. James Mwangi is among those who have re-hired Igathe (l) in the past. [Photo/ KEP]](https://businesstoday.co.ke/wp-content/uploads/2022/11/ezgif.com-gif-maker-12.jpg)

Leave a comment