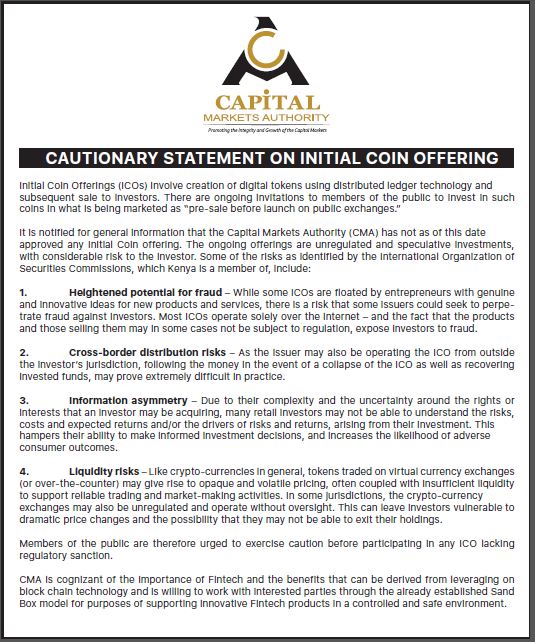

The Capital Markets Authority (CMA) has warned Kenyans against taking part in Initial Coin Offerings (ICOs), saying they are yet to be approved. In a cautionary statement issued on Tuesday, the regulator said ongoing offerings are unregulated and speculative investments with considerable risk to the investor.

“It is notified for the general information that the Capital Markets Authority has not as of this date approved any initial coin offering. The ongoing offerings are unregulated and speculative investments with considerable risk to the investor,” it said. It said some of the risks identified by the International Organization of Securities Commissions include heightened potential for fraud, cross border distribution risks, information asymmetry and liquidity risks.

Cryptocurrencies have become popular across many economies in the world with Kenya less developed on this front in comparison to Australia, for instance, which has a wide variety of crypto exchanges. “Like crypto-currencies in general, tokens traded on virtual currency exchanges may give rise to opaque and volatile pricing, often coupled with insufficient liquidity to support trading and market-making activities,” the statement said.

READ: Water crisis hits major towns as rivers dry up

“Members of the public are, therefore, urged to exercise caution before participating in any ICO regulatory sanction,” CMA said in a statement published in newspapers. “CMA is cognizant of the importance of Fintech and the benefits that can be derived from leveraging on blockchain technology and is willing to work with interested parties through the already established Sand Block model for purposes of supporting innovative Fintech products in a controlled and safe environment,” the CMA added.

Leave a comment