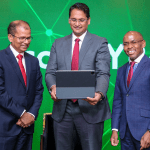

KCB Bank has scooped two top awards in the 2024 Kenya Bankers Association (KBA) Customer Satisfaction Survey. KCB won Best Overall Bank and Best Bank in Customer Experience in Tier I, reflecting its efforts in putting in place the necessary mechanisms to support customers at their point of need.

KCB Director of Customer Excellence, Micheu Njiru, noted that the awards reinforce the bank’s commitment to building a brand that is not only focused on profits alone but on making a delightful experience for its customers at every touch point.

“We are honoured to be the recipients of these two distinguished awards as they serve as a testament to the continuous efforts we put in serving our customers throughout their financial journey,” Micheu said.

The KBA annual awards recognise banks that go out of their way to ensure that customers can easily access banking services at their convenience while identifying areas of improvement and support.

Meanwhile, National Bank of Kenya (NBK) emerged as the first runner-up in the Tier Two category in customer experience.

NBK Managing Director, George Odhiambo said the ranking reflects NBK’s commitment to meeting customer needs and expectations, with the survey evaluating key parameters such as customer satisfaction, digital banking adoption, complaint resolution efficiency, and accessibility for persons with special needs.

“The year 2024 has been fair to us, regardless of the challenging economic and political environment that we faced,” Mr Odhiambo said. “We remained steadfast in our customer proposition, and getting this recognition is a good sign. For this year, we aim to take our services higher to ensure we don’t just claim the top position but make our customers proud through service and product offering.”

> Shifting Tastes: Customers No Longer Loyal to One Bank

Leave a comment