The Kenya shilling set to continue losing value to the dollar as the US Federal Reserve raises rates by 0.25% to reach 4.75% while the Central Bank of Kenya keeps rates steady at 8.75%.

Analysts at FXPesa say that while the CBK chose a dovish stance on policy tightening, an aggressive Fed is expected to further stretch the US Dollar-Kenya shilling (USD-KES) exchange rate, which worsened from 123.5 to 124.5 in January. The shilling is currently trading at 125 to the dollar.

A strong recovery in the DXY – the forex benchmark that compares the value of the US dollar to a basket of six foreign currencies – is likely to push the USD-KES to 130 in February as demand for US treasuries continues to rise because of higher interest rates, according to Rufas Kamau, the lead market analyst at the FXPesa in Nairobi.

On 30th January, the Central Bank of Kenya (CBK) chose to retain rates at 8.75% citing that the previous rate hikes haven’t been fully felt in the economy, a mark-timing strategy as it watches the economy to determine whether there’s a need to make additional policy changes. From the monetary policy report, the CBK noted that December inflation had slowed to 9.06% with food inflation, which was a big concern, slowing to 13.8% from 15.4% the previous month.

Read Also >> Money Experts Reveal Best Investments For 2023

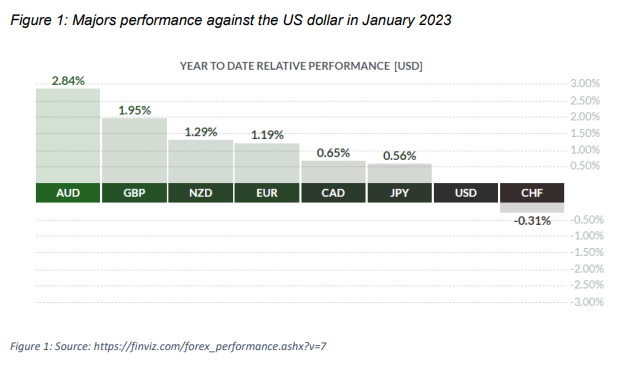

Major currencies have been on a strong start to the year against the dollar with the Australian dollar leading the gains with a 2.86% rally against the Dollar in January 2023. The UK pound has also rallied 1.95% against the dollar while the New Zealand dollar gained 1.31% against the US dollar. The dollar index (DXY) is down 1.23% in January having made volatile swings to a high of 105.38 in the first week of January and a low of 101.35 in the third week of January.

“Since the beginning of 2020, the Kenya shilling has lost approximately 25% of its value against the US dollar, falling from Ksh99 to Ksh124,” says Mr Kamau, the market analyst at FXPesa. “This means that Kenyans will need to spend 25 percent more shillings to buy the same amount of dollars.”

Importers are paying an extra 25% and have had to increase prices for their items, raising the cost of consumer goods. Exporters, at the other end, are getting more shillings for the same quantity of exports, making their products cheaper in the world market.

Importers are paying an extra 25% and have had to increase prices for their items, raising the cost of consumer goods. Exporters, at the other end, are getting more shillings for the same quantity of exports, making their products cheaper in the world market.

See >> The Five Companies Running Ruto’s Hustler Fund

There are various reasons why the Kenyan unit has lost value against the US dollar. “First, the Federal Reserve Bank of the United States (Fed) has been extremely aggressive in monetary tightening, raising interest rates from a limit of 0.25 percent in March 2022 to 4.5 percent now,” says Mr Kamau.

As a result, he says, the US dollar has risen in value relative to other currencies, including the Kenyan shilling. “In September 2022, we witnessed the Euro trading at a historic low of 0.9535 against the US dollar,” he says.

That represented a 15% fall from the exchange rate at the start of 2020. The Japanese yen, for example, had lost 40% against the US dollar by October 2022, having peaked at 151.9 before beginning to recover.

Next >> President William Ruto Seeks To Buy Off Standard Newspaper

Leave a comment