Sidian Bank has announced its title sponsorship for the 8th Annual Kenya Union of Savings & Credit Cooperatives (KUSCCO) conference which will be held at Sarova Whitesands Beach Hotel, Mombasa, from February 20 to 24, 2023.

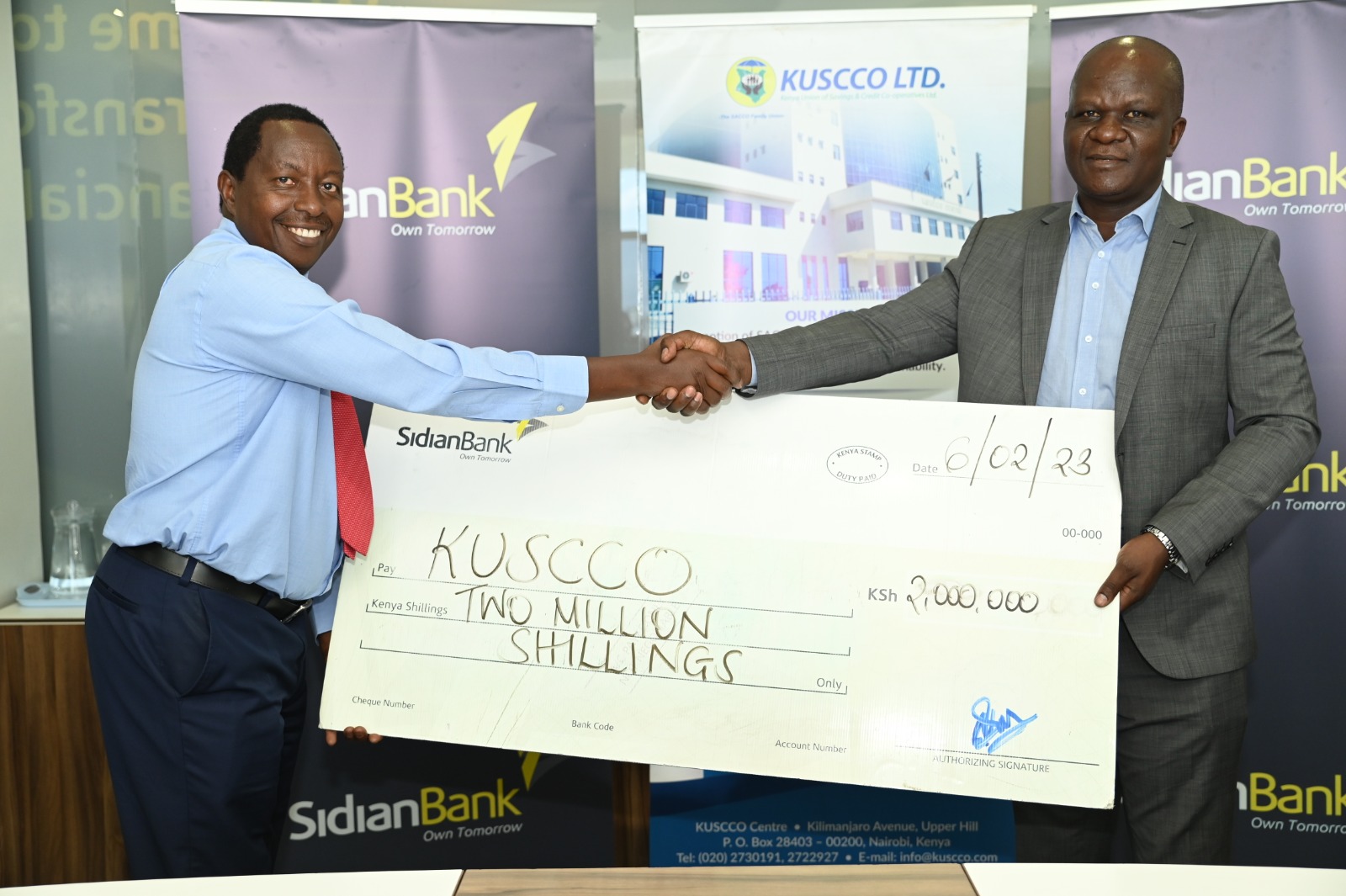

KUSCCO will receive a Ksh2 million sponsorship from Sidian Bank aimed at supporting Cooperatives and how SACCOs can be positioned as vehicles to accelerate Socio-Economic Development in the Country.

The conference will be aimed at showcasing success stories of socioeconomic development of SACCO members’ lifestyles through improved housing, education, incomes, skills development and employment. This will help to discuss an industry roadmap that can enable greater benefits from digital technologies in future to enhance financial inclusion among SACCOs and to create awareness among SACCO Leaders on the need and benefits of collaboration with the Government and other Financial service providers.

“We are grateful for this partnership with KUSCCO. We have enjoyed a partnership with KUSCCO since 2019, and this partnership has enabled us to extend tailored digital payments, collections and cash management solutions to SACCOs. You might be aware that SACCOs play a pivotal financial inclusion role in the economy by extending financial services into rural and peri-urban areas and this partnership affords us a chance to deepen these services and solutions,” Sidian Bank CEO Mr Chege Thumbi said.

“This conference will enable us to offer extended financial and digital solutions to the SACCOs, women groups and youth groups. We are keen to support the SACCOs and in turn support the government in enabling Kenyans and businesses access affordable credit to continue building the economy.”

As part of the organization’s SACCO Banking solution, they are a one-stop shop offering their customers remote cheque clearing, where SACCOs clear their customer cheques in real-time, a money transfer service through PesaLink that allows SACCO members to send money across commercial banks in real-time, trade finance solutions that provides bid bonds, performance bonds, advance payment guarantees, and bank guarantees, where SACCO members can access these instruments from the SACCO through Sidian Bank.

“We are glad to cement our relationship with Sidian Bank which has been ongoing for the last 5 years. A number of our members are keen on accessing credit to develop businesses through the lending that Saccos do but don’t have enough capacity. Through this relationship, Sidian will enable us to implement technology inclusion in the SACCO industry through training, the SACCOs will learn how to advance Sacco credit in the Sacco segment and also to their own members. We intend to train our leaders on cybersecurity, digitisation and competition in the business space and how the hustler fund will be impactful in the SACCO community,” KUSCCO CEO George Ototo said.

SACCOs are member-based, member-owned and member-controlled where members are owners and customers. For governance, members elect the board of directors in a democratic system (one man, one vote) regardless of the amount of individual investment or savings in the SACCO. SACCOs are operated for the purpose of promoting thrift, access to affordable credit as well as general financial services to the members.

Read: Sidian Bank Donates Ksh1M To Ręd Cross For Humanitarian Assistance

>>> Sidian Bank Partners With Isuzu To Provide Financing For Commercial Vehicles

Leave a comment