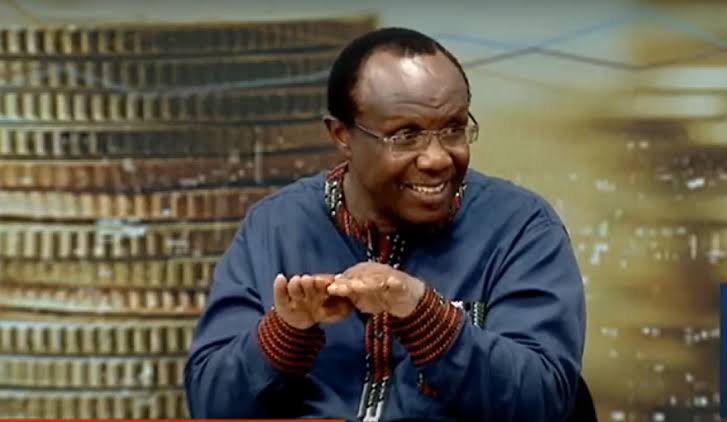

David Ndii has been in the headlines lately with his thoughts on Kenya’s fiscal crisis, with the government yet to pay civil servants’ March salaries and counties failing to receive allocations from the national government for the past four months. Ndii, a renowned economist, is currently the Chairperson of President William Ruto’s Council of Economic Advisers.

READ>David Ndii on Wasteful GoK, Unpaid Salaries and Debt Repayments

He was previously one of the top strategists in former Prime Minister Raila Odinga’s 2017 Presidential bid. But beyond the politics, Ndii is a player in the wealth management business through his company Zimele Asset Management Limited.

Ndii is the holder of a doctorate and master’s degrees in economics from Oxford, and masters and bachelor’s degrees from the University of Nairobi. He has also been a Rhodes scholar at Oxford University and an Eisenhower Fellow. Ndii put his economic smarts to work in the world of business as a founding investor in Zimele Asset Management Limited. He currently serves as the company’s board chairperson.

Zimele opened its doors in August 1998, primarily providing fund management services. Today, Zimele offers investment advisory services to individuals and corporate clients, and manages funds under the Zimele Unit Trust and the Zimele Pension Schemes.

The company’s main income streams are fund management fees, advisory/consultancy fees, and fund administration fees for Zimele Asset Management, as well as dividend income and interest income for its Zimele Unit Trust.

In the six months to June 2022, Zimele Asset Management posted a profit before tax of Ksh5.2 million on a total income of Ksh30.2 million. It was a significant increase from a similar period in 2021 when its profit before tax stood at Ksh1.39 million on total income of Ksh22 million.

Zimele Asset Management’s total assets as of June 2022 stood at Ksh61.9 million, compared to Ksh56.9 million in June 2021.

NEXT>Peter Burugu: Meet Beer Billionaire Supplying Nairobi’s Drinkers

Leave a comment