Old Mutual Holdings PLC has announced a profit after tax of Ksh327 million for the first half of 2024, a remarkable turnaround from the Ksh195 million loss recorded during the same period last year.

The substantial improvement is largely attributed to a significant reduction in finance costs, which fell from Ksh1.8 billion to Ksh529 million following the conversion of shareholder borrowing to equity in 2023. This deal is awaiting regulatory approvals. Additionally, the company benefited from a substantial improvement in its effective tax rate, which decreased by over half of its previous value — from 150% to 70 percent.

Despite a 27% decline in operating profit before financing costs – from Ksh2.2 billion in the first half of 2023 to Ksh1.6 billion by June 30, 2024 – the company’s financial performance remained positive. The decline was primarily due to an increase in medical and flooding claims in Kenya and higher reinsurance expenses in Uganda.

The Group experienced a Ksh1.1 billion decrease in other comprehensive income, driven by the translation effects of foreign currency denominated subsidiaries into Kenya shillings, following the strengthening of the Kenya shilling. This currency translation adjustment led to a reduction in the consolidated net assets of the Group by Ksh873 million.

> Kenya Airways Makes Strategic Changes to Accelerate Recovery

Looking ahead, the company is optimistic about the second half of the year, during which will will implement a robust strategy focusing on product and technological innovation to drive growth.

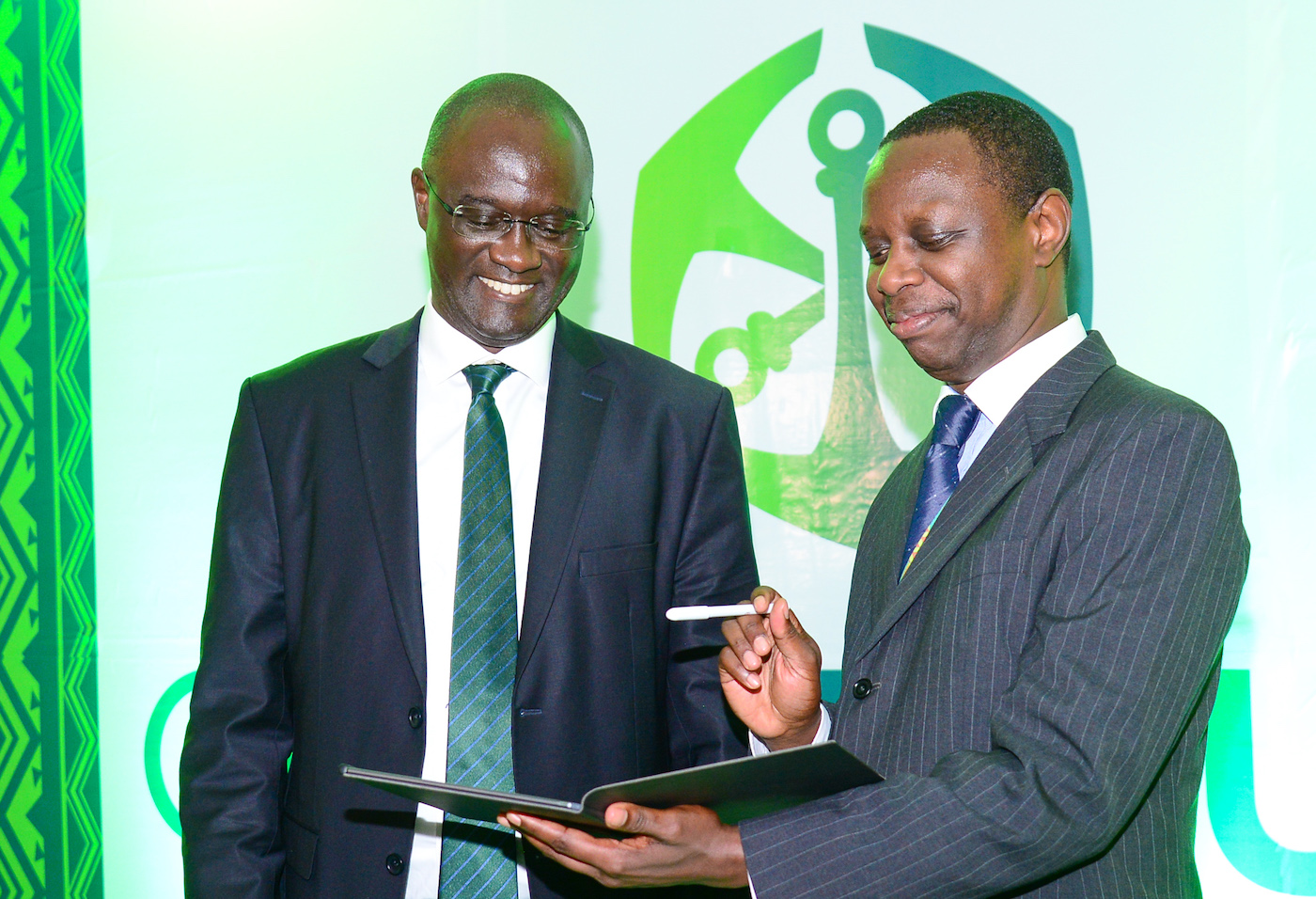

“Despite the challenges we faced in the first half of the year, we are confident that our strategic initiatives and innovative approach will position us for a strong performance in the coming months,” said Mr Arthur Oginga, the Group’s Chief Executive Officer. “We remain committed to the delivery of value to our customers and stakeholders, anticipating a GDP growth and easing inflation across our markets[MM1] .”

Old Mutual’s leadership in innovation was recognized in the period under review, winning the Best Practice Innovation Award at the Association of Kenyan Insurers (AKI) Awards in March. The firm was also ranked third best in the highly competitive General Insurance Company of the Year category.

Separately, Brand Finance, a respected brand valuation consultancy, named Old Mutual the strongest insurance brand globally, underscoring its strong market presence and reputation for reliability.

> Unilever Unveils Financial Literacy For Women Entrepreneurs

Leave a comment