President William Ruto has revealed that the Hustler Fund has disbursed more than Ksh 72 billion to over 26 million Kenyans in under three years since its launch, making it one of the most impactful financial inclusion programmes in the country’s history.

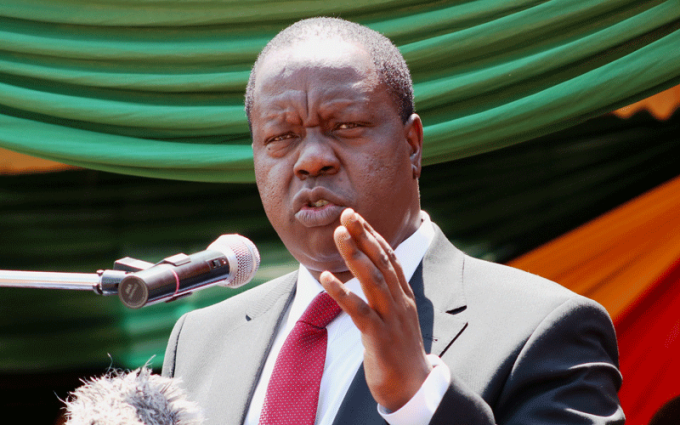

Speaking on Wednesday, August 6, during the Presidential Private Sector Roundtable in Nairobi, Ruto praised the initiative as a transformative tool that has helped millions of ordinary citizens, especially small traders and informal workers, access credit and grow their businesses.

“We take pride in the success of the Hustler Fund that has, in under three years, disbursed more than Ksh 72 billion to over 26 million Kenyans,” the president said.

He added that the fund, which was launched in 2022, has also mobilised over Ksh 5 billion in savings and currently enjoys a repayment rate of 83.6 per cent, reflecting high levels of financial responsibility among borrowers.

“In the same period, this transformative initiative, with a repayment rate at 83.6 per cent, has mobilised over Sh5 billion in savings and offered capital to millions of our small businesses,” he noted.

Ruto stressed that the government is determined to continue offering financial tools to grassroots Kenyans, such as mama mboga, boda boda operators, and others in the informal sector.

“The Government remains committed to presenting the right tools and a fair chance to ordinary Kenyans like the mama mboga, boda boda operators, among others, to grow and thrive,” he said.

The president also highlighted the fund’s role in changing Kenya’s credit landscape, saying it was introduced to fix a broken financial system that had left millions behind.

“We launched the Hustler Fund with three key objectives, and one of them was to fix the market imbalance that had denied many Kenyans access to loans. That goal has been achieved,” Ruto said during the roundtable, which was hosted by the Ministry of Investments, Trade and Industry under the theme Strengthening Government-Private Sector Collaboration for Investment, Trade and Industry-Led Economic Growth.

He explained that the fund now provides the government with rich credit behaviour data from 26 million users, helping to shape more responsive financial solutions.

“Right now, we have credit behaviour data for 26 million Kenyans. Every day, nearly 2 million people use the Hustler Fund to access quick loans,” he said.

The president also noted that 650,000 Kenyans have already qualified for larger, unsecured loans of up to Ksh 150,000 based solely on their repayment history.

“They didn’t need any title deeds or logbooks. Their only security was a consistent record of good repayment over the last year,” he explained.

This new form of credit scoring has also attracted attention from mainstream financial institutions.

“Today, your borrowing history determines your credit limit. Banks are beginning to offer services to people based on their record with the Hustler Fund,” Ruto said.

Looking ahead, the president said the government would continue working closely with the private sector to expand economic opportunities for all Kenyans.

“We will keep innovating and building Kenya, fueled by the public-private partnership, powered by enterprise, anchored in equity and driven by a shared purpose, to uplift everyone,” he said.

Bottom-up economic transformation

The Hustler Fund was launched in November 2022 as part of President Ruto’s bottom-up economic transformation agenda.

The initiative is designed to provide low-interest loans to ordinary Kenyans, especially small traders, boda boda riders, and informal sector workers who have long been ignored by formal lenders.

Loans start from as little as Ksh 500 and grow progressively based on repayment discipline. Interest is charged at 8% per annum on a reducing balance, making it more affordable than many digital lending platforms.

In addition to personal loans, the fund also offers microcredit for groups and small businesses, to support enterprise development and job creation.

So far, the Hustler Fund has disbursed hundreds of billions in microloans and is widely viewed as one of the most ambitious financial inclusion projects in Kenya’s history.

Leave a comment