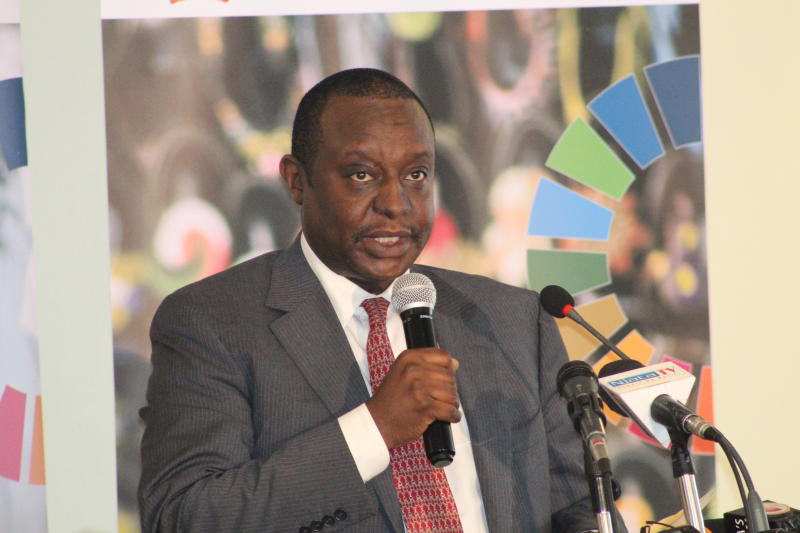

National Treasury Cabinet Secretary Henry Rotich has proposed a new statute that would see company executives, including CEOs, barred from leaving the country if entities they lead fail to honour their tax obligations.

The proposed Departure Prohibition Order also proposes to ground managing directors, company secretaries, treasurers/ chief finance officers (CFOs) and trustees in an effort to ensure that the executives are directly responsible for their companies’ obligations to the taxman.

Rotich’s proposal means that the executives will have to be cleared by the Kenya Revenue Authority (KRA) before being allowed to leave the country either by air or by ship.

James Mulili, a director and taxation expert at audit and financial services firm, PKF says that the move is geared at ensuring that the executives are legally responsible for their companies’ tax compliance.

“Previously, there was a loophole, there was a corporate veil that meant that no one was legally responsible for making sure that the entities are tax compliant,” said Mulili during PKF’s post-budget review, a forum held at the Oshwal Centre, Parklands in Nairobi on Tuesday. “Rotich’s proposal is not new, it was a provision in the Companies Act,” he said.

According to Mulili, the proposal is contained in the Finance Bill 2019.

{Read: Seven reasons why Rotich will suck the poor man’s coffers dry}

“It is a very small provision but it has very far reaching consequences for companies. It means that if KRA classifies a company as non-compliant, an executive can get to an airport and find that they cannot travel out of the country.”

With the taxman under increasing pressure to raise Ksh2.2 trillion revenue, this could be an indicator that KRA is looking at raising revenue from all possible avenues before the next financial year.

PKF also lauded the move to identify the digital economy as a potential area to raise more taxes.

{See also: Equity Bank lends Sh6.5b to MSMEs in three months}

“It’s a step in the right direction. They won’t have it easy like in other sectors because other countries are struggling with that as well, so what they need to do is to come up with a framework to govern how they will go about the whole process. The CS (Rotich) has already set up a task force so let’s see how it goes,”

Leave a comment