For many years, filing tax returns has been a tedious job forcing Kenyans to keep postponing until the last minute.

Filling the ITR excel sheets for the KRA has seen many pay tidy sums to have others do the job for them while many have given up altogether due to the complexities involved.

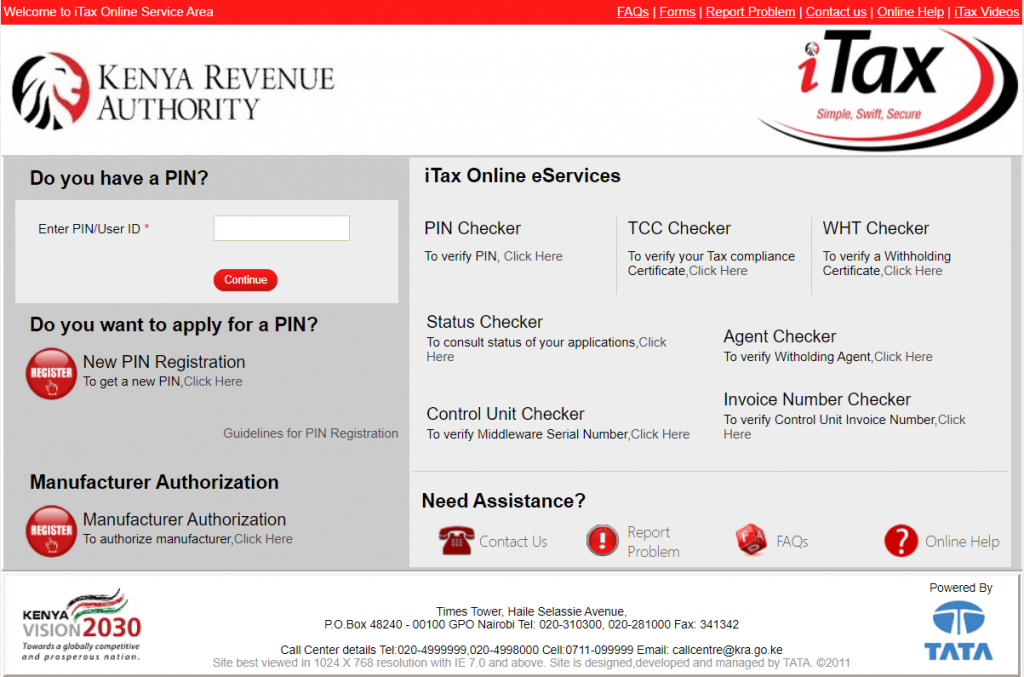

However, KRA has gone a step further this year to make filing tax returns easier for Kenyans such that with all the particulars needed, one could be done in less than 30 minutes. All they need to is fill the required information on the iTax portal.

To make Kenyans file their tax returns early and avoid the last-minute rush, KRA has been carrying out campaigns to enlighten citizens as well as encourage all to do what is required of them through the iTax portal.

With the June 30th deadline for filing tax returns fast approaching, Kenyans will have no excuse why they could not have done it in time.

For employment income, here are the things you need to know before filing your income tax returns 2020.

An internet-enabled device. This could be a smartphone, a laptop or a computer. If none of the above is available, you can always use a cyber café.

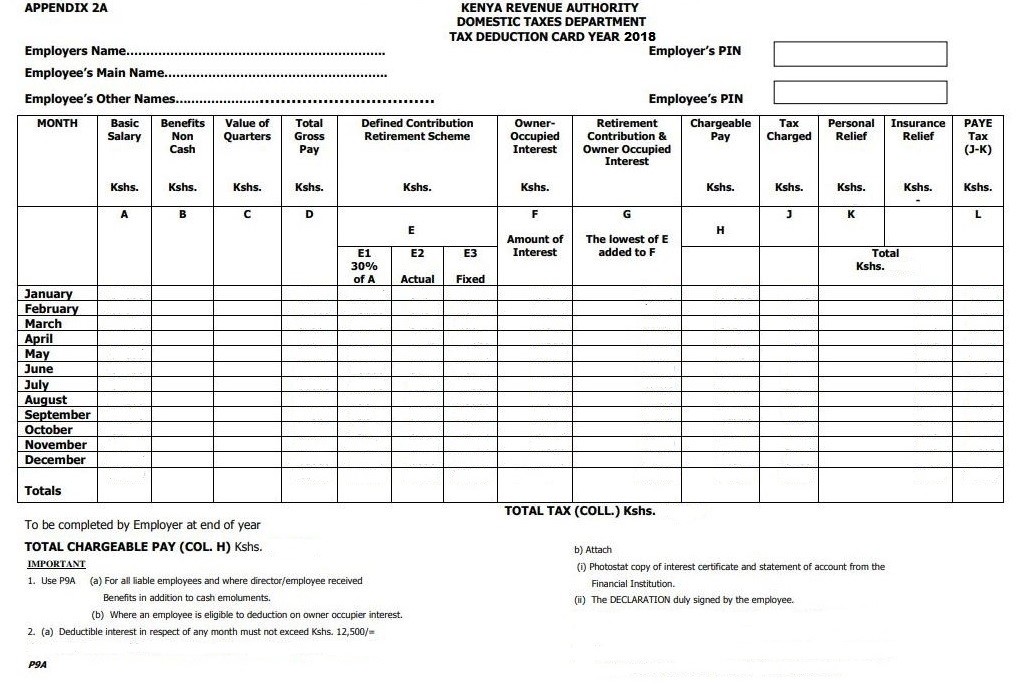

You need a P9 form from your employer. This form indicates all the deductions and it is always up to date for the period you are filing your tax returns for.

You definitely cannot file your tax returns without a KRA PIN so you need to have one which can only be accessed using an iTax password.

Filing tax returns has been there since 1992 with KRA saying that Kulipa Ushuru ni Kujitegemea. By filing your tax returns, it also helps you ascertain that what was deducted from your income as tax by your employer is the correct amount.

Having confirmed that, you are set to file your returns. The P9 form contains the total income received in a year and may include the following depending on the structuring by the employer; basic salary, allowances and benefits, gross salary, pension contribution, PAYE charged and personal relief entitlement.

Here is how KRA explains the P9 information:

Gross pay is the sum of your basic pay and any other taxable allowances and benefits received as a result of employment.

Pension contribution, mortgage interest and savings in a homeownership savings plan (HOSP) if any are deductible contributions. They are therefore deducted from your gross pay before arriving at the taxable income. These amounts should be captured in their respective sections on the online return form.

Failure to capture these correctly on the form will result in tax payable at the end of the filing process.

The deductible contributions are however subject to various conditions. Mortgage interest or owner-occupied interest on an amount borrowed for either purchase of premises or improvement of premises you occupy for residential purposes is deductible up to a maximum of Ksh 25,000 per month (Ksh 300,000 per annum).

Savings in a Home Ownership Saving Plan from an approved institution is deductible up to a maximum of Ksh 4,000 per month (Ksh 48,000 per year)

Contributions towards a defined contribution fund such as a registered pension fund, individual retirement fund or the National Social Security Fund (NSSF) is allowable up to a maximum of Ksh 20,000 per month (Ksh 240,000 per annum). The deductible amount is however limited to the lesser of:

- 30% of your pensionable (basic) income

- Actual contribution

- Ksh 240,000 (i.e. equivalent to Ksh 20,000 per month)

An Individual’s taxable income or chargeable pay is taxed on a graduated scale according to the prevailing tax rates in that particular year.

As a resident individual, you are entitled to a personal relief which is a tax incentive that reduces the amount of tax payable. The current rate of personal relief is Ksh 16,896 per annum (i.e. Ksh 1, 408 per month) with effect from 1st January 2018.

If you have a life, health or an education insurance policy, you are entitled to an insurance relief of 15% of the amount of premiums paid for self, spouse or child. However, it shall not exceed Ksh 60,000 per annum.

With these few tax filing concepts, you are now ready to file your returns.

It is important to start the filing process early so that in case you face any challenges that require KRA’s intervention, you have ample time to get it sorted out prior to the deadline.

How are those not in formal employment supposed to file their returns?

There are different segments on the iTax portal. You choose the one that suits your particular filing.

There is nothing new about this write up. In fact it is rather easier than that. If I recollect, for employment income your don’t need any of this as it’s all captured by iTax from Employers account to Employee’s account. If your case is straight forward and you agree with all emoluments and PAYE deducted, etc you don’t need P9; just had to iTax and there is an area for filling employment income tax return. There may be round off diffs which the KRA can go to hell to demand!

Thanks, Hassan!

Did you see this: “All they need to is fill the required information on the iTax portal.”?

The p9 is for authentication…

Well captured but you igonred the non employment income tax like consultants, sale executives, agents.

Dont write a general topic only to capture the obvious. Actually the most hectic taclx its the one you ignored

Thanks for pointing this out, Chrispas!