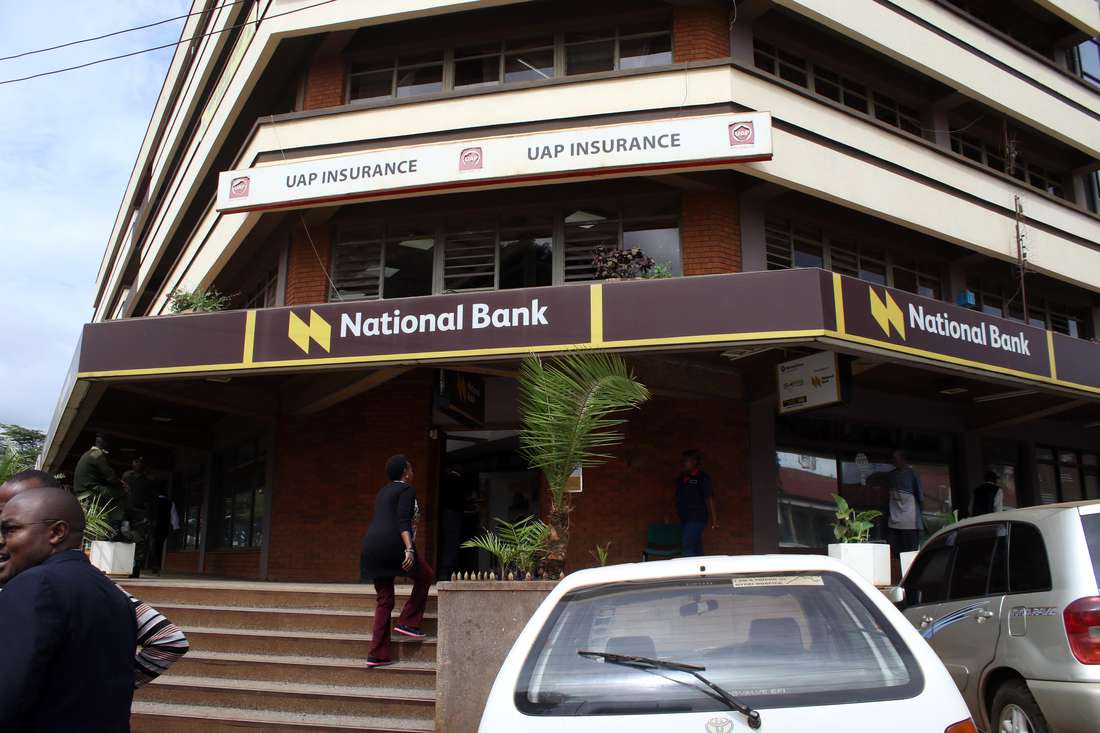

National Bank of Kenya (NBK) has posted a profit after tax of Ksh828 million for the financial year ending December 31, 2022.

The Bank maintained strong operational performance, reporting an operating income growth of 13% to Ksh11.7 billion compared to Ksh10.2 billion recorded in 2021. The impressive revenue growth was contributed by both net interest income and non-funded income.

During the period under review, the Bank’s net interest income increased by 10% to Ksh9.1 billion, mainly contributed by higher lending. The non-funded income stream registered a 29% growth to Ksh2.6 billion, mainly driven by growth from new businesses such as bancassurance and trade finance.

“Despite a challenging operating environment characterized by slowdown in business activity in an election year, rising inflation, currency pressures and geopolitical risks that affected both the global and local economy, we delivered good results, demonstrating our continued strategic focus to deliver innovative and bespoke financial solutions to various customer segments,” said NBK Managing Director George Odhiambo.

Net loans and advances went up 6% to Ksh71 billion from additional lending to critical sectors of the economy such as agribusiness, building and construction, and manufacturing sectors.

During the period, total operating expenses increased to Ksh8.6 billion, representing an 11% increase from the previous year, largely driven by increased investments in technology and strategic Bank projects.

Total assets stood at Ksh143 billion, largely driven by investment securities and customer deposits.

While reflecting on the 2023 outlook, the MD said: “we are in a strong position to continue supporting our customers as a reliable financial partner in order to achieve their aspirations. Our focus is to invest in and grow market-leading businesses as well as expand into new strategic areas to provide innovative and bespoke financial solutions to our customers”.

Read: George Odhiambo Appointed NBK Managing Director

>>> NBK, AGF Sign Loan Portfolio Guarantee Agreement To Finance MSMEs

![He was replaced at BPR Bank Rwanda by Patience Mutesi, whose appointment was confirmed on January 26th, 2022. [Photo/ Twitter]](https://businesstoday.co.ke/wp-content/uploads/2023/01/f-scaled.jpg)

Leave a comment