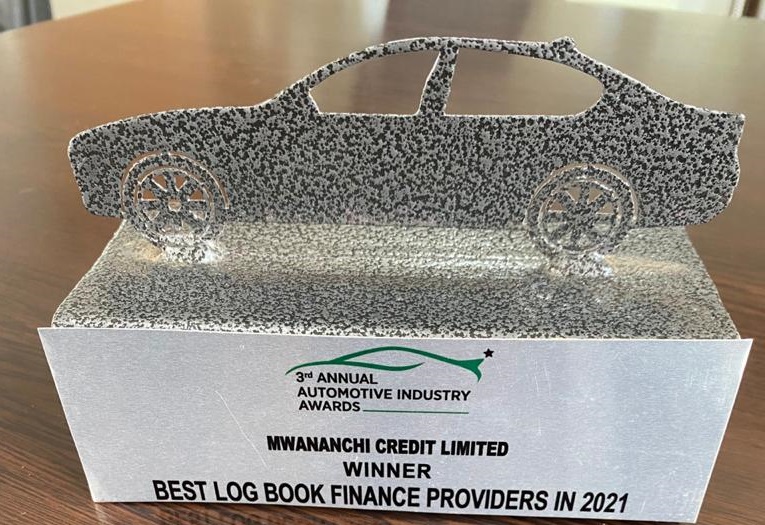

Best Logbook Loans: Mwananchi Credit has been recognized for the third consecutive year as the Best Logbook Financier 2021. The micro-credit company was awarded at the Third Annual Automotive Industry Awards.

Mwananchi Credit was recognized for offering timely and affordable logbook loans and creating proper financing structures that have made it the preferred logbook loan provider for owners of motor vehicles.

Accepting the award, Mwananchi CEO’s Dennis Mombo said: “We are greatly humbled by this award which is a recognition by our peers and customers of our resolve to make logbook loans an affordable financing option for all motorists in this country. To win this award once is a privilege. But to win three times in a row, it is the grace of God. We will work extra hard to ensure that we keep pushing our excellence levels.”

Mwananchi Credit has been banking on innovation to sustain itself during the pandemic period. It was the first and currently the only logbook loan provider to fully embrace risk-based financing model, where borrowers are charged more affordable interest if they can prove that they are a lesser credit risk.

This move slashed interest rates, which averages around 5% in the industry, to a low of 1.5% for corporate clients, making Mwananchi Credit one of the most affordable logbook loan providers.

Last week, the company announced a programme to refinance distressed logbook loans from other lenders, offering borrowers a new lease of life from their current expensive loan contracts. The company has also indicated plans to expand its presence to all the 47 counties within the next two years as it seeks to bring services closer to the people.

Mwananchi Credit is one of the leading logbook loan providers in the country. Its diversified product portfolio includes title deed loans, civil servant salary check off loans, import financing and asset financing among others.

Leave a comment