Minet Kenya is set to grow its pensions portfolio under management above Ksh180 billion after it received Regulatory approval from the Retirement Benefits Authority (RBA) to receive and manage National Social Security Fund (NSSF) Tier II contributions.

The Regulatory nod will see Minet provide pension administration services to employers who would like to opt out of Tier II NSSF contributions and channel their members’ remittances into a scheme certified by the RBA for the purposes of receiving these contributions.

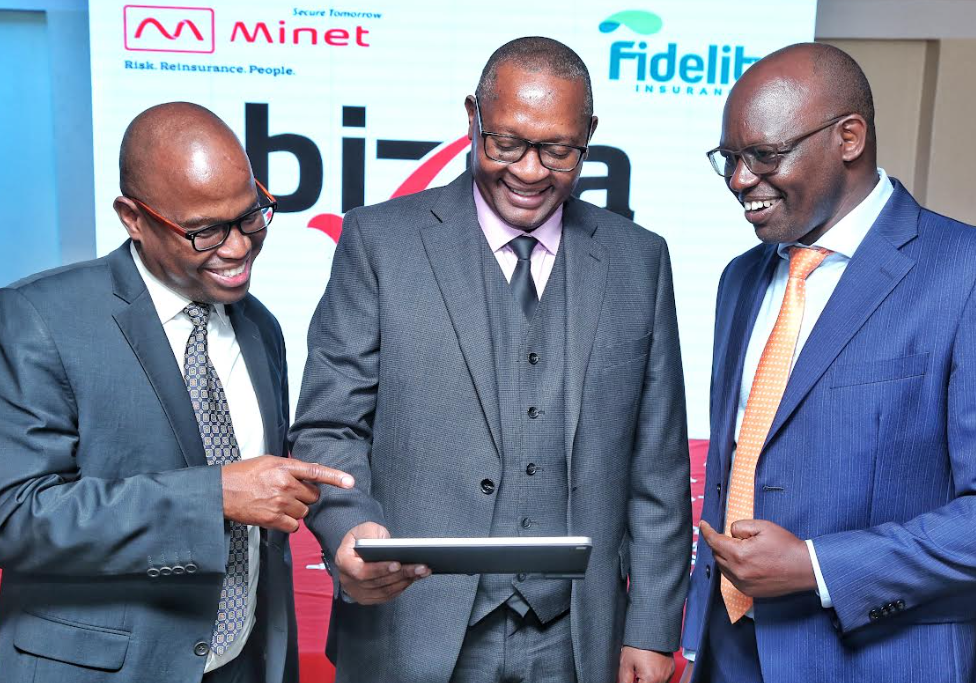

“Minet is pleased to receive this approval from the regulator and looks forward to supporting employers who would like to channel Tier II contributions to the Minet Kenya Umbrella Retirement Fund and Minet Individual Pension Plan,” Minet Kenya’s Chief Executive Officer, Sammy Muthui said.

Under the provisions of the NSSF Act No. 45 of 2013, Tier I contributions from both the employee and the employer are capped at Ksh720 go NSSF while the rest of the contributions above Ksh720 up to a maximum of Ksh1,440 categorised as Tier II are now to be managed by private asset managers.

“As Kenya’s oldest Pension Scheme administrator, Minet is ready to offer its many years of expertise in pension administration to secure the future of Kenya’s working population with solutions that guarantee them a comfortable retirement,” Muthui added.

Minet Kenya manages over 200 Employer Pension Funds with assets under administration of Ksh180 billion and at least Ksh3.5 billion in pension funds. The trusted risk advisor has in the past three years seen the number of employer pension plans under its watch expand by 15.

Minet Kenya’s pension offering boasts of a pension software (accessed through Minet mobile app or web) that enables customers to access a wide array of products that include the Umbrella Fund, individual pension plan, actuarial services, Post-Retirement Medical Fund setup for respective schemes, financial wellness and retirement planning.

Read: Minet Kenya Targets SMEs With New Insurance Offering

>>> Zimele Pension Plans To Receive Tier II NSSF Contributions

Leave a comment