Two people have been arraigned in court in connection to Royal Media Services owner SK Macharia’s bid to take over a matatu insurance company.

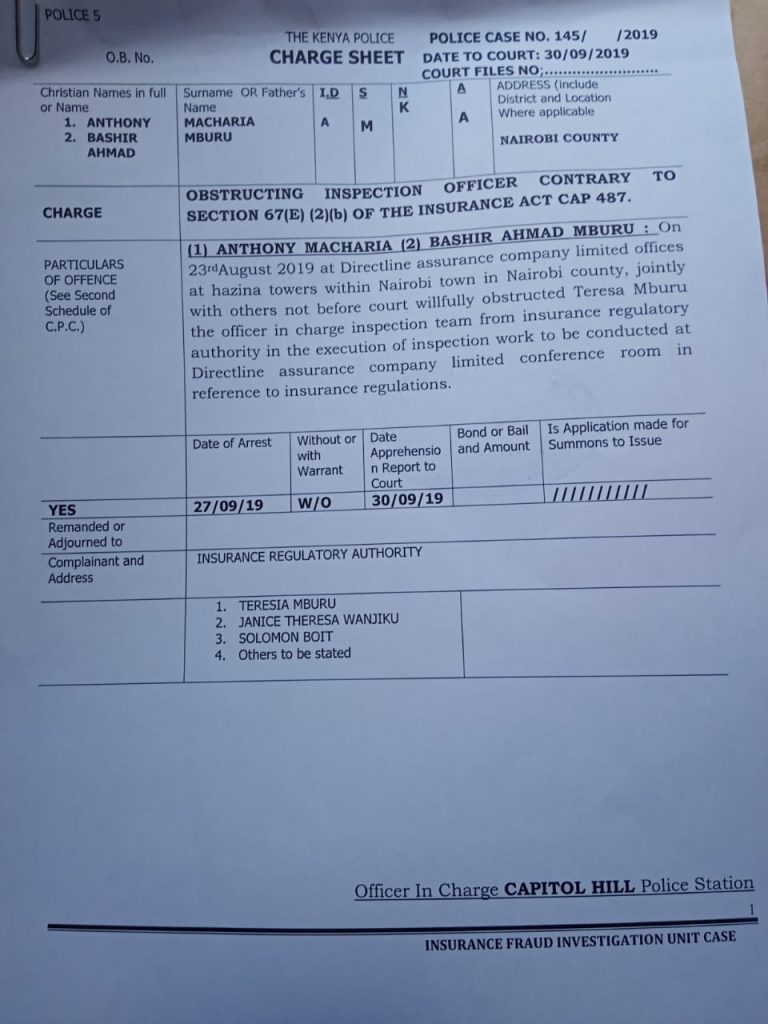

Anthony Macharia and Bashir Ahmad Mburu have been charged with obstructing an inspection officer from conducting an inspection as required by the IRA.

Money, power play

The two have been caught up in a power play involving SK Macharia and the IRA over the appointment of new Directline board of directors.

Macharia and Mburu were arrested by police officers attached to the insurance fraud investigation unit on Friday and appeared in court on Monday.

IRA has rejected the appointment and communicated the same to Macharia and other interested parties.

On September 5, the IRA instructed the shareholders of Directline Insurance Company Limited to stop with immediate effect any physical involvement in the operations of the insurer.

IRA Commissioner of Insurance and CEO Godfrey Kiptum directed the shareholders to comply with the Authority’s directive failure to which regulatory action provided under the Insurance Act would be taken.

In a letter addressed to the shareholders, the Commissioner pointed out that the alleged appointment of a Chairman of the company is irregular and in contravention of the provisions of the Insurance Act.

“The purported appointments of Chairman, Directors and CEO is against the provisions of the Insurance Act and the Corporate Governance Guidelines which require that such a persons be approved by the Commissioner before they can take up those positions,” he said.

The Commissioner further explained that the above requirement spells out the requirements for directors and management of insurance companies and the approval process to be followed.

Control of an insurance company

He pointed out that the ultimate responsibility to have control over an insurance company is vested on directors who have been approved by the Authority and that the purported actions are outside the legal framework and thus considered null and void.

“It is only the approved directors that have the ultimate responsibility to have control over an insurer and the Authority, therefore, does not recognise any purported action taken to control the affairs of the insurer outside the legal framework and hence such actions are null and void,” he said.

By way of information, the Authority, in a bid to find a solution to the corporate governance issues affecting the company, has intervened in the management of the insurer as provided for under the Insurance Act by appointing three directors to the board of the insurer.

The Authority is mandated to protect the interests of consumers and insurance beneficiaries and the actions taken towards the management of Directline Insurance Company Limited are towards ensuring that the corporate governance issues the insurer is facing do not affect the insurance policyholders and beneficiaries.

Governance issues

IRA has been making efforts to find a solution to the corporate governance issues affecting Directline Insurance, including intervening in the management of the insurer as provided for under the Insurance Act by appointing three directors to the board of the insurer.

The Authority says it is mandated to protect the interests of consumers and insurance beneficiaries and the actions taken towards the management of Directline Insurance are towards ensuring that the corporate governance issues the insurer is facing do not affect the insurance policyholders and beneficiaries.

Leave a comment