Kenya’s cooperative banking sector is shifting from competing with financial technology firms to partnering with them, as lenders race to modernise services and retain members amid rapid digital change.

The strategy emerged at the fourth annual Cooperatives CEOs Roundtable in Nairobi, where more than 100 leaders of savings and credit cooperatives, or SACCOs, agreed that collaboration with fintechs would be a priority for 2026. The forum was hosted by the Co-operative Bank of Kenya and focused on technology adoption, innovation and workforce readiness.

Kenya’s SACCOs, which serve millions of retail savers and borrowers, are under pressure to upgrade legacy systems as customer expectations move toward faster, mobile-based financial services. Specialised fintech companies have increasingly set the pace in payments, lending and cross-border services, forcing traditional cooperatives to rethink their operating models.

“The technology landscape is evolving at an unprecedented pace,” said Vincent Marangu, director of the cooperatives banking division at Co-operative Bank of Kenya. Continuous monitoring of market and technology trends is now a leadership requirement, he said, as delivery channels expand and member expectations shift.

Executives at the two-day meeting discussed the need to modernise core banking platforms, improve data-driven decision-making and adopt interoperable systems that allow members to move seamlessly across digital channels. Sessions also examined how technology could support growth areas such as youth-focused products, financing for micro and small businesses, and services for Kenyans living abroad.

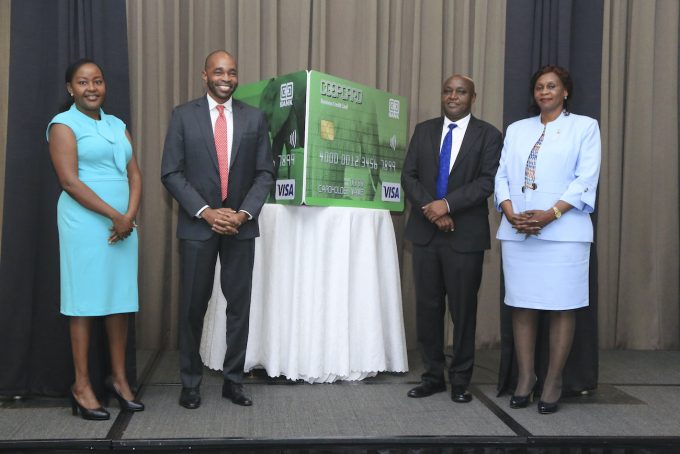

The roundtable drew participation from global technology and payments firms including Visa and Oracle, as well as representatives from the Fintech Association of Kenya, underscoring the sector’s growing reliance on external technology partners.

Kenya’s regulated SACCO sector has continued to expand despite broader economic pressures. Membership rose to about 7.39 million in 2024, up nearly 8% from a year earlier, according to the latest SACCO Supervision Report. Total assets increased from 972 billion shillings ($7.5 billion) in 2023 to 1.07 trillion shillings in 2024, reaching about 1.13 trillion shillings by late 2025. Digital transactions processed through SACCO agent networks climbed more than 14% to 31.65 billion shillings, highlighting the growing shift toward electronic channels.

Participants agreed to accelerate cooperation across the cooperative ecosystem, particularly in shared digital infrastructure, cybersecurity and skills development. Leaders also stressed the need to build technical capacity without undermining the cooperative model, which emphasises member ownership and inclusion.

The annual CEOs roundtable has become a key forum for aligning strategy across the sector and engaging technology providers shaping the future of financial services. Insights from this year’s meeting are expected to guide SACCO investment and policy priorities as cooperatives adapt to a rapidly evolving digital economy

Leave a comment