Kenya recorded an increased demand for electricity, hitting a new high of 2,411.98MW and the highest-ever daily energy consumption of 44,122.60MWh recorded on last week Friday, October 24, 2025.

With an installed capacity of 3846.80MW, according to the latest figures from the Energy and Petroleum Regulatory Authority(EPRA) dated September 2025), Kenya has a thin reserve of approximately 434.82 MW.

Excluding solar, which is not reliable at night, Kenya is operating with a dangerously thin margin of approximately 480 MW.

“This situation demands immediate and substantial investment in electricity generation to bolster our spinning reserves and secure Kenya’s energy future, vital for its economic and social development,” said Emmanuel Wandera, an Energy Communications Specialist.

With the onset of the rainy season in Kenya, frequent power blackouts have become a daily occurrence, as the Solar Energy Component, which is 14.12% of Kenya’s installed power capacity, experiences low output.

The surge in electricity demand is alarming. Early this year, there was a record peak demand of 2,316 MW on February 12, following closely on the heels of a 2,043 MW peak demand in January.

“This rapid increase underscores a troubling reality of our energy reserves are dwindling. To put it simply, the country’s “reserve”, which is the difference between the generation capacity available and the highest recorded peak demand is shrinking fast,” said Wandera.

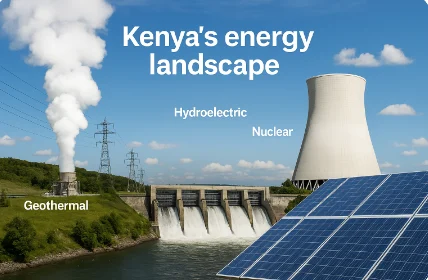

Geothermal forms the largest share of the country’s installed electricity capacity at 943.7MW or 25.92% followed by Hydro with 872.6MW (23.97%), Thermal- 627.1MW (17.22%) Solar -514.1MW (14.12%), Wind-436.1MW or 11.98%, Bioenergy 163.8MW (4.50%)and Imports of 200MW.

KenGen remains the main green power supplier, contributing the lion’s share of the country’s total energy mix through geothermal and hydropower generation, which together account for over 53% of all electricity generated.

KenGen’s geothermal stations produced 12,787MWh, exceeding dispatch projections by 5.07%, while its hydropower plants generated 9,871MWh, 3.23% above target, collectively powering Kenya’s growth with renewable energy and ensuring system stability even during periods of fluctuating wind and solar output.

“KenGen’s consistent renewable generation continues to anchor Kenya’s grid reliability and reduce reliance on expensive thermal power, aligning with national climate goals,” said KenGen Managing Director and CEO, Eng. Peter Njenga.

The country has touched new electricity demand peaks as KenGen advances its green energy expansion strategy and optimization of existing assets under the firm’s G2G 2034 strategy.

“This growth in power demand is a strong indicator of Kenya’s economic rebound and the success of our long-term investments in sustainable generation,” said Eng. Njenga.

As the nation edges closer to universal electricity access, the record demand underscores the growing importance of sustainable baseload power, which ensures affordability, reliability, and resilience in Kenya’s power supply.

Today, KenGen PLC has an installed generation capacity of 1,786 MW, of which about 90% is drawn from green sources namely: Hydro (826 MW), Geothermal (754 MW), Wind (25.5 MW). The balance is from Thermal.

Kenya plans to increase power generation capacity to 8,870MW by 2041

Kenya is uniquely positioned to leverage baseload energy. It possesses vast geothermal potential of 10,000 MW along the Rift Valley, untapped hydro resources and the promise of nuclear power.

Baseload plants, which operate continuously, are essential for providing the constant power supply homes and industries need.

According to the Country’s energy planning tool, the Least Cost Power Development Plan 2022-2041, there is projection of a significant increase in generation capacity, from 2,919 MW in 2021 to 8,870 MW by 2041.

“The Kenya Government’s ambition to deliver Kenya’s first nuclear-generated megawatt by 2032 is a step in the right direction. This diversified approach will not only meet our growing energy needs but also position Kenya as an attractive investment destination, thanks to competitive energy pricing,” said Wandera.

ALSO READ: NSE Hit by Speculators as NCBA, KenGen Shares Soar

![A TotalEnergies outlet in Syokimau, Machakos County. The company operates 176 service stations in Kenya. [Photo/ TotalEnergies]](https://businesstoday.co.ke/wp-content/uploads/2021/09/total-150x150.jpg)

Leave a comment