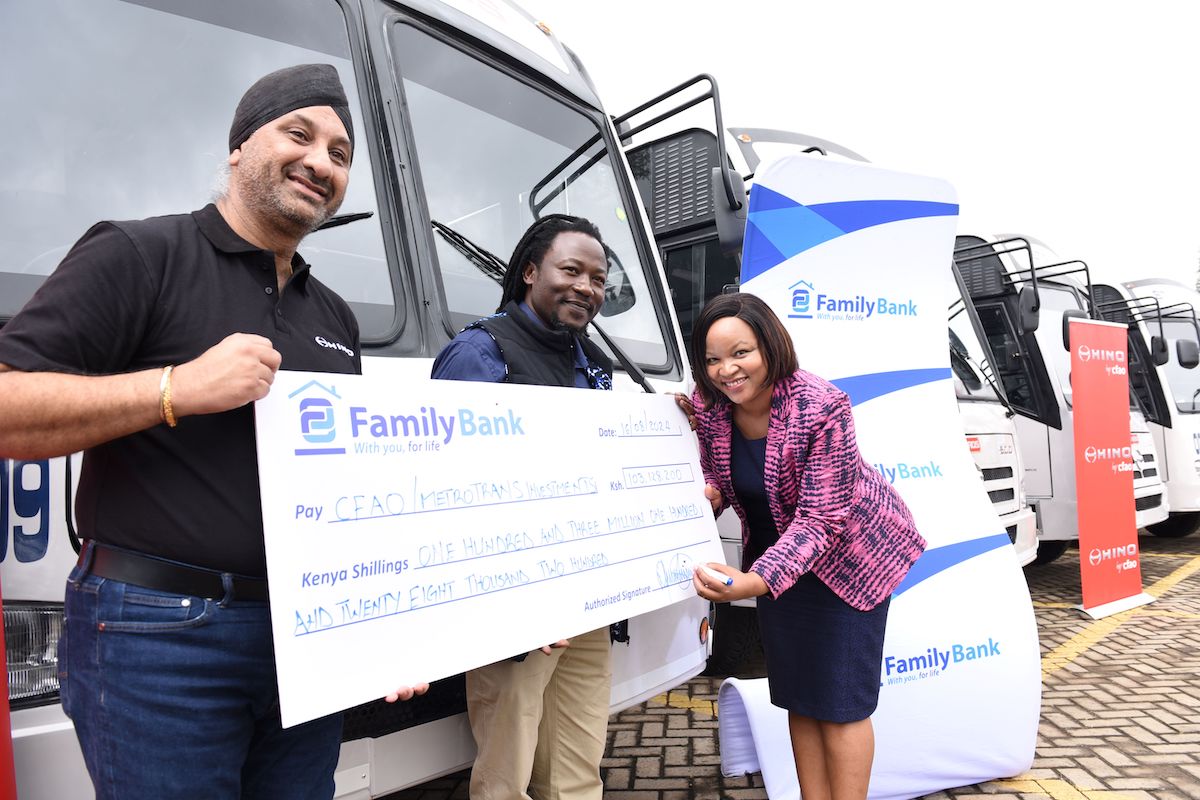

Kenya’s largest automotive distributor and service provider, CFAO Mobility has handed over a fleet of 14 Hino buses, financed by Family Bank at a value of Ksh 103 million, to MetroTrans Bus Company. Hino Buses, one of the most trusted brands in the market, comes with a spacious interior as well as safety, power, and fuel efficiency.

Speaking during the handover ceremony, CFAO Mobility Kenya Managing Director, Mr Arvinder Reel, emphasized the firm’s commitment to maintaining the highest technical and mechanical standards through its local assembly proposition, including the Hino buses that boast enhanced safety features.

“We are honoured to celebrate this significant investment by MetroTrans Limited and deeply appreciate your continued trust in CFAO Mobility as your preferred transport partner,” Reel said. “With a decade-long partnership and a fleet of 37 Hino buses, we remain dedicated to providing vehicles that consistently deliver reliability and efficiency in your operations.”

The move is part of CFAO Mobility’s long-term ambition to support Kenya’s economy through its investment towards local assembly, allowing Kenyans to benefit through technical knowledge transfer and training, and create employment opportunities across its various lines of operations.

> Citi Hoppa Acquires 24 New Buses Worth Sh175 Million

Family Bank CEO, Ms Nancy Njau, stated: “As a key player in enhancing access to capital, we are always diversifying our asset financing to give our SME clients an array of options that suit their business needs. With strategic partners such as CFAO Mobility, we are mutually leveraging and providing opportunities for growth to our customers like Metro Trans.”

With the financing valued at Ksh103 million, Ms Njau said Family Bank is committed to supporting the SME sector and extending affordable and flexible financing terms to its customers.

MetroTrans Ltd Director, Oscar Omurwa Rosanna, noted that as commuter preferences continue to evolve, so is the need for the company to up its game through availing of a newer fleet to keep up with the competition.

“With the new fleet, MetroTrans will enhance its service delivery, expand its routes, and provide a safer and more comfortable experience for passengers. This partnership has and will continue to be instrumental in helping us meet the growing demand for reliable public transportation,” he noted.

> Media House CEO Unmoved After Journalists Launches Solo Protest Over Delayed Pay

Leave a comment