Diamond Trust Bank (DTB) has announced a new partnership with Crown Motors Group, the official distributor of the Nissan brand in Kenya, to offer motor vehicle financing.

The motor vehicle financing scheme dubbed ‘Beba Leo’ targets small and medium-sized enterprises across the country. Under the scheme, SMEs will receive 100 percent financing over 60 months to acquire new vehicles to be used for their business and will receive comprehensive insurance cover.

“Despite providing a huge share of global employment, SMEs still face major challenges when it comes to raising capital for their businesses and accessing funds to grow their business potential,” said Dr Kennedy Nyakomitta, General Manager in charge of Asset Finance.

“The partnership with Crown Motors demonstrates our commitment to walking the journey with our customers as we provide them with customized, flexible, and integrated banking solutions. SMEs will not have to outlay any cash to get these vehicles, they simply need approval from DTB after which they can collect the desired vehicle from Crown Motors.”

Earlier in the month, Crown Motors Group unveiled its latest SUV model into the Kenya Market. The Nissan Magnite will seal Nissan’s commitment to the Kenyan Market in the very competitive segment of sub-compact SUVs.

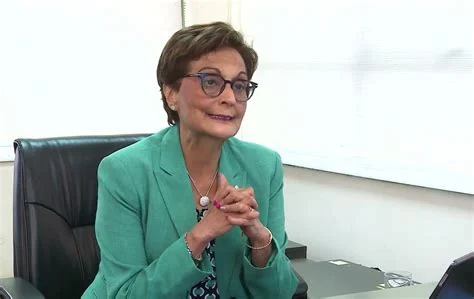

“Kenya is one of Nissan’s oldest markets, with over 60 years of presence in the market, our vehicle models speak to the Kenyan people. This new partnership will strengthen our efforts to offer affordable and accessible mobility solutions to a diverse set of valued DTB customers,” said Maliha Sheikh, the National Sales Manager for Crown Motors Group.

According to a world bank report, Small and Medium Enterprises (SMEs) play a major role in most economies, particularly in developing countries. SMEs account for the majority of businesses worldwide and are an important contributor to job creation and global economic development.

Micro and small enterprises (MSEs) make a substantial contribution to livelihoods and inclusive growth in Kenya. They account for 24 percent of the country’s gross domestic product (GDP), over 90 percent of private sector enterprises and 93 percent of the total labour force in the economy.

Read: Jeremy Ngunze Appointed Non-Executive Director at DTB

>>> I&M, Crown Motors Unveil Asset Finance Partnership

Leave a comment