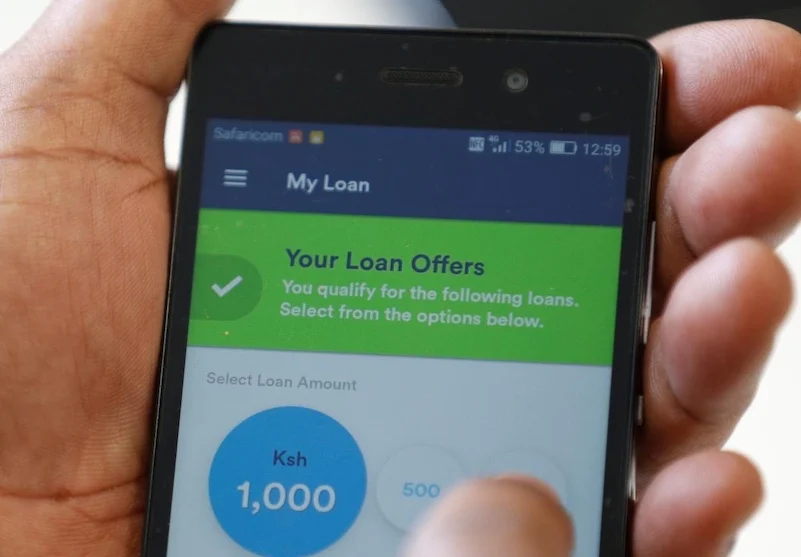

Kenyans had accessed 5.5 million digital loans amounting to KSh 76.8 billion as at the end of June 2025. Majority of this cash was used to cater for school fees, projects, personal needs, purchase assets and running businesses.

In light of this rapid growth in usage and volume of digital loans, the Central Bank of Kenya(CBK) has issued permits to an additional 27 digital lenders. This brings the number of licensed digital lenders to 153 following the licensing of 41 ones in June this year.

CBK is keen to drive this shift to digital cash usage and has thus tightened its licensing and oversight of digital lenders. This is even after concerns were raised by the public about the predatory practices of the unregulated digital lenders. Many have been accused of overcharging for the loan products, using unethical debt collection practices, and the misuse of personal data and customer information.

Data from CBK shows that it has so far received more than 700 applications since March 2022. It has been reviewing these requests based on their business models, consumer protection and fitness structures and the calibre of their shareholders, directors, and management.

> Central Bank Unveils Powerful Loan Pricing Tool to Shield Borrowers

CBK said it still processing other applicants seeking digital lending permits. Reports by the public on unethical practices in the digital lending space can be sent through [email protected]. The focus of this scrutiny has been to ensure that interests of customers are safeguarded.

These lenders predominantly disburse their loan products through digital platforms, through Unstructured Supplementary Service Data (USSD) codes.

Digital lenders have in the recent past been notorious for not making full disclosures, engaging in unauthorized use of personal data and records of their clients or are taking advantage of weak consumer protection laws, to exploit their victims.

Deliberate attempts by the CBK to sanitise the digital lending space comes after concerns that some of these credit providers could be exploiting members of the public, eager to access credit but unable to meet the stiff conditions set by mainstream commercial banks.

> Five Dealers Dominate Trading at the Nairobi Coffee Exchange

Leave a comment