Bank accounts have been a status symbol in Kenya with many people determining the financial wellbeing based on the accounts they run.

While operating a bank account may be glamorous to some, those who have to close one must be prepared to lose money to the bank for the process.

Despite the fact that banks keep minting billions from money customers have entrusted the institutions, they still have the knack to charge you for closing your account.

Long, Tedious Process

According to a report by FSD Kenya, closing an account is a process that could take several days. With the lengthy process, customers were forced people to stick with banks despite their misgivings about the particular institutions.

The process became a barrier to switching banks.

However, it has now become easier and it takes between 10-30 minutes. This process does not come cheap though since those closing their accounts will have to part with some cash to facilitate the process.

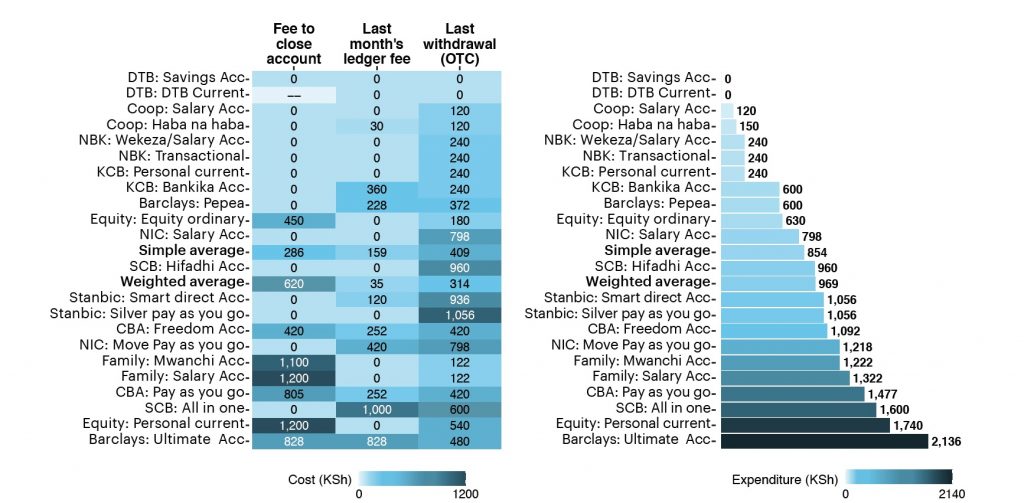

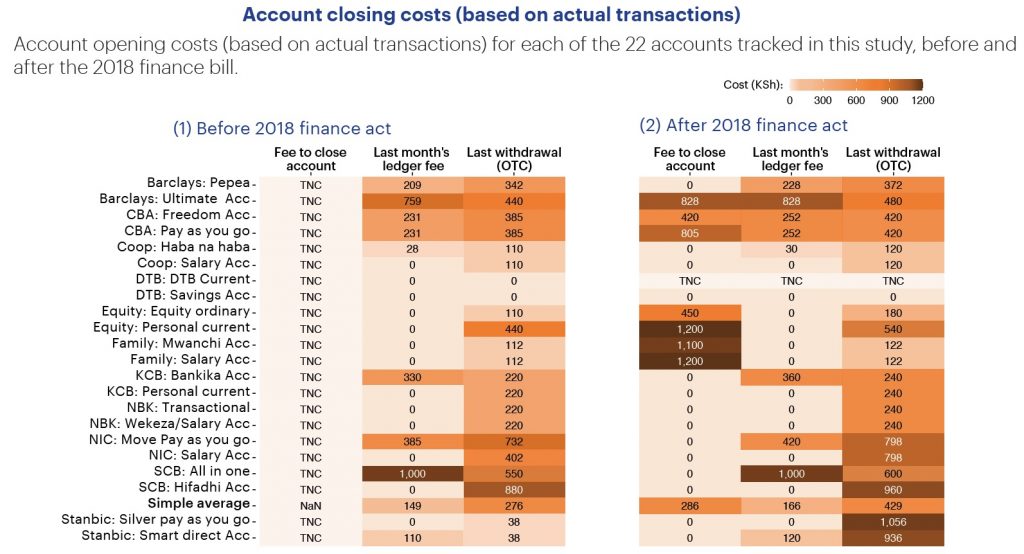

To close an account, the expected total expenditure required includes closing fees and the last ledger fee. For an assumed final withdrawal of Kshs 10,000 at a branch, this is how much it costs:

Noteworthy though is that some data for the DTB-Current account is missing because the account was closed before the end of the survey.

The report, Cost of banking, 2018 notes that what was previously an onerous process and a barrier to switching accounts is now streamlined and easy.

![An ATM. Customers should be careful when opening, operating bank accounts since third-party costs related to digital transactions and unexplained debits may not always be explained. [Photo/BT]](https://businesstoday.co.ke/wp-content/uploads/2016/08/KCB-ATM.jpg)

Leave a comment