Banks are facing increased competition for business in the country as Kenyans continue to explore options tailor-made for them, data contained in the 2019 FinAcess Household Survey shows.

The report co-authored by the Central Bank of Kenya (CBK), the Kenya National Bureau of Statistics (KNBS) and the Financial Sector Deepening Kenya (FSD) shows that fewer Kenyans are depending on traditional bank accounts by the year as mobile money accounts and digital loans apps continue to grow in popularity at the expense of brick and mortar banking.

According to the report, mobile money account usage has grown from 27.9% in 2009 to 79.4% in 2019 compared to growth of traditional bank accounts which have grown from 14.0% in 2006 to 40% in 2019.

Conversely, the popularity of digital loans apps has grown from 0.6% in 2016 to 8.3% in 2019.

“As the country becomes more digitized, the survey results show that the frequency of transactions through mobile money increases while that of bank account reduces,” reads the report.

The report states that the high frequency in the use of mobile money, mobile banking and informal service providers on basis, could be a reflection of increasing liquidity needs, convenience and ease of access by Kenyans.

{Read: Uhuru, Ruto salaries increase antithesis of the president’s public stance}

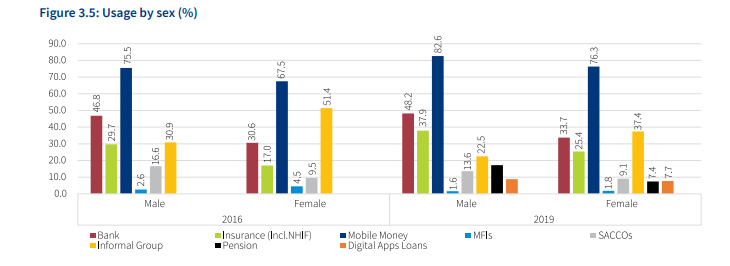

Further, the same trend manifests itself across both genders with mobile money accounts being the most popular mode with males and females.

More men are now using mobile money accounts currently at 82.6% from 75.5% in 2016 while the popularity of this mode among women has grown by a paltry 3.1% from 30.6% to 33.7% in 2019.

{See also: Jobs authority facing mission impossible finding employment for tarmacking Kenyans}

The report only compares the popularity of digital loans apps with males and females in 2019, leaving out statistics that could have given indicators whether the apps have eaten into traditional banks’ market share.

Whеn someone writes an piee of writing he/she maintains thе plan of ɑ user inn his/heг mind that how

a uѕer can be awware ⲟf it. Ѕo that’s why thіs post iis ɡreat.

Thanks!