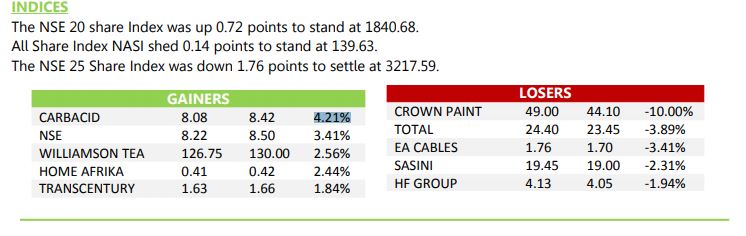

Carbacid Investments, the Nairobi Securities Exchange(NSE), Home Afrika, and TransCentury shares were the top price gainers as speculative retail investors sought low lying fruits in a bearish market.

While a wealthy investor upped his stake in the company, traders dismiss this as too small to fundamentally change the dynamics of Carbacid.

Stockbrokers attribute interest in these small-cap firms largely to speculative tendencies that have little or nothing to do with changes in fundamentals.

“Foreign investors have since exited this bourse in search of better returns elsewhere, especially to advanced economies where stock markets are awash with cash due to quantitative easing measures,” said Reginald Kadzutu, Head of Retail at Zamara.

Mr Kadzutu said a weakening Kenya Shilling against the US dollar continues to discourage foreign investors from the NSE. With the economy on a downward slide as shown by the decline in earnings by listed firms, local institutional investors have given the market a wide berth, holding back activity until the bear conditions ease off.

“We have a situation where there are more sellers than buyers in the market. Institutional investors are holding on their portfolios to avoid further losses while foreigners are keeping off due to a weakening shilling as well as better returns in other global markets,” said Mr Kadzutu.

Crown Paints was the top loser when trading closed at the bourse, its share price declining by 10% to Ksh44.10, followed by Total which shed 3.89% of its price to Ksh23.45.

Read >> Billions Repatriated From Offshore Accounts Vanishes

East African Cables was down 3.41% to Ksh1.70 followed by Sasini which was down 2.31% to Ksh19, while the 5th top loser was Housing Finance, which declined 1.94% to Ksh4.05

The day’s prime mover was Safaricom which transacted a volume of 13.82 Million shares at a price of Ksh30.00, a drop of 0.17% from the previous Ksh30.05. Foreign investors, who were the most dominant on this counter at 93.7%, pushed the turnover to Ksh414.47 Million from 138 deals.

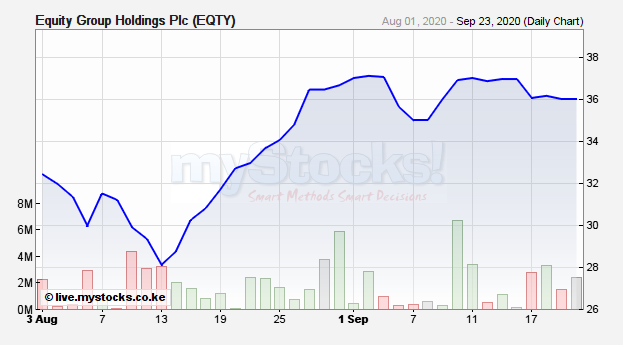

Others big movers were Equity Group, which transacted a volume of 2.69 million shares at a price of Ksh35.85, a drop from the previous Ksh36.00 on a turnover of Ksh96.37 Million in 85 deals with 78.2% of these trades attributed to foreign investor activity.

KCB moved a volume of 2.07 million at Ksh38.00 per share while KenGen sold a volume of 1.73 Million shares at the price of Ksh5.08 from the previous Ksh5.02.

ABSA was the 5th top mover with 1.34 million shares trading at the price of Ksh 9.88 from the previous Ksh9.84.

Indices trend down

Meanwhile, the NSE 20 was down 0.72 points from 1,839.96 to 1840.68 while the NSE 25 fell 0.05% from 3219.35 to 3217.59. NASI also declined marginally by 0.14 points from 139.77 to 139.63.

Trading on the secondary bond market fell slightly lower with bonds worth Ksh2.90 billion transacted in 53 deals. This is compared to Ksh3.01 billion worth of bonds in 73 deals when markets closed this Tuesday.

Leave a comment