AAR Insurance has inked a deal with telecommunications provider Safaricom to roll out new technology infrastructure based on the Amazon Web Services (AWS) as part of its goal to be a full digital insurance company.

The medical underwriter has begun migrating its digital tools and core systems to the AWS platform in a move that will offer clients more secure and efficient digital services.

The AWS cloud computing service will also help interface AAR Insurance digital channels – Mobile Apps, USSD services, web portals and chatbots – with the company’s core insurance technology systems thus enhancing operational efficiency while reducing costs and service downtime.

AAR Insurance Kenya Managing Director, Nixon Shigoli, says migrating all the core insurance platforms and business Applications to AWS will help the company achieve its strategic goals on digital transformation including moving all client interactions to mobile.

“AWS offers services that are affordable and flexible to grow with us as our business evolves. Besides providing enhanced and robust security features to support our business data infrastructure, AWS is reliable and customizable to our unique environment,” said Mr. Shigoli.

He added that Cloud infrastructure is critical to AAR operations as it will enable rapid deployment of Applications and is easy to adjust as needs and resource demands change.

READ>>>>>Is Purchasing Health Insurance For Parents a Great Option?

“Moving our information assets, core systems and digital tools to the Cloud presents attractive opportunities for the realization of our goal of being a full digital insurance provider, by creating an environment for customers to enjoy end-to-end services through their phones and digital devices,” he added.

The AWS Cloud service uses the pay-as-you-go model meaning AAR Insurance will no longer have to deploy expensive hardware infrastructure on premise.

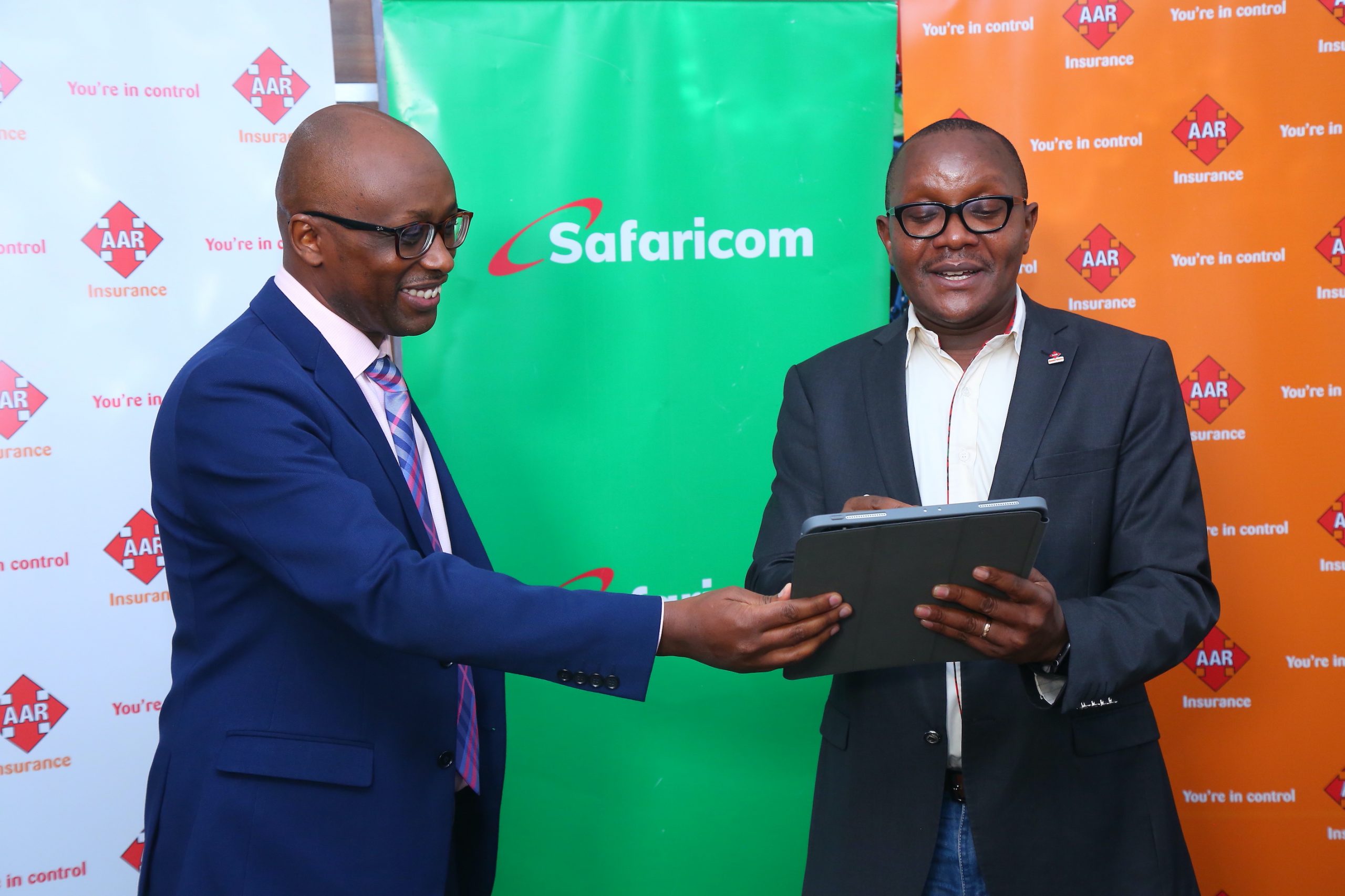

On his part, Safaricom CEO Peter Ndegwa says the AWS Cloud infrastructure offers businesses, including insurance firms, a highly scalable and secure experience to grow and support digital channels.

“AAR Insurance Kenya becomes the first insurance company locally for whom we are implementing the AWS Cloud platform. We are delighted to be part of the digital transformation at AAR and overall growth of digital insurance in Kenya,” said Mr. Ndegwa.

He pointed out that an increasingly digital consumer ecosystem requires robust technology infrastructure to support web Applications among other critical tools underpinning a superior customer experience.

“Cloud is the new normal and most businesses today have either already moved their operations into the cloud or are in the process of migrating,” explained the Safaricom boss.

So far, AAR Insurance has rolled out a number of digital platforms through which clients can enroll and pay for medical, travel and personal accident insurance, manage and track treatment expenses, using phones and other devices. They can also interact real-time with AAR Insurance through WhatsApp.

![Interior PS Dr Raymond Omollo during a consultative meeting with Japan International Cooperation Agency (JICA) Kenya Chief Representative Shinkawa Makoto. [Photo/Dr Raymond Omollo/Facebook]](https://businesstoday.co.ke/wp-content/uploads/2026/02/Ray-200x133.webp)

Leave a comment