Kenya Reinsurance Corporation has posted a 52% rise in profit before taxation for the period ended 30th June 2020. Profitability stood at Ksh2.09 billion compared to Ksh1.37 billion for the period ended 30th June 2019.

Meanwhile, gross written premium increased 2% from Ksh8.86 billion to Ksh9.07 billion compared to the same period in the financial year (FY) 2019. The higher performance is attributable to a number of factors.Fire recorded the highest gross premium of Ksh.2.59 billion in 2020, an increase from Ksh1.51 million in 2019, a 71% growth.

Aggressive business

Gross premium from bond grew by 58% from Ksh91 million in 2019 to Ksh144 million in 2020. Life business grew 17% from Ksh776 million in 2019 to reach Ksh909 million in 2020. Non-Life business grew by 2% from Ksh.8.03 billion in 2019 to Ksh8.16 billion in 2020. Most business lines recorded compared to the same period in 2019. Overall growth stood at 2% attributed to aggressive fair sourcing of business.

The positive results come a month after Kenya Re’s national scale financial strength rating was affirmed by the Global Credit Ratings Agency (GCR). The AA+(KE) rating was based on the strong risk capitalization and similar strength in liquidity and business profile. The shareholders’ funds increased from Ksh31.9 billion as at 31st December 2019 to Kshs.33.1 billion as at 30th June 2020, which is a growth of 3%.

Cedant acquisition costs increased by 6% from Ksh2.02 billion to Ksh2.14 billion, giving a Commission’s ratio of 25% during the period. Investment income for the period under review stood at Ksh1.905 billion which is 2% lower than the prior-year (Ksh1.945 billion), attributed to the effects of the COVID-19 pandemic which has significantly affected the investment environment.

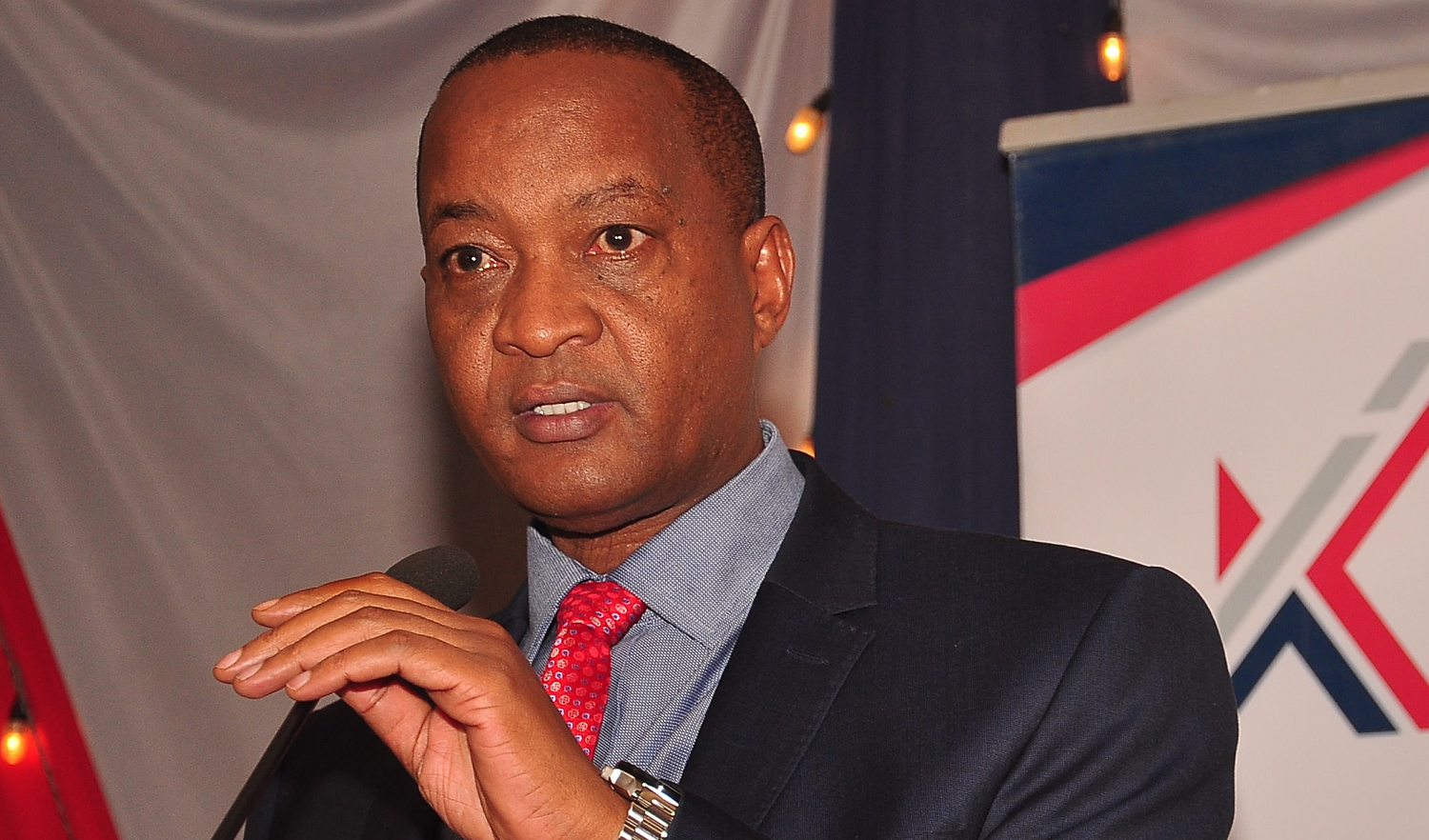

“We are indeed pleased about our half-year results thus far,” said Kenya Re Managing Director, Mr Jadiah Mwarania, “The growth in profit is largely attributed to strong risk-adjusted capitalization, markets diversification, low-risk investment portfolio, a diversified business portfolio, prudent underwriting and effective expenses management among other factors.”

The COVID-19 pandemic has slightly affected Kenya Re’s investment income, he said, but remained optimistic that it would report positive results in the next half of the year.

He said the corporation has anchored its business on five strategic pillars that have helped it make major strides in the reinsurance business. These pillars are financial performance, business development, business process improvement, enhanced risk management as well as people and culture.

The global economy has faced a slowdown due to the ongoing pandemic. More businesses including reinsurers have turned to innovation and digitized products to keep business afloat and to ensure business continuity.

The reinsurance market must also focus on improving operational efficiency, boosting productivity, and lowering costs with new technology and talent transformations in the wake of the pandemic. The corporation continues to implement relevant strategies to mitigate the impact of COVID-19. The Business Continuity Plan in place has enabled adjustment to the disruptions to allow staff to work away from the office.

The Corporation has in place a Virtual Private Network (VPN) connectivity that allows staff to connect from anywhere and access all systems and resources they would normally access while at office. Kenya Re is also optimally utilizing digital communication platforms including Microsoft Teams, Webex, WhatsApp messaging, emails and telephone calls to frequently keep in touch with the cedants/brokers and hence enhance visibility.

Leave a comment