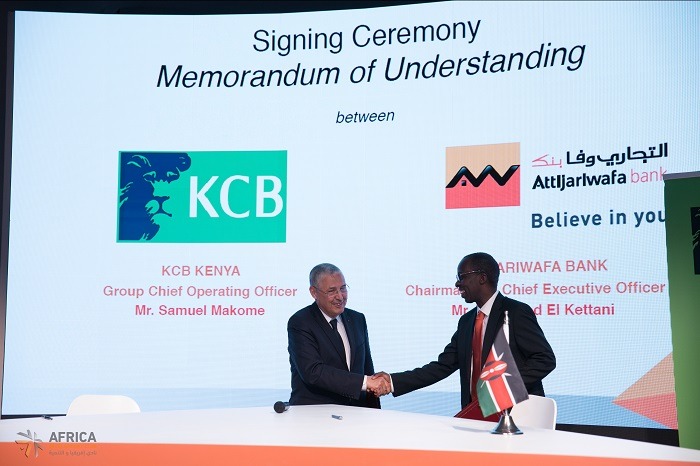

KCB Bank Kenya Ltd has signed a deal with Morocco’s giant lender, Attijariwafa Bank Group to drive cross-border trade and deepen financial inclusion.

The agreement inked in Casablanca is expected to help promote the sharing of best practices in the banking, financial and business in East and North Africa.

“This will also see the establishment of a correspondent banking relationship to enable cross border trade flows,” said KCB Group Chief Operating Officer Samuel Makome.

“This agreement will also help in supporting the housing and infrastructure sectors by undertaking projects, providing technical support and sharing best practice. As we undertake cooperation in each area, both Banks will agree on the investment required for each specific initiative,” Makone added during the signing ceremony on the sidelines of the International Africa Development Forum held on March 14-15.

The Forum is part of the Attijariwafa’s mission to promote inter-African investments, trade and cooperation.

Bringing together the two financial power houses in East and North Africa will see new market opportunities for clients that both banks serve particularly local corporates and SMEs which includes women entrepreneurs. The Banks will also establish a cooperation mechanism in the field of human resources and training.

“This protocol is very important for us. It will help us to offer our economic operators, in all the countries where we are present, access to the Kenyan market as well as to all the markets covered by KCB in East Africa,” said Mohamed El Kettani, the Chairman and Chief Executive Officer of Attijariwafa.

With this agreement, KCB Bank and Attijariwafa Bank Group aims to give a new impetus to South-South cooperation and renew their contribution to the continent’s economic integration.

Read: Standard goes big on digital with an eye on youth market

KCB hopes to use this collaboration to expand its play in facilitating business in Africa. Currently, the lender also has presence in Tanzania, South Sudan, Uganda, Rwanda, Burundi and Ethiopia (rep office).

Leave a comment