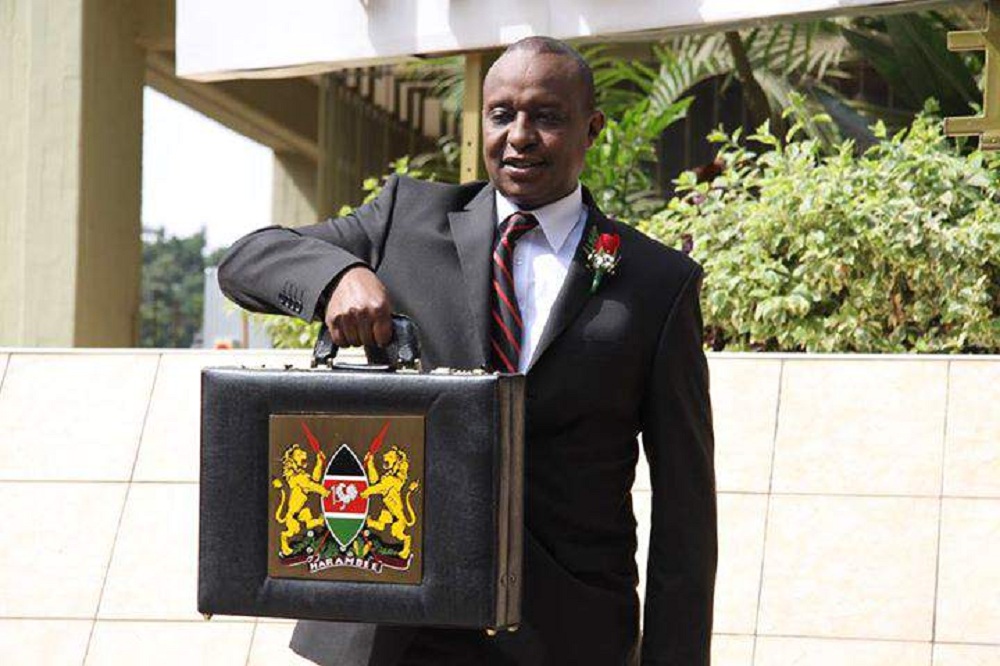

Kenya’s budget deficit should be a worry for investors despite the wide-ranging austerity measures proposed by President Uhuru Kenyatta.

The National Treasury projects a funding gap of 5.9% of gross domestic product this financial year, compared with 7.2% in the previous year. That still falls short of the 3% target the International Monetary Fund (IMF) set for the government when it provided a precautionary arrangement two years ago.

“Kenya should be a country of concern for investors,” Renaissance Capital’s chief economist Charles Robertson is quoted by Bloomberg as telling a conference in the capital, Nairobi. “So we need to see fiscal adjustment in Kenya as we have needed the same in Argentina.”

However, Kenya is not as dependent on hot money as Argentina, making it a safer investment destination than the south American economy, he added.

The government’s revenue projections are “too optimistic” and the budget deficit will likely be wider than estimated, RenCap’s economist for sub-Saharan Africa, Yvonne Mhango told Bloomberg.

The government is reducing spending estimates this financial year by almost 2% after President Uhuru Kenyatta in a memorandum to MPs after declining to assent to the Finance Bill 2018 vowed austerity to improve the country’s fiscal position.

But while he intends to cut expenditure, he has also promised 500,000 low-income housing units, universal healthcare, food security and to increase manufacturing’s contribution to 15% of GDP by 2022, when his second term ends.

Robertson said the country needs to borrow more to finance its investments in infrastructure but a depressed world economy means it has no option but to raise taxes.

“I would like to see Kenya borrow more to do a lot of investment to achieve manufacturing at 15 percent of GDP, but the world economy shows me they have to do a lot less of this, and raise taxes,” Robertson is quoted by Bloomberg as telling a conference in Nairobi.

RenCap said the Kenyan currency is overvalued and should be about Ksh 120 to the dollar. It estimates the shilling will decline to Ksh 105 by the end of 2018 from Ksh 101 at present, Mhango said.

“We have seen the current account decline, which will help contain the FX (foreign exchange) reserves position and the currency,” she said.

While RenCap initially expected economic growth of 4.5% this year because of a cap on commercial interest rates, output has been more robust and it now estimates expansion of 5.4%, Mhango said.

For about two years, Kenya has had a limit of 400 basis points above the prevailing central bank rate that lenders say has crimped credit, especially to risky borrowers.

While Kenya has come under IMF pressure to do away with the cap, the state would not want it gone because banks will resume private-sector lending, which would drive the government’s borrowing costs higher, Robertson said.

READ: M-PESA TRANSACTIONS TO COST MORE AS UHURU RAISES TAX

“With the budget deficit, we see a fiscal argument to retain the rate cap,” he said.

However, in his memorandum, President Uhuru has proposed for a repeal of the rate cap law.

1 Comment