OPay, the FinTech company part of the Opera Group has announced the launch of OKash, the new stand-alone mobile app that provides users access to short-term loans at their fingertips.

Android smartphone users in Kenya now have a safe, easy and flexible way to apply and access credit loans for their everyday life expenses. From education and health expenses to travel and purchase of goods and services, OKash lands in Kenya with the clear goal of making loan management and access easier for everyone who owns a smartphone.

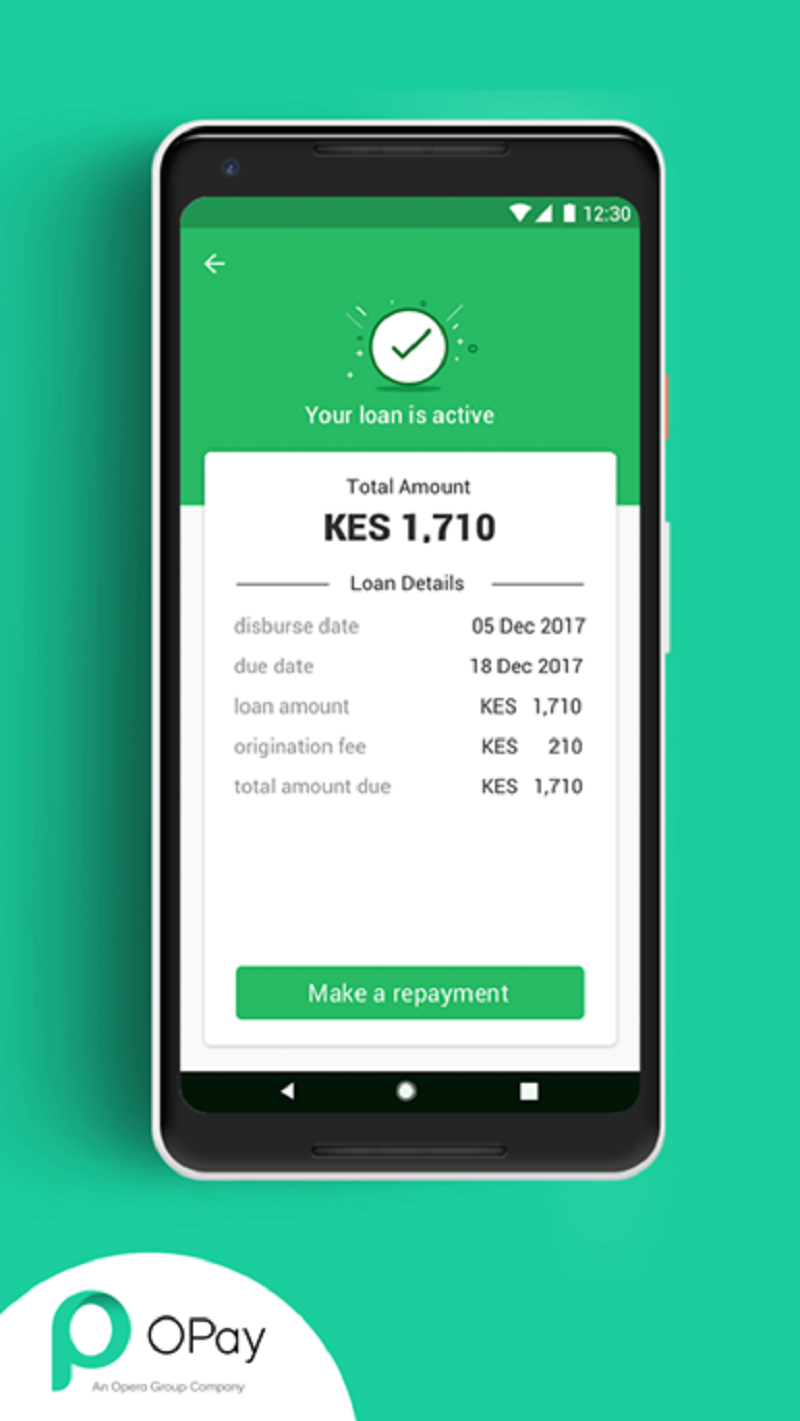

OKash enables users to access small loans for an interest as low as 1% per day and a loan term of a maximum of 14 days. The faster a user pays off an active loan, the sooner they can request a new loan. Users with timely and consistent repayment behaviors can apply for a single loan up to 500,000 KES at a total interest of 5 percent.

Eddie Ndichu, Managing Director for Opera in Kenya, stated: “We know that there are more than 20 million people in Kenya who use loans actively every day and we want to give them a high-end product with an exceptional user experience to make their life more comfortable when applying for and making payments with loans.”

Users can download OKash from Google Play and set up their account in seconds by using their M-Pesa account. By filling out a set of questions, users will get a decision on their loan application in minutes.

To repay the loan, users just need to click the repayment button and process it through the M-Pesa STK push service. This will simplify the process of repaying the loan as the amount will be debited directly from the user’s M-Pesa wallet.

READ: Where to go camping in Nairobi this Easter

OKash is a unique product as it uses artificial intelligence (AI) technology. This technology has been built to analyse the purpose of the loan as well as the repayment behaviour of the user.

Regarding the AI technology behind OKash, Ndichu said: “People who use OKash can expect high quality technology just like the Opera Group’s products. We are offering OKash users high privacy standards in each loan that they apply for as their personal information is highly protected.”

Leave a comment