Financial services group Sanlam Kenya Plc has announced the results of its recent Rights Issue, confirming a 100% subscription and raising gross proceeds of Ksh2.5 billion. The Rights Issue, which opened on 25th April and closed on 12th May 2025, was fully subscribed, recording an 82% uptake from shareholders with the balance being successfully underwritten.

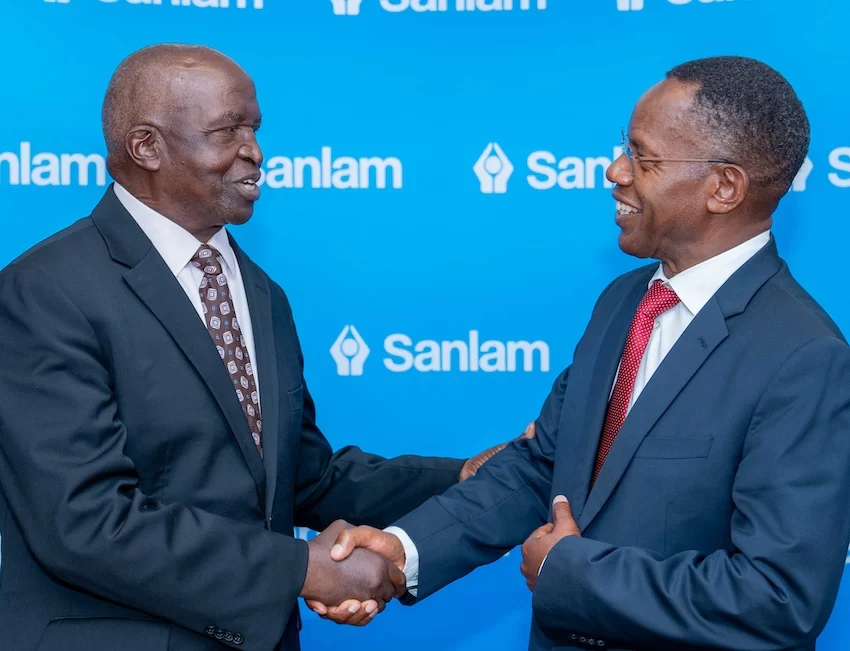

Sanlam Kenya Group CEO Dr. Patrick Tumbo said the proceeds from the Rights Issue would be used to repay an existing debt facility, consequently bringing the Group’s indebtedness to more sustainable levels, reducing interest costs, and supporting operational and financial flexibility to accelerate growth. “The successful Rights Issues mark a key milestone in our strategic transformation journey. The funds raised will enable us to strengthen our balance sheet by repaying our outstanding bank facility, thereby reducing our long-term debt exposure and freeing up resources to reinvest in our core business operations,” Dr Tumbo said.

The Rights Issue was priced at Ksh5 per new share, allowing shareholders to acquire 125 new shares for every 36 existing shares, with 500,000,000 new shares offered.

With the Rights Issue now complete, Sanlam Kenya is well-positioned to implement its strategic plan, which includes expanding its footprint in the non-bank financial services sector, enhancing shareholder value, and building inclusive financial confidence across its customer segments.

> United Nations Official Reveals the Origin of the Deadly Corona Virus

“We are grateful to our shareholders for their continued trust and to Sanlam Allianz Africa for their strong backing. With a healthier balance sheet and capital reserves, the Group will focus on pioneering inclusive financial confidence by investing in diversified non-bank financial services provision,” Sanlam Kenya Chairman Dr. John Simba said.

Statements from the registrar detailing share allocations and any applicable refunds will be dispatched to shareholders on 30 May 2025, and CDS accounts will be electronically credited with the new shares on 3 June 2025. Trading of the new shares on the Nairobi Securities Exchange (NSE) will commence on 4th June 2025.

The transaction was spearheaded by a local advisory team led by Lead Transaction Advisor (Absa Bank (Kenya) Plc), Lead Sponsoring Broker (Absa Securities Limited), Legal Advisor (Anjarwalla & Khanna LLP (ALN Kenya)), Reporting Accountant (KPMG Kenya), Receiving Bank (Stanbic Bank Kenya Plc), Share Registrar (Image Registrars Limited) and Marketing Consultants (Oxygène MCL).

Rights Issue Performance Summary

| Data | Statistics |

| Total Number of New Shares accepted under Entitlement | 402,623,246 |

| Total Value of New Shares accepted under Entitlement | Ksh 2,013,116,230 |

| Entitlement Subscription Rate (%) | 81% |

| Total Number of Additional New Shares applied for under Additional Shares* | 5,062,718 |

| Total Value of Additional New Shares applied for under Additional Shares | Ksh 25,313,590 |

| Total Number of New Shares applied for Under the Rights Issue (Entitlement Shares + Additional Shares) | 407,685,964 |

| Total Value of New Shares applied for Under the Rights Issue (Entitlement Shares + Additional Shares) | Ksh 2,038,429,820 |

| Total Subscription Rate before Underwriting (%) | 82% |

| Total Number of Untaken Shares accepted under the Underwriting Agreement | 92,314,036 |

| Total Value of Untaken Shares accepted under the Underwriting Agreement | Ksh 461,570,180 |

| Total Number of New Shares Allocated | 500,000,000 |

| Gross Proceeds Raised | Ksh 2,500,000,000 |

| Total Subscription Performance Rate including Underwriting | 100% |

> Uganda Holds Biggest Ever Tourism Event in Kampala

Leave a comment