The Competition Authority of Kenya has approved the proposed acquisition of the business and assets of Economic Industries Limited by Kenafric Manufacturing Limited unconditionally, in a low profile transation that is likely to shake the stationery business in the country. The Competition Authority said in its note dated 19th December 2024, that this approval has been granted based on the finding that the transaction is unlikely to negatively impact competition in the market for stationery, nor elicit negative public interest concerns.

Kenafric Manufacturing Limited, a Kenyan company controlled by Zarrar Holding Limited, is involved in the manufacture and trading of polyvinyl chloride (PVC) and ethylene-vinyl acetate (EVA), rubber footwear, as well as stationery items including exercise books, writing pads, envelopes, notebooks, and counter-books. Kenafric’s acquirer’s affiliate manufactures soft drinks, confectioneries, and culinary products. Economic Industries Limited, on the other hand, is involved in the business of manufacturing and distributing school and office stationery products and exercise books.

The proposed transaction involves the acquisition of the business and assets of Economic Industries by Kenafric, which will result in Kenafric controlling Economic Industries Ltd and liquidation of its business. The parties indicated that the transaction will enable the Kenafric expand its activities in the stationery business in Kenya. Under Kenyan law merging parties whose combined turnover or assets, whichever is higher, is over Ksh1 billion are required to seek approval from the Competition Authority prior to implementing the proposed transaction.

In 2021, Kenya’s stationery market registered a year-on-year growth of 23.33% in value shipments, according to data from 6Wresearch. This signals an ease of entry and expansion in the market.

> How Kenafric Billionaire Braved Multiple Failure to Build Sweet, Vast Empire

> Bamburi Cement Shareholders Seal Ksh22.5 Billion Buyout by Tz Company

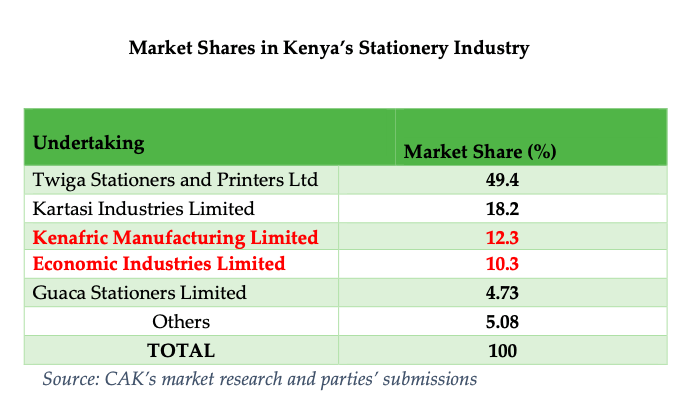

After the merger, Kenafric’s market share will increase from 12.3% to 22.6%, making it the second-largest player, and below the dominance threshold. “The proposed transaction will increase the merged entity’s ability to compete with Twiga Stationers and Kartasi Industries Limited,” the Competition Authority said in its report. “The proposed transaction is unlikely to raise competition concerns since the merged entity will face competitive pressure from other players who control 77.4% of the market.”

It noted that in the stationery market, raw materials (commodity chemicals) are sufficiently available. Clients occasionally purchase key inputs directly from chemical companies who, according to information from the merging parties and their competitors, constitute a significant competitive force.

Research and technology and advertising seemingly play a limited role and involve relatively low expenses. The cost of diversifying into a new product market with a national reach is relatively low, between Ksh10 million and Ksh100 million. However, the substantial initial capital outlay for developing and deploying stationery solutions for expansive projects is a significant challenge. Based on this reality, new players have entered the market over the past five years, including Twaweza Printing Press Limited, Red Ring Industry Limited and Advertising World.

From the foregoing, the proposed transaction is unlikely to lead to a substantial lessening or prevention of competition in the market for stationery in Kenya. Entry and exit barriers in the market for stationery in Kenya are not high and, therefore, transactions taking place in this market are unlikely to raise competition concerns.

> HF Raises Ksh6 Billion as Rights Issue is Oversubscribed by 38%

Leave a comment