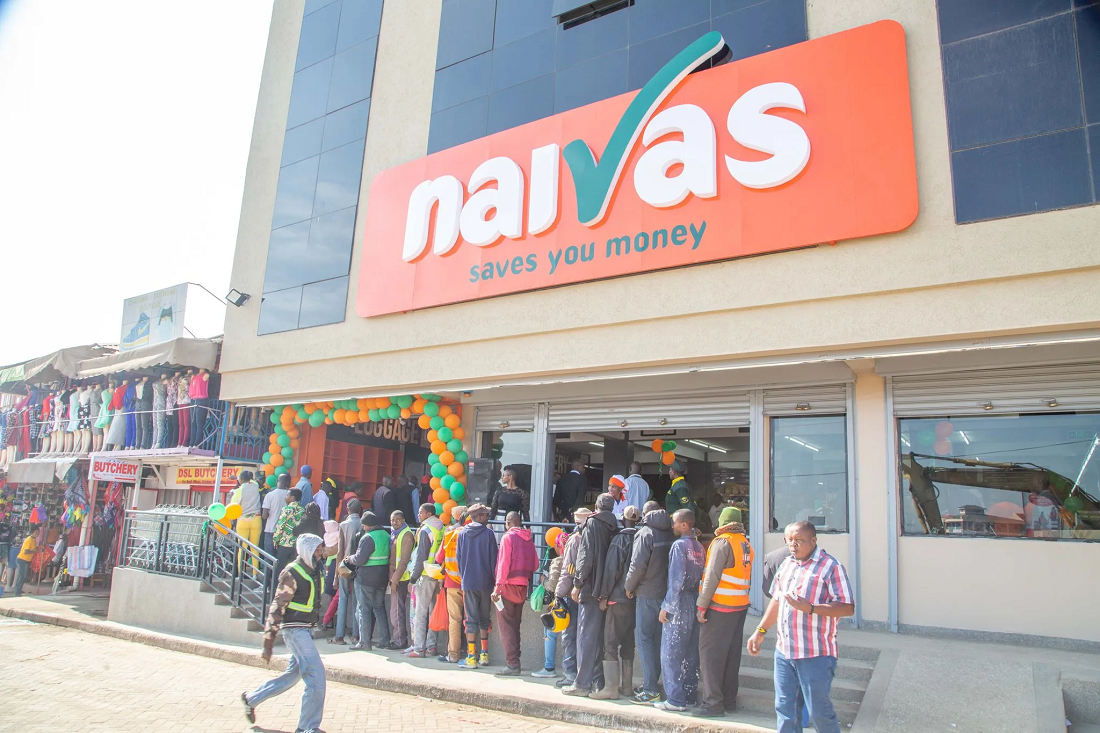

Kenya’s biggest retail chain, Naivas, is gearing up to unveil three new branches this festive season. Making the most of the surge in shopping around Christmas, the branches will be in Nairobi and Malindi.

The firm which currently has over 70 branches has been ramping up expansion following the acquisition of a 30% minority stake worth Ksh6 Billion by a consortium of investors including the International Finance Corporation (IFC), private equity firms Amethis and MCB Equity Fund and German sovereign wealth fund DEG.

2 of the new branches are set to be opened this week. The outlet at Oasis Mall in Malindi will be unveiled on Thursday, November 9 while another outlet in Embakasi, Nairobi will open its doors a day later on Friday, November 10.

The spaces at Oasis Mall and Embakasi were previously occupied by fallen retail giants Nakumatt and Tuskys respectively.

READ>>Retail Curse? Another Supermarket On The Brink Of Collapse

The third outlet located at Greenspan Mall in Donholm, Nairobi is expected to be opened ahead of Christmas. The space was also previously occupied by Tuskys.

“We are elated that our store openings have been greatly enhanced through the support of our stakeholders and investors who have strengthened and improved corporate governance, increased accountability and professionalism within the business,” Naivas Chief Commercial Officer Willy Kimani confirmed.

Naivas’ growth has taken place against the backdrop of the struggles of other players failing to honor tenancy agreements and supplier arrangements. Nakumatt folded under the weight of debts while Tuskys has scaled down and is under pressure to release details of a mystery investor they hope will inject Ksh2.1 Billion to help it meet its obligations to creditors and spur revival.

High Court judge Francis Tuiyot gave Tuskys 30 days from November 26, 2021 to reveal details of the restructuring plan including the identity of the offshore investor, failure to which a liquidation suit would likely be triggered.

Naivas, on the other hand, was in the headlines this week after a ruling disclosed a looming family feud. Newton Kagiri Mukuha had moved to court to challenge a previous High Court ruling that found he had no stake in Naivas.

He wants his younger brother David Kimani ousted as Naivas CEO, a seat on the company’s board, a 20% stake and an additional 20% stake from his late father’s share of the company. He is the eldest of three brothers locked in a battle for control of the retail empire.

He also wanted the Ksh6 Billion paid by the consortium of investors deposited in an interest-earning joint account, and for the court to freeze further sales of Naivas shares.

The three-judge Appelate Court bench composed of David Musinga, Hannah Okwengu and Asike Makhanda agreed to freeze further share sales but failed to issue orders on the rest of Mukuha’s petitions.

![A Naivas supermarket outlet. The firm is ramping up expansion across the country. [Photo/ NMG]](https://businesstoday.co.ke/wp-content/uploads/2021/12/Naivas-Supermarket.jpeg)

![A mobile loan app. [Photo: REUTERS/Thomas Mukoya]](https://businesstoday.co.ke/wp-content/uploads/2021/12/mobi-150x150.jpg)

![Communist Party of Kenya (CPK) members at a demonstration. The party challenged NMS over ongoing works at Uhuru Park. [Photo/ Courtesy]](https://businesstoday.co.ke/wp-content/uploads/2021/12/FE3DpRDWQAAFRht-150x150.jpg)

Leave a comment