Tala has begun customer tours across the country as part of the company’s five-year anniversary celebrations.

The customer tours, which have taken place in Nairobi, Nakuru, Mombasa, and Kisumu, will provide a platform for Tala to thank their customers for choosing Tala as their partner and to educate the public on responsible borrowing practices.

Tala General Manager (East Africa) Ivan Mbowa said that Tala remains committed to leveraging technology to drive financial inclusion and; consumer engagement. He mentioned that Tala advocates for financial literacy among consumers, as this provides a more sustainable environment for operations.

“Digital lending is shaping today’s rapidly changing landscape of digital financial services, and Tala is delighted to be part of Kenya’s growth story over the past five years. Having the capability to offer Kenyans credit facilities is a role we value,” Mbowa said.

“We have valued these tours as a way to celebrate with and thank our customers for joining us on this journey. We also launched new initiatives to educate our customers on responsible borrowing practices and heard valuable feedback on how to evolve our product to meet our customers’ needs.”

In the Kenyan market, Tala remains the largest non-bank fintech having pioneered the use of non-traditional credit under writing to create financial identities and provide much-needed liquidity for the under-banked.

Since its inception, Tala has disbursed loans to over 2.5 million customers in Kenya. At a global level, the platform has disbursed more than Ksh 72.3 billion (USD 700 million).

“The Kenyan population is a youthful one. With access to financial services, the youth have the opportunity to build our economy through venturing into businesses and projects that will curb challenges we face as a nation, including high unemployment rate,” added Mr Mbowa.

“As we engage with our customers during these tours, we encourage them to borrow and invest in revenue-generating ventures.”

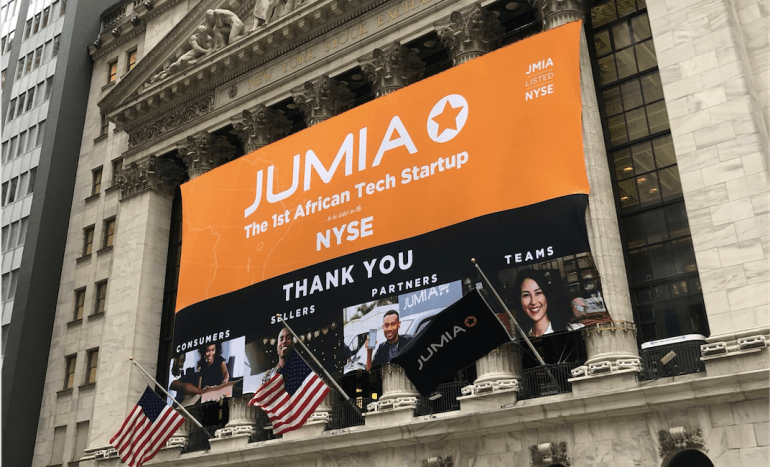

According to research by online retail platform Jumia, Kenya is leading the continent in terms of smartphone penetration which stands at 91 percent. This increased penetration has led to financial inclusion in the country as it has helped make digital lending accessible to the wider audience.

With an established customer base in Kenya, Tanzania, the Philippines, India, and Mexico, Tala is looking at cementing its leading position while exploring new ways to create value for its customers.

Leave a comment