NBK

KCB Q1 2021 Net Profit Rises Marginally To Sh6.4 Billion

KCB Group CEO & MD Joshua Oigara said the economic environment marginally improved in the quarter although the uncertainties from the pandemic remain...

NBK Q1 2021 Profit After Tax Grows 19%, Driven By Loans

NBK Managing Director Paul Russo said the quarter was marked by pockets of slow recovery from effects of the COVID-19 pandemic due to...

NBK Delivers 167% Growth in Net Profit For 2020

The bank’s corporate and retail franchises remained resilient in the subdued economy with reduced activity across sectors. During the period, NBK rolled out...

NBK Q3 Profit Shrinks as Economy Slows Down

The corporate and retail franchises remained resilient, amid a subdued economy and reduced activity across sectors.

NBK Sinks Deeper in the Red After New Tax Regime Devours Profits

he bank’s performance, despite the COVID-19 pandemic, was driven by growth in loans and enhanced returns from government securities.

National Bank Posts Big Loss Despite Cash Injection By KCB

The stock of non-performing loans stood at Ksh25 billion, down from Ksh31 billion in 2018, as a result of an aggressive recovery strategy.

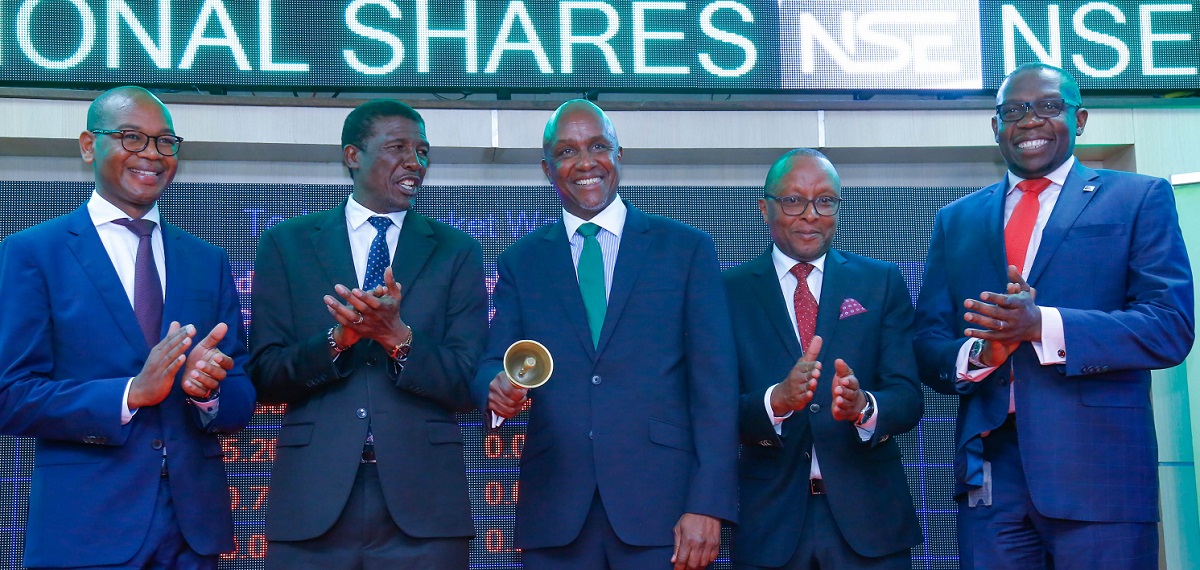

KCB Lists More Shares After Taking Over National Bank

NBK shareholders who swapped their shares for those of KCB will now be able to trade the new stocks at the stock market.

Kenya’s 3 Biggest Banks Jostling For Top Position

All the banks have operations outside Kenyan and strengthening their bases at home would be a strategy to expand even further, faster.

KCB Insider Picked to Head National Bank

New NBK MD takes over from Wilfred Musau, who has been assigned a new role at KCB Group to support the integration.