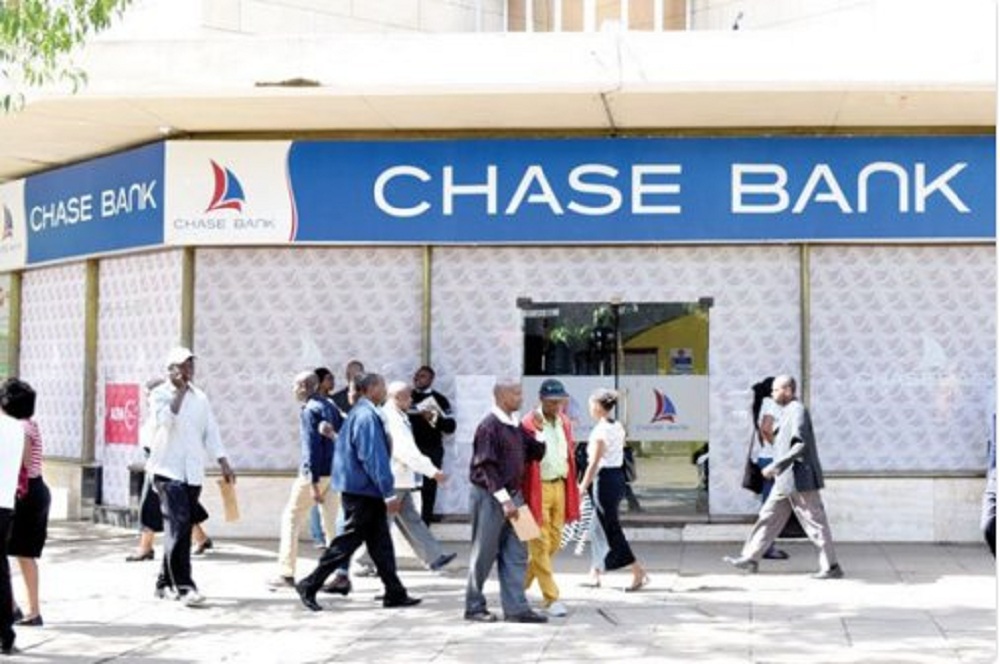

Mauritius-based SBM Holdings IS planning to inject Ksh 6 billion ($60 million) as starting capital following the acquisition of 75% of Chase Bank’s assets and liabilities, a development that means large depositors could start accessing their cash in the next six months. The lender, which recently concluded an agreement for the acquisition of a majority stake in Chase, which had been in receivership since April 2016, has already injected Ksh 2.6 billion ($26 million).

SBM chairman Kee Chong Li Kwong Wing said the new capital will help embolden its dream of growing into a regional lender as it remains keen on serving the SMEs that was popular with Chase Bank.

“We want to use Kenya as a hub for regional development,” said Mr. Kee. “If there are more opportunities to buy more banks we won’t stop. We have appetite, resources and capabilities and we want to do it the African way and according to the demand of the market,” he added.

With deposits of more than Ksh 100 billion, Chase Bank collapsed back in 2016 part of which the deposits were returned when the bank was under the care of Central Bank. Depending on how fast the regulator approves the transaction, SBM says it is now ready to grant access to the remaining deposits once its acquisition of Chase Bank is completed.

“We need the approval of the Central Bank, a minimum of four to six months,” said SBM chairman Li Kwong Wing at a press briefing in Nairobi on Tuesday.

According to the agreement between CBK and SBM, 25% of the deposits will be available immediately Chase Bank starts operations under SBM as well as when they get approvals in Mauritius where SBM is listed on the stock exchange and thus no interest will be payable on this cash.

“But we are not telling the customers to run and take deposits as we are here to stay. Approvals could take between four and six months but the idea is to do it as soon as possible,” he said.

READ: Be wary, investors warned as land prices take hits

Li Kwong Wing said SBM will absorb all Chase Bank’s employees estimated at around 1,300 in about 62 of its branches providing relief to the staffers who were uncertain about their fate.

The bank agreed to match certain assets with corresponding liabilities, including taking over about Ksh 60 billion ($600 million) deposits.