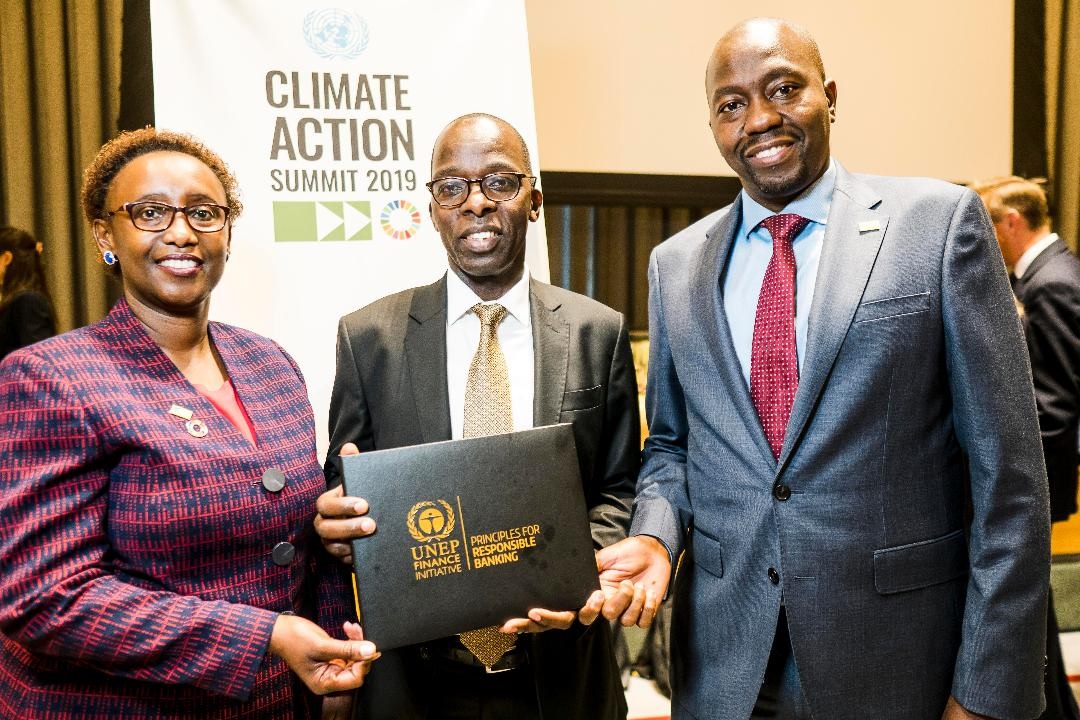

As a means to promote responsible banking, the Nairobi Securities Exchange (NSE) has endorsed a UNEP Finance Initiative (UNEP FI) which among other things supports climate action.

In a statement on September 30, the Nairobi Exchange said the banking sector plays a key role in society by fostering economic growth. “Banks have a unique opportunity to play a leading role in promoting sustainability and responsible business practices,” the NSE said.

The UNEP FI Principles for Responsible Banking was launched on September 22 at the UN headquarters in New York. The Nairobi bourse said, “The Principles for Responsible Banking provide a framework to align the banking industry with society’s goals.”

According to the UN Environment website, 130 banks collectively holding USD47 trillion in assets, or one-third of the global banking sector, signed up. The banks that signed up are reported to believe that their clients, customers and businesses can thrive “only in an inclusive society founded on human dignity, equality and the sustainable use of natural resources.”

The Principles for Responsible Banking were developed by a core group of 30 Founding Banks through an innovative global partnership between banks and the UNEP Finance Initiative (UNEP FI). Kenya’s KCB Group is one of the founding members of the UNEP FI.

Additionally, the UNEP FI is the UN-private sector collaboration that includes membership of more than 240 finance institutions around the globe.

UN Secretary-General António Guterres said, “The UN Principles for Responsible Banking are a guide for the global banking industry to respond to, drive and benefit from a sustainable development economy. The Principles create the accountability that can realize responsibility, and the ambition that can drive action.”

NSE chief executive Geoffrey Odundo said the bourse was delighted to support the Principles for Responsible Banking and urged all listed banks to commit to the principles for the benefit of the entire ecosystem. “As a market, we are confident that the principles will enable banks enhance their attractiveness to investors, as investors focus more on Environmental, Social and Governance metrics in their investment decisions.”

UNEP Executive Director Inger Andersen said that a banking industry that plans for the risks associated with climate change and other environmental challenges can both drive the transition to low-carbon and climate-resilient economies and also benefit from it. “When the financial system shifts its capital away from resource-hungry, brown investments to those that back nature as solution, everybody wins in the long-term.”

Leave a comment