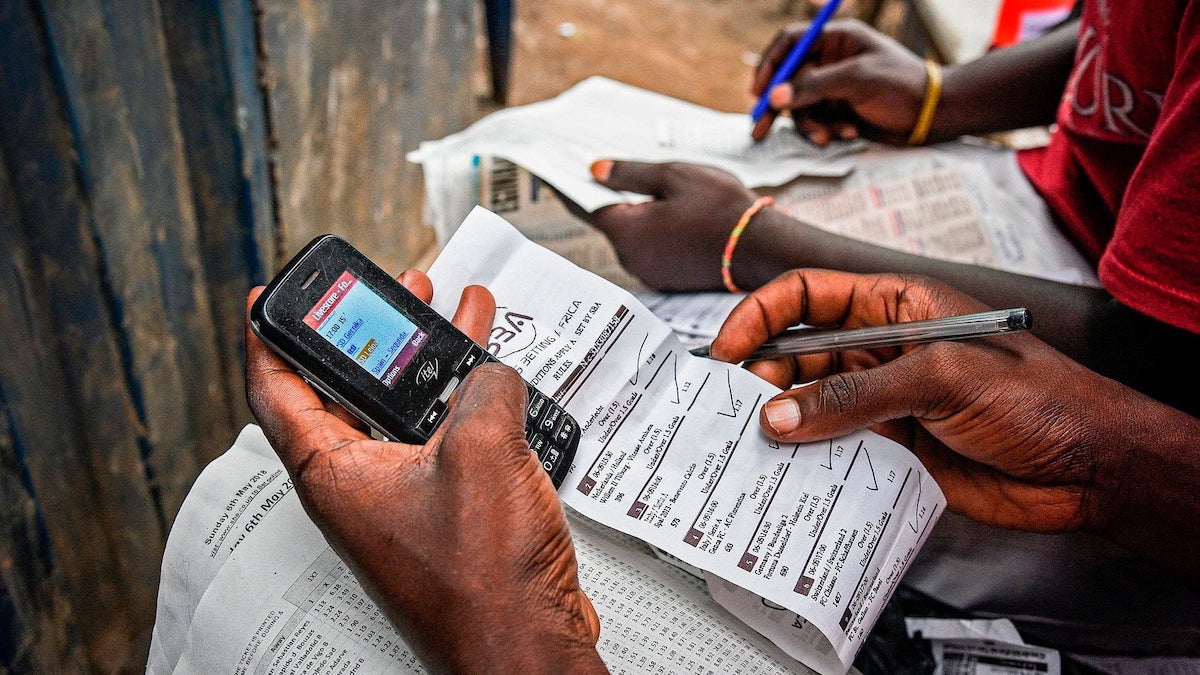

Revenue collection in the betting and gaming sector has registered a significant growth after Kenya Revenue Authority (KRA) collected over Ksh15.1 billion from Excise on Betting and Withholding Tax on Winnings from the betting sector.

The revenue collection reflects a growth of 23.9% from the tax heads, compared to the same period in the financial year 2021/2022, according to Mr David Mwangi, the Commissioner of Domestic taxes.

Excise Duty on Betting registered an exceptional performance of 116.2% after KRA collected Ksh6.640 billion from the sector. The collection was against a target of Ksh5.715 billion, which reflects a surplus collection of Ksh925 million from the tax head. The increase in Excise duty on betting reflects a growth of 30.0% compared to the same period in FY 2021/2022.

The Withholding Tax from winnings also netted Ksh8.601 Billion. The collection reflects a growth of 21.1% compared to the same period in the financial year 2021/2022. The betting tax similarly recorded a growth of 14.7% after KRA collected Ksh3.874 Billion. “The performance is attributed to the integration of betting companies into the KRA tax system,” Mr Mwangi said.

So far, KRA has integrated 36 companies, which contributed to the revenue growth in the sector. KRA has commenced the integration of the final 87 betting firms into the system. This is expected to significantly enhance revenue collection from the sector.

The integration began in mid-October 2022, targeting the daily collection of the 7.5% Excise Duty on stakes and the 20 per cent Withholding Tax on winnings from the companies. The initiative is in line with KRA’s commitment to streamline tax remittances from the sector, with the aim of scaling up revenue mobilisation and collection.

read >> Equity Bank CEO James Mwangi Reveals Banking Lessons From His Mum

The programme has enabled KRA to make significant improvements on tax administrative processes in the betting and gaming sector, with the daily visibility of the firms providing trends that inform compliance measures.

Additionally, the integration has made betting and gaming transaction data readily available, which facilitates the verification of daily remittances by taxpayers. The integration is part of tax-at-source initiatives being implemented by KRA.

“Tax-at-source is an emerging global trend moving away from the traditional self-assessment of taxes. This concept allows the collection of tax information and revenue directly at the source of income on a real-time basis,” Mr Mwangi said in a statement.

Through this programme, KRA is implementing reforms to move towards seamless taxation by ensuring that its systems, taxpayers and businesses are integrated to allow data to move automatically through machine-to-machine based processes, including real-time where appropriate.

See >> Young Kenyans With D+ To get Capital For Business

Other initiatives under the tax-at-source programme include the Electronic Tax Invoice Management System (eTIMS), which has minimised VAT fraud and enhanced tax revenue. A total of 95,732 VAT-registered taxpayers were onboarded, which led to remittances of Ksh272.365 billion.

Revenue performance is projected to improve considerably upon enhanced uptake of eTIMS. The system is also anticipated to achieve simplified return filing through prepopulated VAT returns.

Leave a comment