Service Kenya Revenue Authority (KRA) has commenced a strategic reform process whose objective is to enhance operational efficiency, optimise processes and streamline administrative procedures within the tax administration.

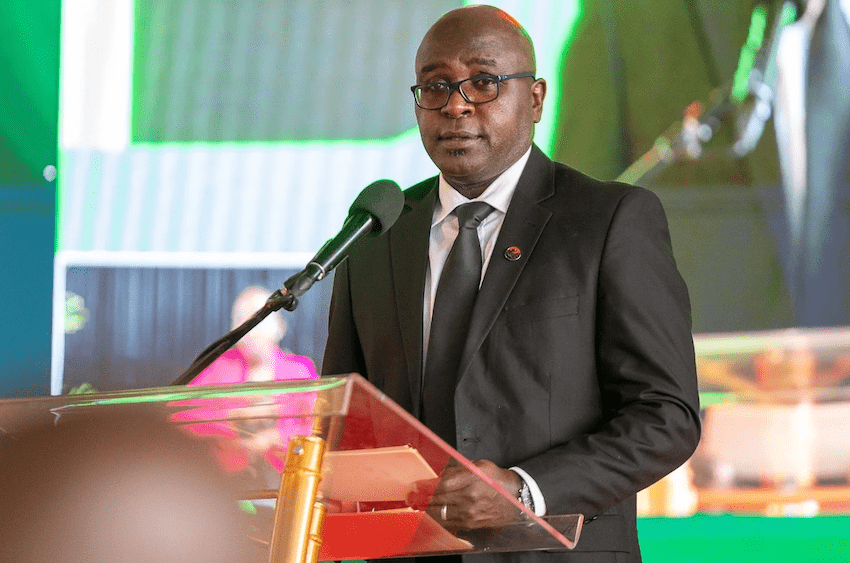

Kenya Revenue Authority Commissioner General Mr Humphrey Wattanga says the process is anchored on KRA’s 9th Corporate Plan which envisions an agile tax and customs revenue agency facilitating voluntary compliance for as well as a a more responsive and customer-centric organisation.

As part of this transformation, Mr Wattanga said KRA is implementing internal realignments within its functional areas of revenue, technology and service with a view to creating an flexible and responsive tax administration framework, strengthen the digital infrastructure for data-driven decision-making and automation, and to improve taxpayer engagement and support, thereby promoting ease of compliance and service delivery.

Changes include integration of the Large and Medium Taxpayers into a core functional area, and the Micro and Small Taxpayers as another core functional area. “With this change and through the relationship management framework, taxpayers can expect more personalized support and attention to their unique compliance needs,” Mr Wattanga says.

> Kenya Airways Buys Boeing 737 Aircraft From Dubai

He said these functional areas will also support KRA’s endeavour of growing the tax base in alignment with the ambitions of the Medium-Term Revenue Strategy and KRA’s 9th Corporate Plan. The ambition to be a data-driven revenue administrator will now be functionally crystallised through the introduction of a technology-focused division – the Business Strategy Technology and Enterprise Modernisation Department.

The twinning of technology and reviewed segmentation provide an opportunity to serve taxpayers in a more efficient and seamless manner, he said.

Mr Wattanga added that internal alignment will further focus on enhancing workflow processes to reduce redundancies, optimise internal resources and leverage advanced analytics and automation for effective delivery of KRA’s mandate.

“This transformation underscores our commitment to facilitate tax compliance through efficient administration, technology-driven solutions and service excellence,” he said. “KRA remains committed to ensure a smooth transition during this period and reassures the public that service delivery will continue uninterrupted.”

> United Nations Backs Equity Bank Youth Innovation Programme

Leave a comment