If you receive money from a friend or relative living abroad, work online, or live and work in the diaspora and need to send money back home – it is likely that you are familiar with several online money transfer services.

The emergence of online money transfer services — which allow for faster, more affordable and more convenient cross-border money transfers compared with traditional remittances services that rely on physical agents — has been a huge driver of increased remittance flows into Kenya and the wider African continent. Today, diaspora remittances in Kenya surpass forex earnings from tea, tourism and other leading export earners, while in Africa, diaspora remittances surpass Official Development Aid.

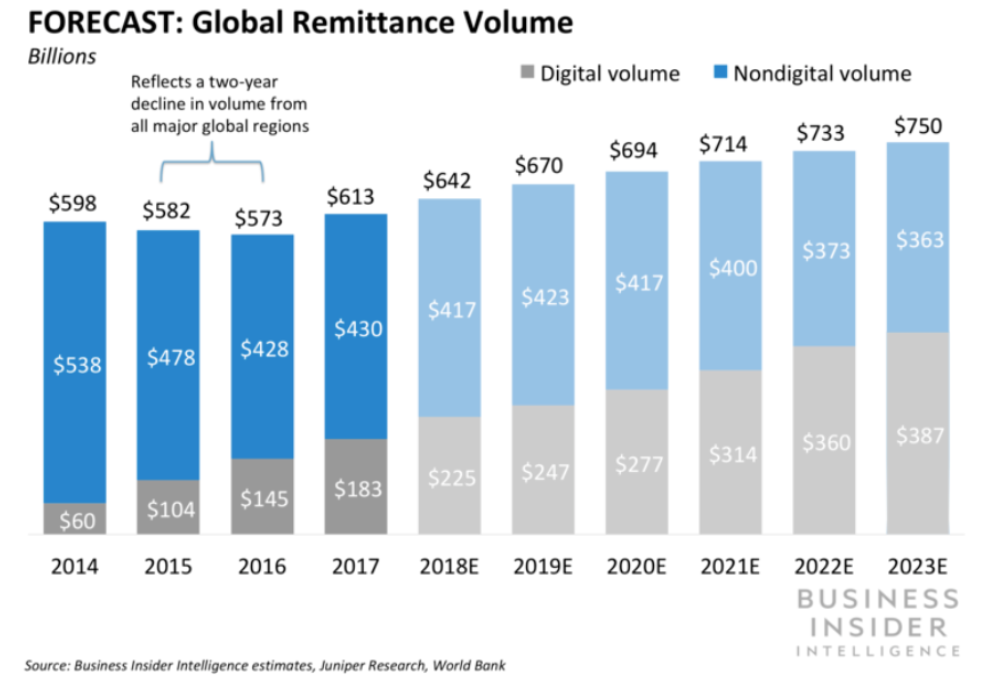

Digital remittances are expected to surpass 50% of total global remittances by 2023, up significantly from approximately 10% in 2014. As more online money transfer services go to market in response to the opportunity in digital transfers, consumers need to know how to choose a service that best suits their needs. Knowing the difference between a good online money transfer service and a great one is important regardless of what side of the transaction you are on (whether you are sending money or receiving it).

As part of our coverage of the fintech sector, we chose to review WorldRemit – one of the leading international online money transfer services, which is headquartered in London and has a strong presence in Kenya and the wider African continent, alongside other global markets.

In 2019, the company saw a 43% growth in remittances to Africa from higher-income nations, underlining its growth in Africa. The top five African countries receiving remittances from the diaspora via WorldRemit in 2019 included, Ghana, Kenya, Uganda, Zimbabwe, with Nigeria receiving the most remittances. The top sending countries to the region included the United States, Australia, Canada, and Sweden, with the UK sending the most remittances.

Who is WorldRemit?

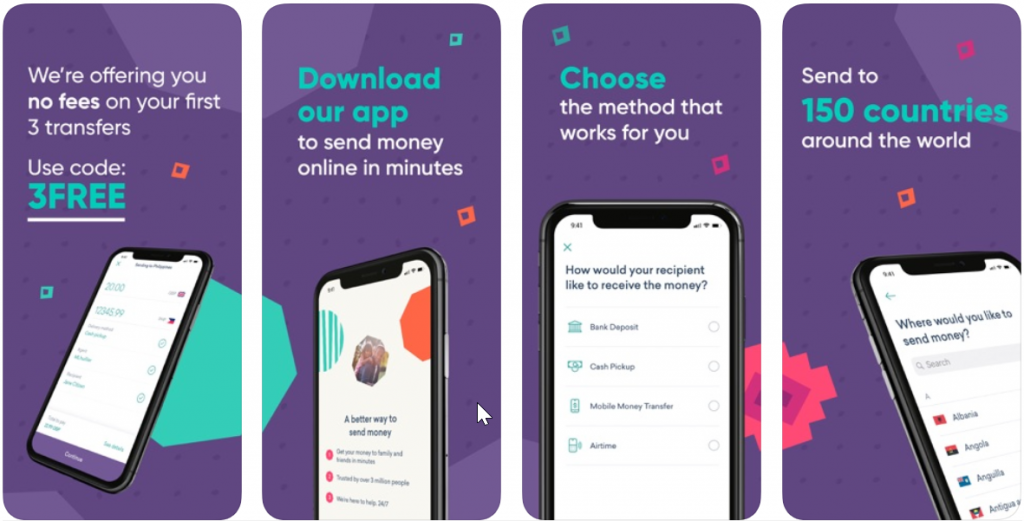

Even before reviewing WorldRemit’s service, the first observation we made was the interesting story behind its founding in 2010. In just one decade, WorldRemit has grown into a global brand that supports sending money from 50 countries to 150 countries. Who is the person behind this phenomenal growth?

Ismail Ahmed, the founder and current Executive Chairman of the company. Ismail Ahmed was the CEO of the company from its founding in 2010 until 2018 when he was elevated to Executive Chairman, after which Breon Corcoran, the current CEO, took up the reins with the mission of consolidating the gains and unlocking the next chapter of growth.

Ismail is a former refugee from Somaliland who came to the U.K. in 1988 to escape war. Following a career at the United Nations, he founded WorldRemit – a company that has captured the imagination of the tech and business community across the world. We found this profile from Wired UK to have some very interesting anecdotes of Ismail’s journey, including how he used £200,000 to start WorldRemit in 2010.

Little did he know that ten years later the company he helped build would establish a fast-growing global customer base of more than 4 million users and employ more than 800 people, besides raising more than $375 million in debt and equity funding.

How it works

So, with that background, how does WorldRemit work?

- If you are sending money

The service allows you to send money from 50 countries around the world via the WorldRemit website or on the app, which is available on Android and iOS. Countries that have large Kenyan diaspora populations are covered – the U.S. (across all states), Canada, U.K., France, Germany and other European countries, as well as countries in the Middle East, Australia, Asia and the Americas. You can get the full list of countries HERE

See Also > > WorldRemit Brings to Kenya a Unique Money Transfer Service

On the “send” side, the service is 100% digital. Your WorldRemit account is linked to your bank, card or online wallet and you simply send the money with a few taps of your phone or at the convenience of your laptop. It takes a few minutes for the transaction to be processed, and you get to see the charges upfront as well as the estimated time the transaction will take.

This experience differs significantly from traditional remittances, where you physically need to go to an agent location and line up. There is an obvious economic benefit to the user – the absence of physical agents reduces WorldRemit’s cost of remittances, allowing it to pass on the savings to users through affordable fees.

- If you are receiving money

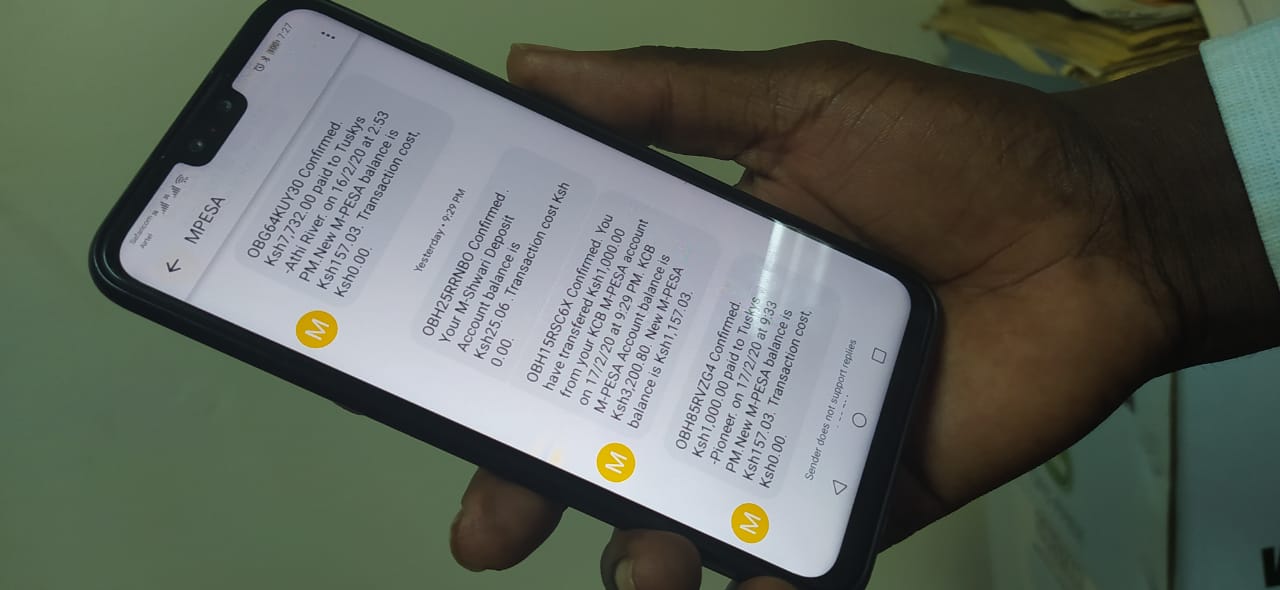

For those receiving money, there are a wide range of options, including bank deposits, cash pick-up, mobile airtime top-up and mobile money. This enhances convenience, as it may sometimes be more convenient to receive the money on your M-PESA rather than directly in the bank, especially if you have an active lifestyle. At other times, you want to collect your money in hard currency at a safe location. You may even want to receive money – especially if it is small amounts – as airtime; this may prove useful for people like students or those that work online and need data bundles.

You can receive money in 150 countries (including Kenya). A full list of countries supported can be found HERE

What we liked

Safety first

- In the online money transfer space, safety, security and privacy are highly important considerations when selecting a service.

- WorldRemit is a fully licensed international money transfer service. Operating as an Authorised Electronic Money Institution, it is regulated by the Financial Conduct Authority in the UK. It also meets the requirements of global regulatory bodies.

- There is also comfort in knowing that all connections to WorldRemit through the website and mobile app are secured and encrypted. This means that information exchanged between your browser and the site is not accessible to any third party.

24/7 support

- We also liked the fact that WorldRemit’s customer care team is responsive and available 24/7. Even with the best technology, it is good to know that someone is available to speak to, even if it is just for advice about the best times to transfer money or other processes.

Trusted reviews

- The app has an aggregate rating of 4.4 stars out of 5 on Google Play and has received more than 125,000 5-star reviews on TrustPilot and an overall TrustPilot rating of over 4 stars. Customer reviews are important in assessing which service to use.

Simple, fast and affordable

- The speed and simplicity of sending money using WorldRemit, as well as the affordability are certainly worth mentioning. It is also convenient to receive money, given the options available to customers – cash pickup, airtime top-up, mobile money and bank deposit.

Test drive

- It is always daunting to experiment with a new financial service. We liked the fact that WorldRemit has a promo that waives fees on the first 3 transfers. This means that if you are in an eligible“send country” you can test-drive the service at no cost; you can also suggest the service to your contacts abroad in case you want to make use of the offer.

What we are looking forward to

Business payments

Last year, the company launched WorldRemit for Business, a new service that enables small and medium-sized business owners to quickly pay their employees and contractors in 140 countries worldwide, including fast-growing markets such as Ghana, Kenya, and South Africa. The platform is available to U.K.-registered businesses but is set to expand.

We are closely monitoring this as there is a growing community of online workers and entrepreneurs in Kenya who could benefit from more variety when receiving money from clients abroad.

Leave a comment