House prices continue to reel from slow economic growth as prices fell 3% in Q2 of 2019, the HassConsult Property Price Index reveals.

HassConsult says that the slowed growth has reduced liquidity in the market in the process making developers cut prices. In turn, this has presented opportunities for investors in the short term.

“We have seen an increase in distressed properties in the market as reflected by advertised property auctions. Additionally, developers are offering generous terms which continue to suppress prices and rents to the point where investors are opting for safer short-term investments while they cherry-pick the best bargains in the market,” said Sakina Hassanali, Head of Development Consulting and Research at HassConsult.

This is leading to investors active in the market buying properties at discounted prices confident that once the economy picks up there will be liquidity which will be reflected in the property market through increased prices.

HassConsult analysts however do not think this will persist.

“Despite the drop in asking prices it is important to note that property is a long-term investment and has historically performed better than other asset classes in the long run,” noted Ms. Hassanali.

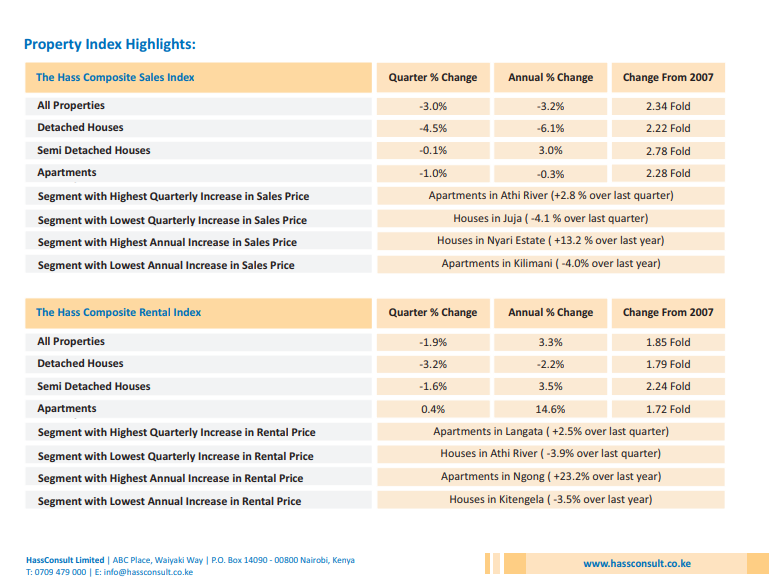

The quarterly price deductions were led by Juja, with houses in the satellite town dropping by 4.1%.

On the other hand, Athi River had the best property market with apartment prices in the area increasing by 2.8% over the same period.

House prices in Nyari registered the highest increase year on year, at a spike of 13.2%. On the other end of the spectrum, apartments in Kilimani dropped the most over the same period at a 4% fall.

Rent prices dropped by 1.9% in the quarter, led by the detached housing segment which dropped by 3.2% over the period.

Langata recorded the highest quarterly increase in asking rent prices at 2.5% per cent over the quarter while Athi River recorded the biggest drop at 3.9%.

[See Also: Relief as government extends e-passport deadline]

Leave a comment