[dropcap]A[/dropcap]lexander Forbes, a leading financial services player, says Kenyans cannot maintain their present lifestyle on retirement, as they will be earning only 22% of what they were being paid before retirement.

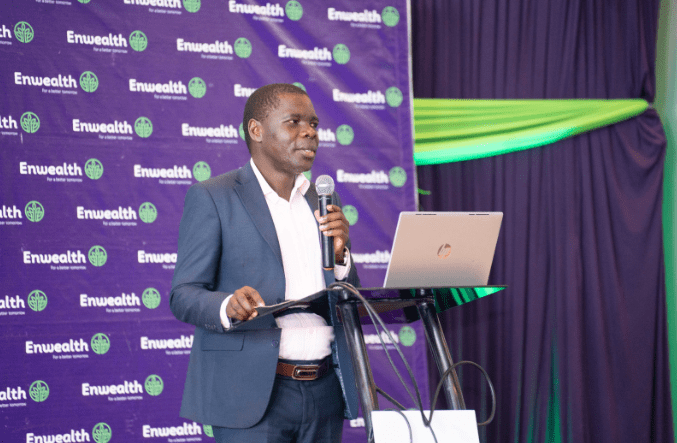

While briefing over 100 participating employers of the Alexander Forbes Retirement Fund last week on the investment environment and the outlook on market performance for the current year, Executive Director James Olubayi said several market studies conducted by the Retirement Benefits Authority (RBA) as well as Alexander Forbes showed that Kenyans were retiring with only 22% of their pre-retirement salaries.

Mr Olubayi, however, said a recently completed study of the income replacement rates for the members of the Alexander Forbes Retirement Fund indicated a much higher and commendable average rate of 53%.

“As Trustees of the Fund, our long term objective is to ensure that members retire with at least 60% of their pre-retirement salaries through the Fund investment strategy as well as member education and communication portals,” he added.

SEE ALSO: You can get rich by making very tiny saves at a time

He said the Fund will continue to offer varied different investment strategies that will present great opportunities for participating employers to exercise the appropriate strategy depending on their risk profile.

The Fund chairperson Ms Lucy Kambuni, told members that they would continue to drive optimal investment performance despite the concerns for this year, being an election year. “With investments it’s not about timing the market, it’s about time in the market”, she stressed.

Ms Kambuni said it is important for anyone to know what they own, and know why they own it. “It’s not about how much money you make, but how much money you save, how hard it works for you, and how many generations you keep it for”, she advised.

NEXT: How to start saving without having money

Many Kenyan workers end up retiring in abject poverty due to inadequate pensions paid out to maintain their sunset years when they need sustainable income.

Since its establishment in 2005, the Fund has registered strong growth in terms of both assets and members and it is now the largest multi-employer retirement Fund in East Africa, with over KShs 22 billion in assets for over 150 organizations and 30,000 members.

Leave a comment