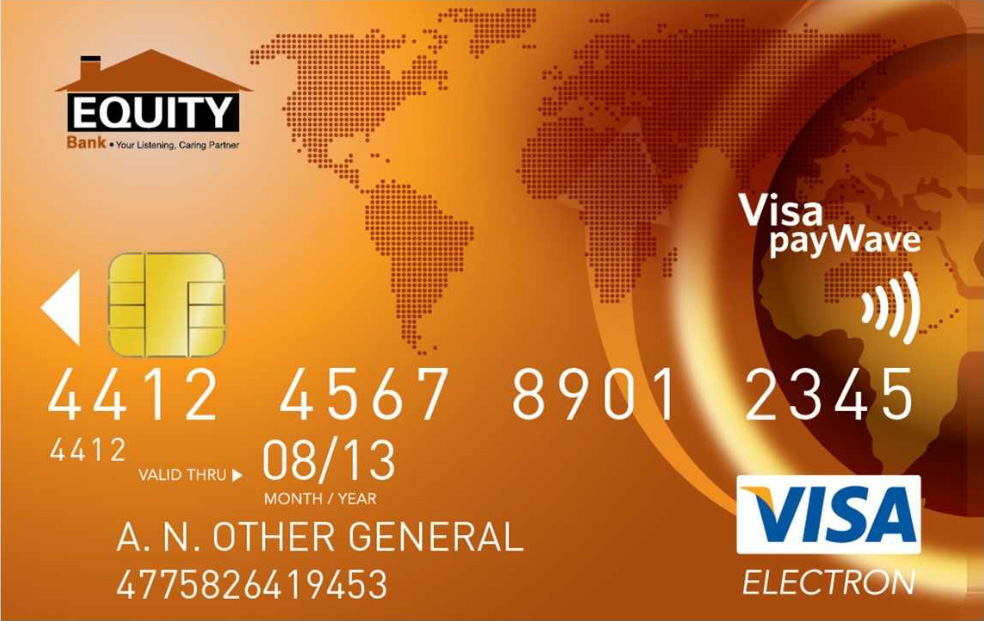

Equity Bank has started charging its customers an annual fees of Ksh240 for holding ATM cards, whether Visa or Mastercard. The fee is in addition to Ksh700 one-off fees charged for the card, making the lender’s ATM card one of the most expensive in the country.

Already, customers have started receiving messages alerting them of a deduction for the money from their accounts, without prior notice. “A fee has been deducted from your account (hidden) Amount: KES: 240 Desc: Annual Debit Card Fee,” the message which most customers have received read.

Equity Bank has at least nine million customers/accounts, which will translate to Ksh2.16 billion every year assuming every account has an active ATM card.

The charge is despite customers being charged transaction fees for every transaction using the ATM card.

Recently, Equity Bank launched a new all-in-one payments solution dubbed One Equity.

One Equity offers businesses a single till number that allows customers to make payments via M-Pesa, Airtel Money, PesaLink, Equitel, and the Eazzybanking app. It eliminates the need for business owners to acquire multiple till numbers from telcos and financial service providers.

It also integrates QR code payments for customers wishing to scan-to-pay via payment channels including Equity’s Eazzybanking App, M-VISA, Masterpass QR and UnionPay.

“Businesses will now be able to get the most out of their activities by devoting their time to their clients as the Equity solution simplifies their operational needs from a payment standpoint. One Equity Till Number is simple and interoperable making it very inclusive and in tune with the needs of many businesses,” said Equity in a statement.

Equity recorded a Ksh26.8 billion net profit in Q3 of 2021 compared to Ksh15 billion posted in the same period last year.

This was attributed to a 28.8 percent growth in non-funded income to Ksh31.9 billion including fees and commission income on loans, bond and forex trading income.

“Non-funded income grew by 29 percent faster than the interest income from loan book which grew by 24.4 percent as the bank deployed deposits to high-earning asset base other than government securities. We continue to look at where we can invest much for revenue,” Equity Group chief executive James Mwangi said in November 2021.

Read: Safaricom’s Lipa na M-Pesa Faces Equity Onslaught

>>> Equity Bank Now Offers One-Day Settlement For PayPal Withdrawals

Equity is behaving badly now.

I received such a message of deduction.

I think am on my way out of such a bank that doesn’t seem to have even a courtesy of informing it’s customer of new charges. Who knows what will happen tomorrow. Equity may just wake up and deduct Kes 10,000 from each customer and send some sms saying it charges for having had the account for 10 years.

I would urge Kenyans to say enough is enough.

#my money my sweat.

Equity seems to have forgotten how Kenyans supported it during its formative stages. When a frog is assisted to cross the river,it start boasting that it made it by itself.

#shopping for a bank now.

If they are charging for every ATM transaction then why impose an annual ATM fee also having the ATM card does not necessarilly mean its being used

This is not fair now is like equity has become expensive in terms of having accounts with them

Who needs an ATM when you can easily withdraw with Equitel or EAZZY app.

Equiy is just trying to help you save your hard earned money though innovate technology. Just adapt and you will thank me later.

In my view, this is the BEST bank in kenya today

It has the worst customer service in the country