Digital technologies have opened unlimited opportunities for individuals and businesses and the ripple effect is deeply felt in Kenya where six out of ten people own a smartphone.

The proliferation of internet technologies has created a pool of 30,000 apps accessible to smartphone owners, among them, tens of digital lending apps, commonly known as loan apps.

In a proactive move to help customers and lenders by increasing transparency and introducing sanity in the market, leading fintech companies combined efforts to create an umbrella association called Digital Lenders Association of Kenya (DLAK).

Making Affordable & Less Painful

Whereas the traditional finance sector operates on a rule-based regulatory framework, DLAK understands that sometimes the legal is not ethical and, therefore, takes a principle-based approach that rides on good conduct, transparency, ethics, professionalism and customer-centricity.

The rationale here is that businesses should operate on a triple-bottomline approach that recognizes the economic-social nexus of “doing well by doing good”.

It means that the industry cannot just wait for regulators to intervene as players should be able to cater for the needs of customers without exposing them to adverse practices.

DLAK understands that there are critical supply and demand-side issues affecting the market, among them, hidden costs and data privacy (supply side) and identity fraud and high default rates for small loans (demand side).

The (Code of Conduct) aims at balancing the interests of the two parties to achieve a fair and reasonable standard practice.

See Also >> Most Affordable Mobile Lending Apps in Kenya

The story of mobile lending is synonymous with the trend of financial inclusion in Kenya as 91% of loans are disbursed through mobile handsets.

It is a blue-ocean trend that captures the increased access to credit for previously unbanked consumers. The leaders in mobile-based lending are backed by financial institutions, with KCB MPESA (backed by KCB) and Mshwari (owned by NCBA) controlling 82% of mobile lending market.

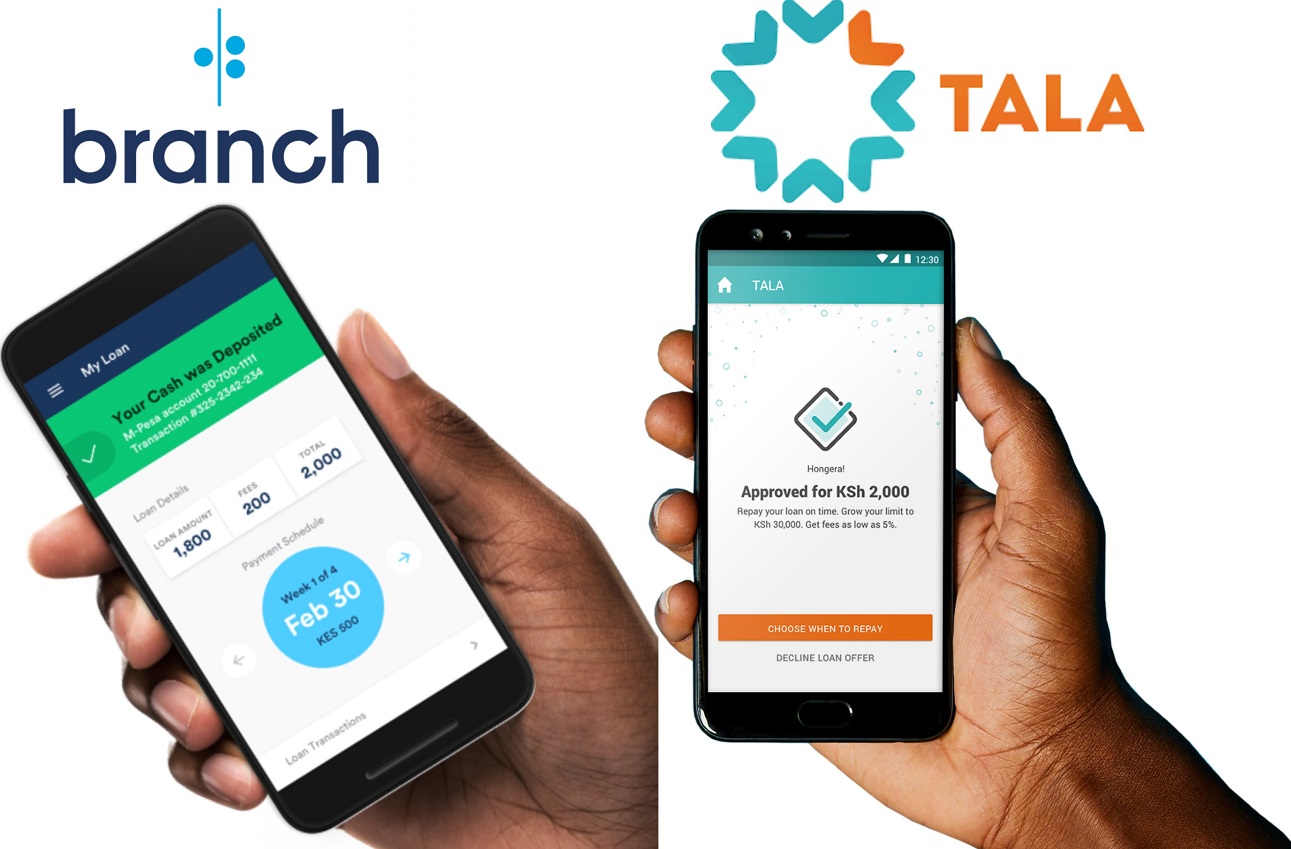

As more Kenyans purchase smartphones, the expectation is that the number of people borrowing money from android-based apps will skyrocket. Already, the major players in this subsector (Tala and Branch) have a combined customer base of 1.52 million people.

Mobile lending is synonymous with financial inclusion in Kenya as 91% of loans are disbursed through mobile handsets.

Different surveys by institutions such as Financial Sector Deepening-Kenya (FSD) estimate the number of non-bank lenders (non-deposit taking MFIs) between 50 and 100. A more detailed study is required to establish the exact number.

This is one of the initiatives that DLAK will pursue with the guidance of the relevant regulators. However, most non-bank lenders (e.g non-deposit taking MFI) obtain a no-objection letter from Central Bank of Kenya (CBK), making CBK a better source of the estimated total number of all phone-based money lenders.

Presently, market practices dictate that each lender provides its offer details including the interest rates on its webpage or the mobile application.

See Also >> Just Check, You Could Be Listed on CRB Without Knowing

However, without an overall body to provide a guide on what is permissible and what is not, it is difficult to achieve uniformity and unanimity in practice.

Given the rapid growth and emerging challenges in the sector, there is a need to address the need for a more focused, comprehensive and effective regulatory framework for the mobile lending space.

DLAK proposed the preparation of a comprehensive White Paper about the phone-based money lending market and market players to be followed by the recommendations and best practices drawn from all over the world.

Digital lending regulation

Such a report should be guided by the regulators and developed in collaboration with a prominent professional auditing/consulting firm (e.g. PWC, E&Y) with global experience and expertise in the field.

The regulators are in discussions with the Digital Lenders Association of Kenya and industry experts about the prerequisites needed to undertake this process.

Such a discussion couldn’t commence before the establishment of DLAK, as holding a dialogue with every single market player would be unproductive and would go against good market practices.

Next Read >> How Tala Uses Personal Info on Your Phone to Assess Your Credit Score

Leave a comment