It was obvious that Finance Cabinet Secretary Henry Rotich would impose sin tax on alcoholic drinks. But when he raided lovers of alcohol with more taxation, not many Kenyans noticed the implication of the 14.3 increase in tax on high-value spirits from Ksh175 to Ksh200 per litre.

The tax directly hit President Uhuru Kenyatta, who is a big fan of whiskey. “Mr Speaker,” Mr Rotich read, “the consumption of high value spirits has increased tremendously. I also propose to increase the tax rate of spirits from Ksh175 per litre to Ksh200 per litre.”

This pushes up the cost of the high-value spirits which have become a staple of the middle-class and super-rich in the country.

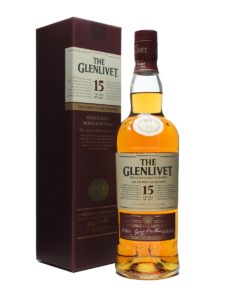

Last year, barman Charles Njuguna Warui, who used to serve Uhuru at Caribana Bar and Grill in Hurlingham, Nairobi, before he was elected, revealed that the President’s drink of choice when he used to patronise every Sunday of the week was Glenlivet whiskey, 18-year-old. The President is also known to like Jameson and John Walker Green Label.

The last time Warui served Uhuru, he said, was two weeks before elections. It’s not likely that his taste buds have changed as he has been seen in situations that confirm he still partakes of high-value spirits.

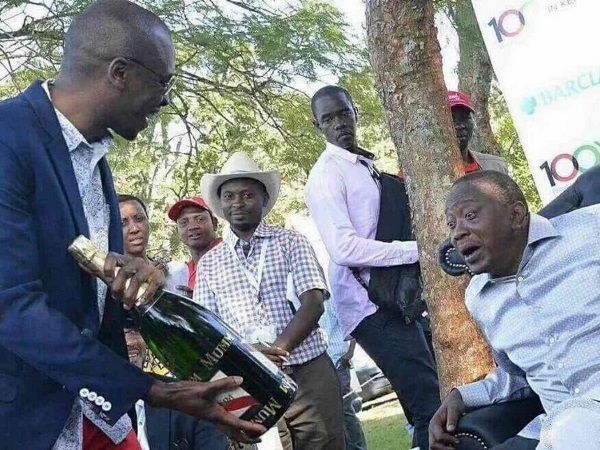

During the March 2016 Barclays Kenya Open Golf Tournament, the President was presented with a bottle of champagne during the just concluded 2016 edition of the Barclays Kenya Open golf tournament. A seemingly surprised Uhuru took the bottle of French champagne G H Mumm, a limited edition packaged in a three-litre bottle retailing at close to Ksh70,000 per bottle.

Also See >> Barman reveals President’s drinking secrets

The increased demand of whiskey and brandy has seen an influx of the international brands, with Budweiser beer and Officer’s Choice Whiskey, setting up shop in Kenya to meet demand, which is brand-oriented and focused on quality with its high spending power. The middle class in Kenya is influenced by global trends, due to their global exposure through international travel and internet access shaping their behaviour and consumption patterns.

Meanwhile, still on alcohol, Rotich gave a reprieve to beer produced using local materials to discourage the consumption of illicit drinks. “I have proposed 80% remission (cancellation) of excise duty in respect of locally manufactured beer made from locally produced sorghum, millet or cassava or any other produce, excluding barley.”

While the taxation of beer did not change, the inflation adjustment that will be effected from 1st July will increase government revenue, he said.

Read >> Budget proposals that will change your life for better

The Cabinet Secretary did not stop there as he announced more tax for cigarettes, although it’s not clear whether smoking is on the President’s favoured list. “The current single tax structure of Ksh 2,500 per mille of cigarette has been inequitable and has adversely affected demand for locally produced low value cigarette.

“To cushion the local cigarette manufacturers from the adverse financial effects due to loss in market, I have proposed a two-tier tax structure of Ksh 2,500 per mille for cigarette with filters and Ksh 1,800 per mille for plain cigarette. This tax measure will ensure equity and fairness in the tobacco industry and prevent job losses in this sector.”

[crp]

Leave a comment