Best Stock Brokers: Governments, businesses, social lives, and education have all been influenced by technological advancements. People nowadays have easy access to the resources and information they require to maintain and operate their enterprises. The stock market is one of the sectors where technology has had a significant impact.

You must accept technology if you want to be successful in stock trading. You may have understood as an investor or broker how technology might assist you in becoming a better investment. To put this in perspective, it was recently stated that millennials account for up to 60% of the 15 million online traders throughout the world, which is a natural development given that this is the first generation to grow up with digital technology at their disposal.

With the advancement of technology, much has changed in the trade industry. Regardless of their prior experience, even the best stock brokers in South Africa have adopted technology to get the game a notch higher. It has made the market more accessible to everyone, allowing anyone to benefit from the benefits of responsible and regulated trade, otherwise referred to as the three A’s: accessibility, accountability, and affordability.

Technological improvements have made it possible for anyone to trade from anywhere in the world, as long as they have access to the internet. As a result, the digitalization of the business was a significant step forward in ensuring that more people, besides the brokers, have access to trading tools.

Clients can also hold stock brokers answerable in terms of pricing, execution, and services in a digital world, providing an environment where clients feel comfortable participating.

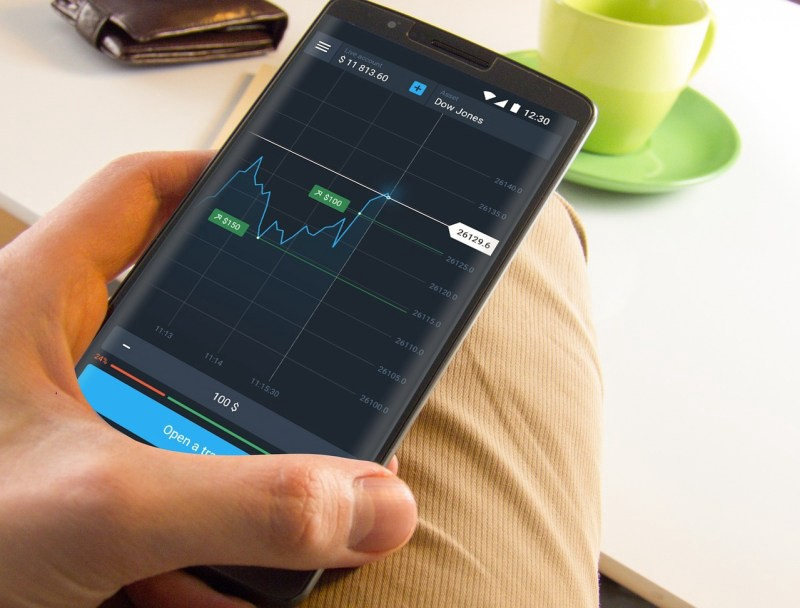

Finally, the digitization of the sector has made trading less costly; instead of spending a lot of money on a stock broker, all that is required nowadays is a $100 investment and internet connectivity.

Tools for pricing, charting, and order logs are by far some of the most significant technological developments in online trading. However, given the App Generation that we live in, one thing we have seen becoming increasingly popular is the concept of mobile trading, which allows people to buy and sell stocks from the comfort of their phone, laptop, or tablet at any time.

This digital evolution necessitates policy changes by regulators to ensure that businesses and their market solutions are geared towards client satisfaction and consumer protection.

While this may hinder regulatory progress at times, it allows trade partners to better understand clients so that we can supply them with the best possible solution.

Traders should search for a company that not only represents a client-centric mentality, but is also regulated, offers affordable pricing, and uses the most advanced trading technology available when choosing to work with an online trading service. Traders should also think about the provider’s server dependability and execution speed.

To be an effective trader, you must acquaint yourself with the best trading best practices and pay attention to trends and the risks that come with them. While there are numerous resources available on the internet, including tutorials, programs, manuals, and videos, it is vital to remember that quick information does not always equate to instant success, and actual trading strength and knowledge come through experience.

As a result, it’s critical to work with a broker that keeps an eye on digital progress while also maintaining the human touch that will help you create a trusting connection.

It is critical to conduct research about the firm and the regulations that they follow in order to choose the proper trading partner. The Securities Commission of The Bahamas (SCB) is the ideal place to start because they keep an up-to-date registration of all corporations and their commercial activity.

Traders should preempt the investment risks and benefits, as well as whether they can afford to lose a significant amount of money.

keep in mind that not all components of technology have proven to be beneficial in the stock market.

If something seems too good to be true, it almost always is. Be cautious of programs where opening an account, depositing money, trading, and making money are all too simple. This is a strong indicator of insufficient regulations and procedures.

It’s also worth considering how the brokerage makes money if your investment is too little. If this is the case, there is usually more going on than you realize.

While technology has clearly aided in the advancement of the trading sector, the client remains at the center of the industry, and technology advances in response to how clients utilize it. Human value is still important in today’s digital environment.

See >> How To Make Money From Forex Trading

It’s important to keep in mind that not all components of technology have proven to be beneficial in the stock market. In certain cases, stock movements have been discovered to have been generated by erroneous signals. Given how quickly information is distributed in today’s world, there have been occasions where investors have made decisions based on false information.

Furthermore, automated trading eliminates the necessity for market indications. Computerized trades have been known to create stock market panic and rapid fluctuations. Technology offered some of the best stock brokers, on the other hand, has shown to be useful in such instances.

Leave a comment