The squeeze Kenyans are going through as a result of slow economic growth and a strict regime governing access to credit due to the rate capping law has seen many of their properties going under the hammer as creditors move to redeem their money.

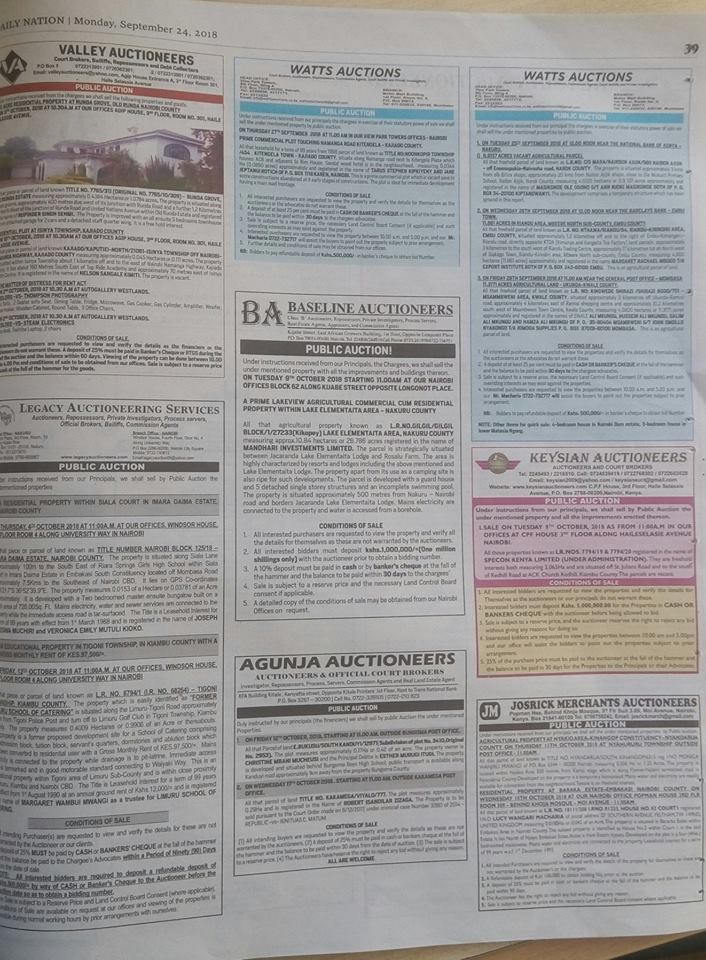

On Monday alone, 27 advertisements across five pages ran in the Daily Nation, a signal of how bad the situation is getting.

Among the properties belonging to loan defaulters that auctioneers are seeking to sell are prime residential houses, agricultural land and motor vehicles across several counties.

Ironically, National Treasury Principal Secretary Kamau Thugge’s VMS Towers, a building in Ongata Rongai consisting of five-storied blocks of residential flats and parking bays, was set to be auctioned on Tuesday, September 25.

The rise in auctions means the economy is set to shake off the effects of last year’s heated political environment that spilled over to the early weeks of the year before the two protagonists, President Uhuru Kenyatta and Opposition leader Raila Odinga, shook hands as the initiated the Building the Bridges Initiative to take the country back to normalcy as ways of addressing underlying issues are sought. The situation was exacerbated by prolonged drought and election related expenditure.

Despite Treasury mandarins remaining optimistic about the growth of the economy revising it from 5.8% in June to 6%, for ordinary Kenyans and households, it will be one of the toughest years following imposition of wide-ranging tax measures in the Finance Act 2018.

The Act imposed a 8% VAT on petroleum products down from the initial 16% and Ksh 18 per litre non-adulteration levy on Kerosene. Employers and employees will also pay a 1.5% housing levy to free Uhuru’s Big Four agenda of affordable housing.

Duty charged on excisable value on telephone and internet data service was also raised to 15.0% from the earlier 10.0%, as well excise duty fees charged for money transfer services by banks, agencies and other financial services providers to 20.0% from the earlier 10.0%.

Excise duty charge on other fees charged by financial institutions will also be increased to 20.0% from the earlier 10.0%. The imposition of these would replace the robin hood tax deemed more expensive and complicated to implement and the projected Ksh 20.2 billion revenue to be collected is set to be channeled to finance universal health care.

According to Cytton Investments, the additional taxes on fuel as well as the housing levy will put a strain on overall consumption leading to reduced profits especially in the telecommunication and financial sectors.

READ: INSTAGRAM FOUNDERS QUIT AMID FACEBOOK RIFT

This is because consumers will have to rationalie their consumption on goods and services due to the dilution of their purchasing power, which effectively means a reduction in the quantity of goods and services a single unit of currency can buy.

Rotich also slapped a 20% excise duty per kilogramme on sweets and chocolates, later saying the move will help address obesity in the country.

7 Comments