CBR, shorthand for Credit Reference Bureau has become one of the most dreaded acronyms in Kenya. Mention it and shivers run down the spines of Kenyans, majority of whom are servicing various types of loans. Some are on the run, having taken up credit and decided to dodge payment by changing mobile telephone numbers.

See Also >> A New Radio Station Seeks To Disrupt The Airwaves

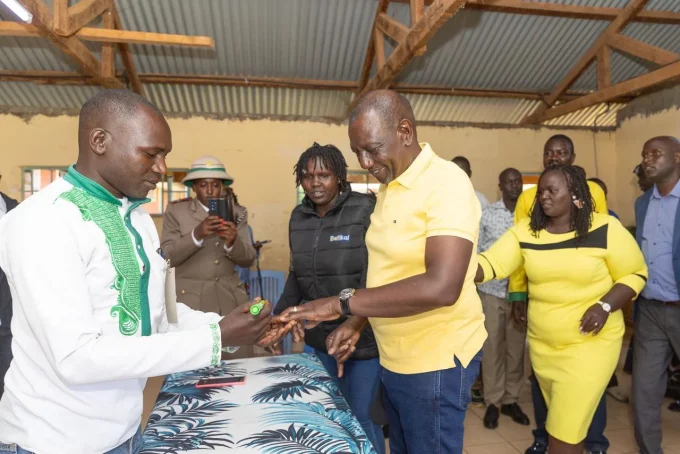

Well, freedom appears to be on the horizon, with President William Ruto promising to review the administration of CRB. His administration has announced plans to reform the credit information sharing system to lower the cost of loans for micro and small businesses.

President Ruto has hinted at reforms aimed at gradually moving away from the negative listing of loan defaulters, which has scared off many Kenyans from taking up credit. Worse, many borrowers have been blacklisted from accessing credit for defaults as low as Ksh1,000.

“Our starting point is to shift the credit reference bureau (CRB) framework from its current practice of arbitrary, punitive and all-or-nothing blacklisting of borrowers, which denies borrowers credit,” Dr Ruto said in his inauguration speech on Tuesday.

He said the government will work with credit reference bureaus on a new system of credit score rating that provides borrowers with an opportunity to manage their creditworthiness.

The announcement comes just two weeks to 30th September when the relief offered by President Uhuru Kenyatta on negative listing of defaulters of up to Ksh5 million lapses. While this protects defaulters, it has slowed down lending, especially for individuals and small enterprises seen as high-risk.

Data from the CRBs showed last year a third of Kenyan loan accounts are negatively listed as defaulted in an economy. The bulk of the new listings are for mobile digital loans despite the government having frozen the blacklisting of defaulted loans below Ksh1,000 from April to December last year.

The rising number of blacklisted loan accounts has jeopardised the chances of millions of Kenyans to borrow more. “Financial inclusion and access to credit are critical in addressing the fundamental factors of the cost of living, job creation and people’s well-being,” Dr Ruto said. “We shall take measures to drive down the cost of credit.”

Next >> Scramble For Kenya Power Shares Sparks A Rally In Price

Leave a comment