NAIROBI, KENYA

Leading local retailers have sounded an alarm over increased cases of operational losses occasioned by shoplifting and general theft, which could be costing them up to Ksh3 billion per year. The losses, technically referred to as shrinkage in retail trade parlance, is rising by the day due to what industry players fear could be a case of an emerging organised pilferage ring targeting local supermarkets.

Speaking during the first Kenya Retail Industry Conference organised by GfK, one of the world’s leading market research companies, Nakumatt Holdings Managing Director Atul Shah, disclosed that local retailers are suffering immense losses estimated at more than 1.5% of turnover due to increased cases of shoplifting and general store stock losses arising from theft.

Going by Nakumatt’s analysis, Shah explained that the emerging organised pilferage ring is targeting high value products such as electronic items, furniture items, baby food products cosmetics, and general food items. With the formal retail trade market estimated to be worth more than Kshs 200 billion the industry could well be losing more than Kshs 3billion annually to shoplifters among other loss avenues.

“What we previously thought to be small time cases of shoplifting has unfortunately evolved to become an organized crime leading to high shrinkage rates on our stockholding,” Shah explained.

And added: “It’s extremely alarming to note that conventional in store policing measures are not helping much and there’s an urgent need to review existing laws to make them more punitive both for shoplifters and also for employees tried under theft by servant clauses.” According to the 2011 Global Retail Theft Barometer (GRTB), produced by The Centre For Retail Research, global shrinkage covering customer theft, employee theft and general stock losses due to internal systems errors last year exceeded US$119 billion in a study covering 1,187 global retailers. The 2011 GRTB study conducted in 43 countries indicated that the global shrink rate grew 6.6% from 1.36% of global sales to stand at 1.45% with India, Russia and Morocco emerging as the most affected countries.

At the same time and in a progressive move expected to fully entrench the role of retail traders in the local market, Shah has reiterated the need for retail trade sector players to consider forming an umbrella association to address industry concerns. The wholesale and retail sector, Shah noted is the second most important economic driver in Kenya having registered a 7.3% growth beating the manufacturing, Building& Construction, agriculture, Transport and communication sectors according to the 2012 national economic survey.

“All local formal retailers need to engage in housekeeping by forming an industry lobby association to champion our interests. We must start speaking in one voice and seeking recognition and incentives to help accelerate our growth,” Shah explained. And added: “Providing a platform to encourage formal retail trade has a potential to significantly raise government revenues by more than a quarter of the current measure. In actual fact, the formalisation of retail trade while creating higher government revenues should also lead to less VAT Taxation and still achieve positive development effects.”

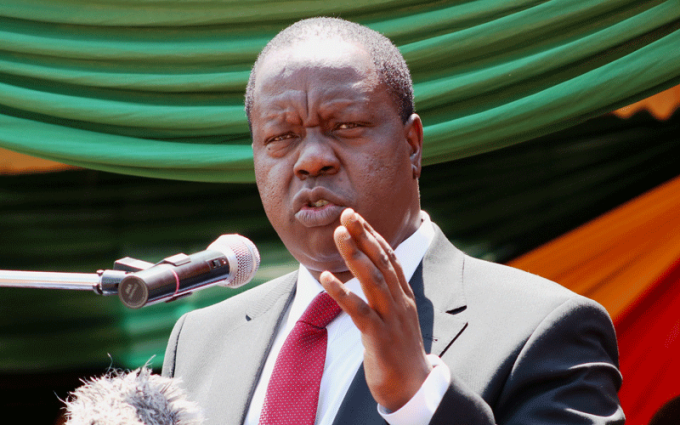

While releasing this year’s Economic Survey report, Planning, National Development and Vision 2030 Minister Wycliffe Oparanya identified the Wholesale and retail sector as one of the economic fronts that had witnessed comparatively higher growth last year. Having registered a 7.3% growth to rank second after the financial intermediation sector, the retail sector is also identified as having been one of the key economic drivers in the last five years ranking second after the transport and communication sector at 18.5% and 20% respectively.

![Motivair by Schneider Electric, a new CDU (MCDU-70) with the capability to scale to 10MW and beyond for next-generation AI Factories. [Photo/Schneider Electric]](https://businesstoday.co.ke/wp-content/uploads/2026/01/MCDU_70_Product_Evolution_NO_LOGO_1920x1080-200x113.webp)

![Pula Co-Founders and Co-CEOs, Rose Goslinga & Thomas Njeru. Pula provides agricultural insurance and digital products to help smallholder farmers manage climate risks, improve farming practices and increase their incomes. [ Photo / Courtesy ]](https://businesstoday.co.ke/wp-content/uploads/2021/01/Pula-Co-Founders-and-Co-CEOs-Thomas-Njeru-Rose-Goslinga.jpg)

Leave a comment