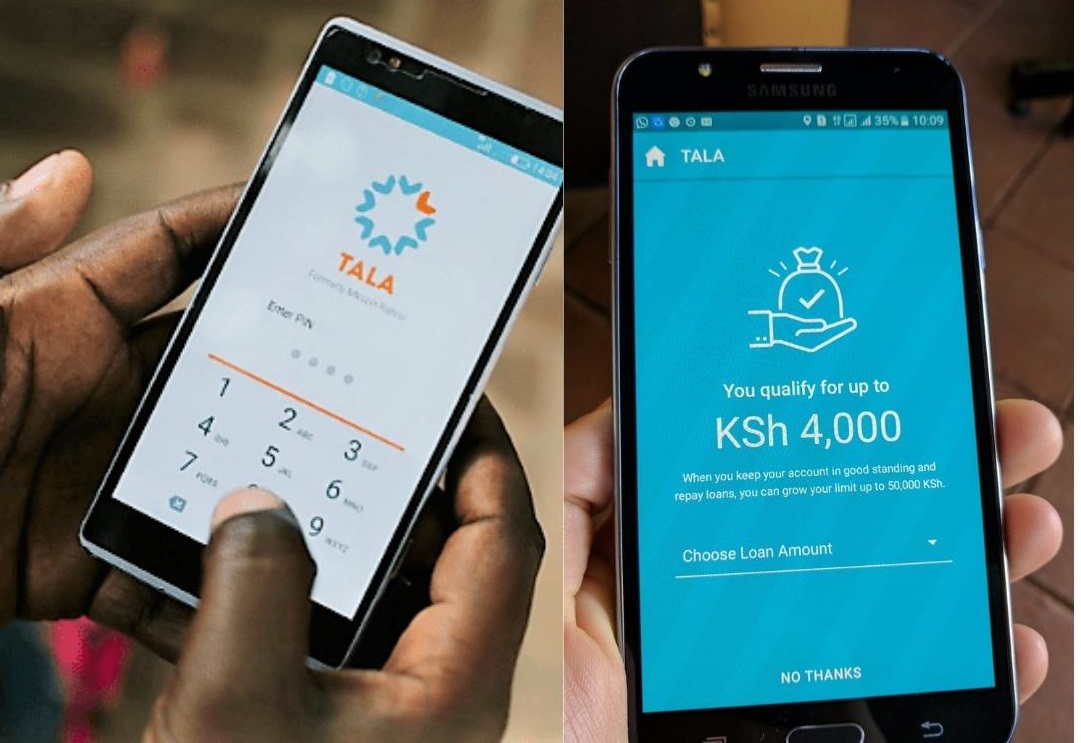

When Tala, the digital lending firm entered the Kenyan market in 2014, it tapped a business opportunity that hinged on ensuring financial inclusion to a growing tech-savvy population.

This population craved financial services in an easy and convenient form.

Tala Regional Manager for East Africa Rose Muturi says as the business slowly picked up in 2017, the organisation had a very rough time even convincing employees to join the firm.

According to Muturi, Tala was a tough sell for the skilled individuals who had their minds set on established brands in the market such as Safaricom, Deloitte and British American Tobacco (BAT) East Africa.

“When we were setting up,” Muturi told Business Today in an interview, “we put out adverts for talent to join our project but it turned out to be harder than we had anticipated. We had vacancies for techies (technology experts) and department heads but unfortunately, the brand was not a draw for them at the time.”

But as fate would have it, the start-up would go from strength to strength and is currently an award-winning brand which boasts 1-2 million repeat customers in Kenya.

As of March 2019, the company had lent out Ksh1 billion across the markets in which it operates including Kenya, Tanzania, Philippines, Mexico and India.

[ READ: Baby steps that will lead you to financial success in life ]

Kenya is Tala’s best performing market so far but the company has also registered good business across these other markets.

This has helped it to secure funding from international corporations to expand operations.

In April 2018, Tala announced that it had acquired Ksh6.5 billion Series C funding from international lenders to be used in product development, increasing human capacity in Kenya, and to expand to India and Mexico.

What’s more? In October 2018, Tala announced that it had secured undisclosed funding from American online payments firm PayPal to expand its global reach.

This good business has changed attitudes and the Kenyan office is teeming with talent.

“The company has a negligible turnover rate which I would put up at 0.5%,” says Muturi, “which is an indicator of how solid the team is at the moment.”

[ SEE ALSO: Return to sender: State agency rejects sub-standard power poles ]

Leave a comment