itax

KRA Deadline Day: Inside Scramble to File Tax Returns

Many have been filing returns in a bid to avoid stiff penalties. Failure to file annual returns by the due date attracts a...

KRA Optimizes iTax Ahead Of Tax Returns Deadline

The Kenya Revenue Authority (KRA) has enhanced the iTax system in readiness for high traffic ahead of the 2020 annual income tax return...

Tax Returns: KRA Steps Up Efforts To Avoid Last-Minute Rush

The 1st of January, 2021, marked the beginning of the tax return filing season for the 2020 income year. All annual tax returns...

Automation Of Customer Support No Longer Optional

Automation: I recently stumbled upon an old photo showing a meandering queue of taxpayers outside Times Tower, Nairobi, waiting to submit their annual...

Do Not Wait Until the Last Minute to File Taxes, File Your Annual Returns Now

As we reflect on 2020, the Kenya Revenue Authority (KRA) reminds all taxpayers that the filing of annual tax returns for the year...

Beat Deadline by Filing Tax Returns on New KRA M-Service App and iTax

January 1st, 2021 marked the beginning of the tax return filing season for the 2020 year of income. All annual tax returns for the year 2020 for...

KRA’s Voluntary Tax Disclosure Program to Improve Revenue Collection

The VDTP provides a platform for a taxpayer to disclose tax liabilities that were previously undisclosed to the Commissioner for the purpose of...

Digitization Should Enhance – and Not Impede – Tax Compliance

One of the platforms that KRA uses to engage scholars and members of the public on tax matters is the annual tax summit.

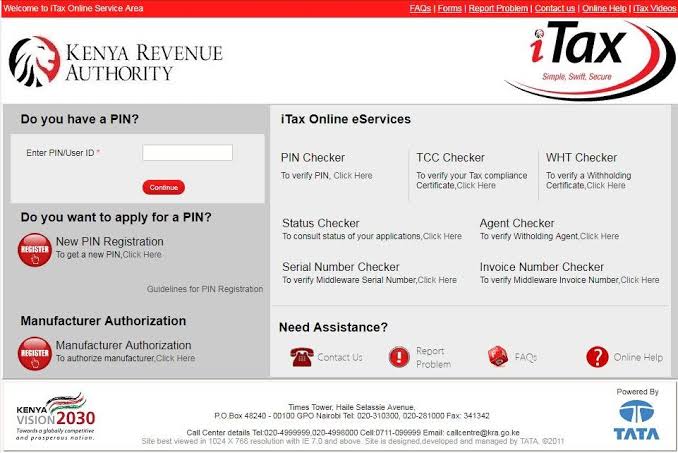

Filing your tax returns on iTax system

It is that time of the year when every Kenyan who has a Kenya Revenue Authority PIN or personal identification number, is required...