Dividend

Fat Dividend Excites KCB Share Price, Raising Investor Appetite

KCB Group shareholders will be smiling all the way to the bank to collect their fat dividend cheque after the lender declared a...

KCB Shareholders Paid KSh9.6 Billion Dividend

KCB Group Plc shareholders have approved a Ksh9.6 billion total dividends payout for the 2024 financial year, reaffirming a sustained return to shareholders,...

Safaricom Dividend Announcement Excites Investors

The board has retained Safaricom dividend at Ksh0.55 per share for the interim period, which translates to Ksh22.04 billion, despite facing a tough...

Safaricom Shakes Market With a Hefty Dividend

Safaricom PLC today held its Annual General Meeting (AGM) virtually, where shareholders approved a final dividend of Ksh0.65 per share, amounting to Ksh26.04...

Safaricom Shareholders Sh48 Billion Richer After Dividend Payout

Safaricom shareholders have approved a final dividend of Ksh0.62 per ordinary share with the dividend payout amounting to Ksh24.84 billion.

KCB Group To Pay Shareholders Sh6.4B Dividend

KCB Group shareholders have approved Ksh3.2 billion in final dividend payout for the 2022 financial year.

KenGen’s Billion-Shilling Dividend Boom For Shareholders

KenGen Dividend: Kenya Electricity Generating Company PLC (KenGen) will pay a total of Ksh1.32 billion in dividends to its shareholders for the year...

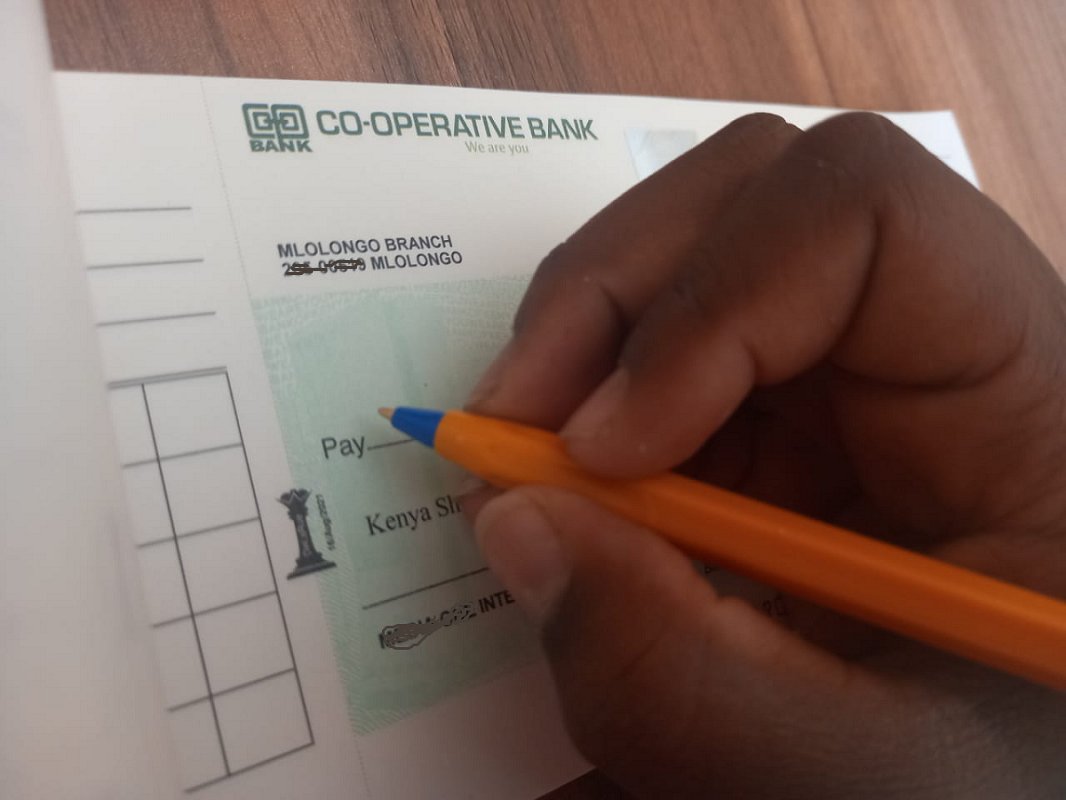

Co-op Bank Teases Shareholders With Higher Dividend Forecast

Co-operative Bank has projected paying a higher dividend at the end of this financial year, riding on improved earnings in the first quarter...

Co-op Bank Ends Year On a High As Shareholders Poised To Get Dividend

In 2020, the bank maintained a Ksh5.86 billion dividend payout despite full-year net profit declining 24.4% on increased provisions for bad loans.