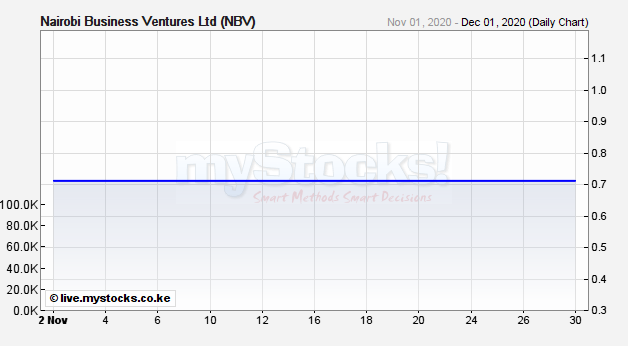

Nairobi Business Ventures(NBV) was the top price gainer at the Nairobi Securities Exchange( NSE), rising 649.3% to Ksh 5.32 at the close of trading on Tuesday 1st December. The NBV shares had closed the previous day trading at Ksh 0.71.

NBV resumed trading at the NSE after it was suspended to allow for its restructuring. A volume of 71,000 shares of NBV were traded on Tuesday resulting in a turnover of Ksh378,100.00.

NBV has completed its reengineering process following the entry of Delta International (FZE), a new investor, adding 415 million new shares to the counter.

Investors have reacted to a change in NBV’s business model to manufacturing, importing, and selling raw materials used by cement and steel processors and other firms in the infrastructure sector. NBV’s restructuring involved a share split, allotment, and issuance of shares to Delta International FZE.

Delta International has pumped Ksh 83 million into the NBV business, shifting the firm from the business of selling shoes and leather accessories.

Other price gainers on Tuesday, 1st December 2020, included Bank of Kigali which posted a 10.5% jump in net earnings for the nine months period ending 30th September 2020 to $28.6 Million.

Carbacid Investments which is targeting to acquire BOC Kenya, had its share price up 8.02% to KSh 12.80 while TransCentury was up 4.72% to KSh 1.33, Olympia Capital share price rose 4.55% to Ksh2.30.

The worst performers were led by Umeme Limited whose share price was down 8.89% to Ksh6.56 per share followed by Flame Tree Holdings, Liberty Holdings and Crown Paints. Investors also reacted to profit warning and net loss that widened to Ksh730.2 million in Q3, 2020.

The 5 top movers were Safaricom with a volume of 10.67 million, KCB ( 7.82 million), KPLC (1.13 million), ABSA (480,400) and NSE(439,900).

The benchmark NSE All Share Index was down 0.81 points to close at 144.39 from 145.20. The NSE 20 Share Index slumped 7.76 points to close at 1,752.17 points from 1,759.93. The NSE 25 Share Index fell 9.63 points to close at 3254.52.

The derivatives market had one Safaricom contract expiring on 17th December concluded during Tuesay’s trading session.

Leave a comment